Just Four Days Till Compañía de Distribución Integral Logista Holdings, S.A. (BME:LOG) Will Be Trading Ex-Dividend

Readers hoping to buy Compañía de Distribución Integral Logista Holdings, S.A. (BME:LOG) for its dividend will need to make their move shortly, as the stock is about to trade ex-dividend. You can purchase shares before the 24th of February in order to receive the dividend, which the company will pay on the 26th of February.

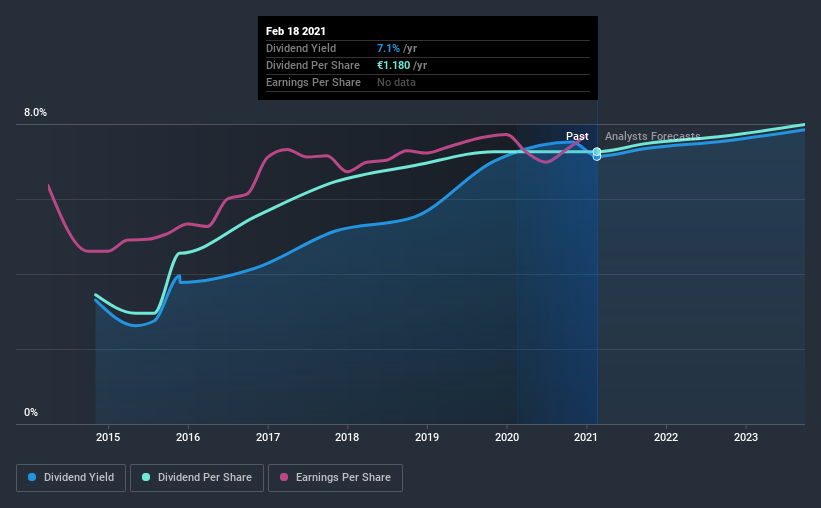

Compañía de Distribución Integral Logista Holdings's upcoming dividend is €0.64 a share, following on from the last 12 months, when the company distributed a total of €1.18 per share to shareholders. Last year's total dividend payments show that Compañía de Distribución Integral Logista Holdings has a trailing yield of 7.1% on the current share price of €16.54. Dividends are a major contributor to investment returns for long term holders, but only if the dividend continues to be paid. As a result, readers should always check whether Compañía de Distribución Integral Logista Holdings has been able to grow its dividends, or if the dividend might be cut.

Check out our latest analysis for Compañía de Distribución Integral Logista Holdings

Dividends are typically paid from company earnings. If a company pays more in dividends than it earned in profit, then the dividend could be unsustainable. Last year, Compañía de Distribución Integral Logista Holdings paid out 94% of its income as dividends, which is above a level that we're comfortable with, especially if the company needs to reinvest in its business. A useful secondary check can be to evaluate whether Compañía de Distribución Integral Logista Holdings generated enough free cash flow to afford its dividend. The good news is it paid out just 20% of its free cash flow in the last year.

It's good to see that while Compañía de Distribución Integral Logista Holdings's dividends were not well covered by profits, at least they are affordable from a cash perspective. Still, if this were to happen repeatedly, we'd be concerned about whether the dividend is sustainable in a downturn.

Click here to see the company's payout ratio, plus analyst estimates of its future dividends.

Have Earnings And Dividends Been Growing?

Companies with consistently growing earnings per share generally make the best dividend stocks, as they usually find it easier to grow dividends per share. If earnings decline and the company is forced to cut its dividend, investors could watch the value of their investment go up in smoke. With that in mind, we're encouraged by the steady growth at Compañía de Distribución Integral Logista Holdings, with earnings per share up 8.7% on average over the last five years.

Another key way to measure a company's dividend prospects is by measuring its historical rate of dividend growth. Compañía de Distribución Integral Logista Holdings has delivered 13% dividend growth per year on average over the past six years. It's encouraging to see the company lifting dividends while earnings are growing, suggesting at least some corporate interest in rewarding shareholders.

To Sum It Up

Has Compañía de Distribución Integral Logista Holdings got what it takes to maintain its dividend payments? Earnings per share have grown modestly, and last year Compañía de Distribución Integral Logista Holdings paid out a low percentage of its cash flow. However, its dividend payments were not well covered by profits. While it does have some good things going for it, we're a bit ambivalent and it would take more to convince us of Compañía de Distribución Integral Logista Holdings's dividend merits.

With that being said, if dividends aren't your biggest concern with Compañía de Distribución Integral Logista Holdings, you should know about the other risks facing this business. For example - Compañía de Distribución Integral Logista Holdings has 1 warning sign we think you should be aware of.

A common investment mistake is buying the first interesting stock you see. Here you can find a list of promising dividend stocks with a greater than 2% yield and an upcoming dividend.

If you’re looking to trade Compañía de Distribución Integral Logista Holdings, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About BME:LOG

Logista Integral

Through its subsidiaries, operates as a distributor and logistics operator in Spain, France, Italy, Portugal, and Poland.

Excellent balance sheet established dividend payer.

Similar Companies

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

Perdana Petroleum Berhad is a Zombie Business with a 27.34% Profit Margin and inflation adjusted revenue Business

Many trends acting at the same time

Engineered for Stability. Positioned for Growth.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026