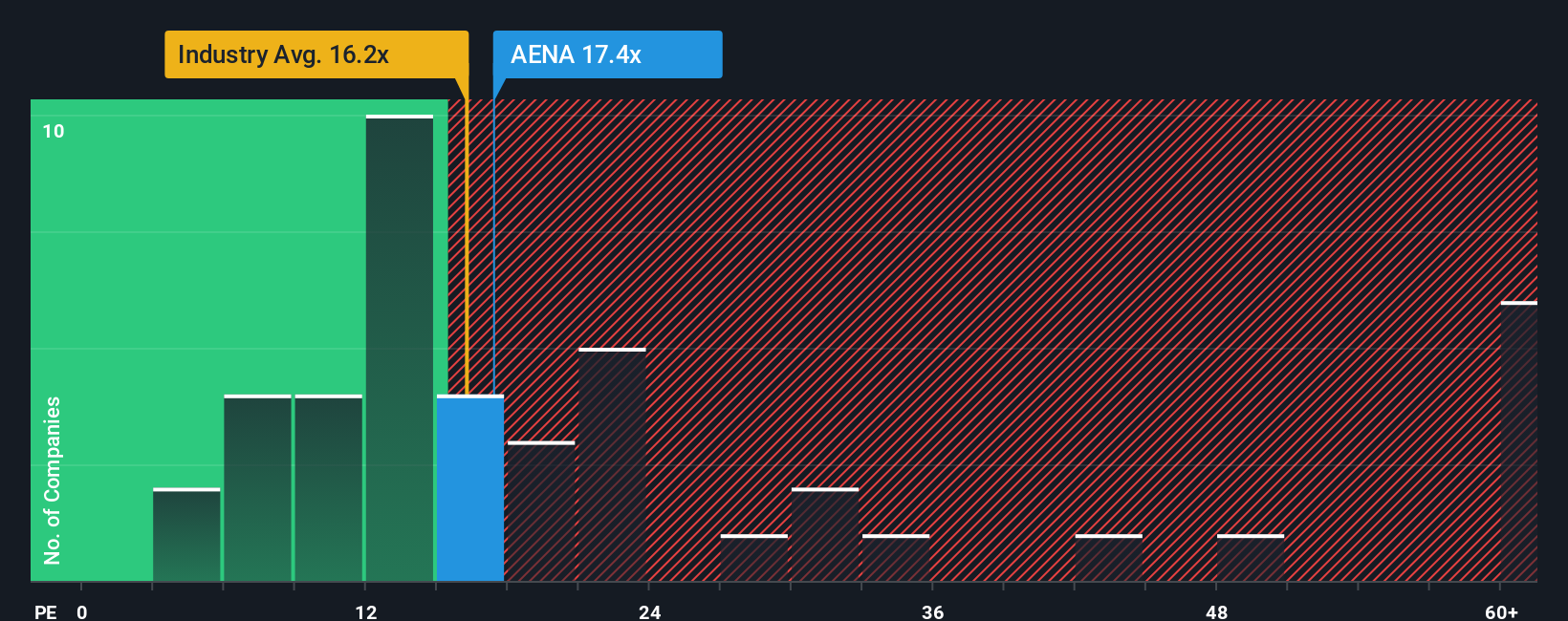

There wouldn't be many who think Aena S.M.E., S.A.'s (BME:AENA) price-to-earnings (or "P/E") ratio of 17.4x is worth a mention when the median P/E in Spain is similar at about 19x. Although, it's not wise to simply ignore the P/E without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

Recent earnings growth for Aena S.M.E has been in line with the market. It seems that many are expecting the mediocre earnings performance to persist, which has held the P/E back. If you like the company, you'd be hoping this can at least be maintained so that you could pick up some stock while it's not quite in favour.

View our latest analysis for Aena S.M.E

What Are Growth Metrics Telling Us About The P/E?

In order to justify its P/E ratio, Aena S.M.E would need to produce growth that's similar to the market.

Retrospectively, the last year delivered a decent 12% gain to the company's bottom line. Still, EPS has barely risen at all in aggregate from three years ago, which is not ideal. Accordingly, shareholders probably wouldn't have been overly satisfied with the unstable medium-term growth rates.

Shifting to the future, estimates from the analysts covering the company suggest earnings should grow by 4.8% per annum over the next three years. Meanwhile, the rest of the market is forecast to expand by 14% per year, which is noticeably more attractive.

With this information, we find it interesting that Aena S.M.E is trading at a fairly similar P/E to the market. Apparently many investors in the company are less bearish than analysts indicate and aren't willing to let go of their stock right now. These shareholders may be setting themselves up for future disappointment if the P/E falls to levels more in line with the growth outlook.

The Final Word

Using the price-to-earnings ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

Our examination of Aena S.M.E's analyst forecasts revealed that its inferior earnings outlook isn't impacting its P/E as much as we would have predicted. Right now we are uncomfortable with the P/E as the predicted future earnings aren't likely to support a more positive sentiment for long. This places shareholders' investments at risk and potential investors in danger of paying an unnecessary premium.

You should always think about risks. Case in point, we've spotted 2 warning signs for Aena S.M.E you should be aware of.

If these risks are making you reconsider your opinion on Aena S.M.E, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About BME:AENA

Aena S.M.E

Engages in the management of airports in Spain, Brazil, the United Kingdom, Mexico, and Colombia.

Proven track record with adequate balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success