- Spain

- /

- Telecom Services and Carriers

- /

- BME:TEF

Is Telefónica a Bargain After Recent Partnerships and a 3.3% Stock Jump?

Reviewed by Bailey Pemberton

- Wondering if Telefónica stock is a bargain or just another name on your watchlist? Let’s dig into whether now is a smart time to take a closer look at its value.

- The stock has had its ups and downs recently, rising 3.3% over the past week but still sitting 6.3% lower year-to-date and trailing with an 8.8% loss over the last 12 months.

- Recent headlines have focused on Telefónica’s ongoing moves in European telecom markets, including fresh partnerships and network upgrades. These developments have caught the eye of both investors and analysts, helping shape investor sentiment and potentially explaining the latest share price swings.

- On the valuation front, Telefónica scores 5 out of 6 on our value checks, which you can check out here. In the next sections, we’ll explore traditional and alternative approaches to valuation. There is also a more comprehensive way to piece it all together, which we reveal at the end of the article.

Find out why Telefónica's -8.8% return over the last year is lagging behind its peers.

Approach 1: Telefónica Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model is a classic valuation approach that estimates a company’s true worth by projecting its future cash flows and discounting them back to today's value. This helps investors gauge what Telefónica may be worth based on its ability to generate cash over time.

Currently, Telefónica generates free cash flow of approximately €3.85 Billion. Over the next five years, analyst forecasts are available, and beyond that, projections are extrapolated by Simply Wall St. Looking a decade ahead, the company is forecasted to generate around €4.23 Billion in free cash in 2035. These projections combine both analyst estimates and calculated growth rates.

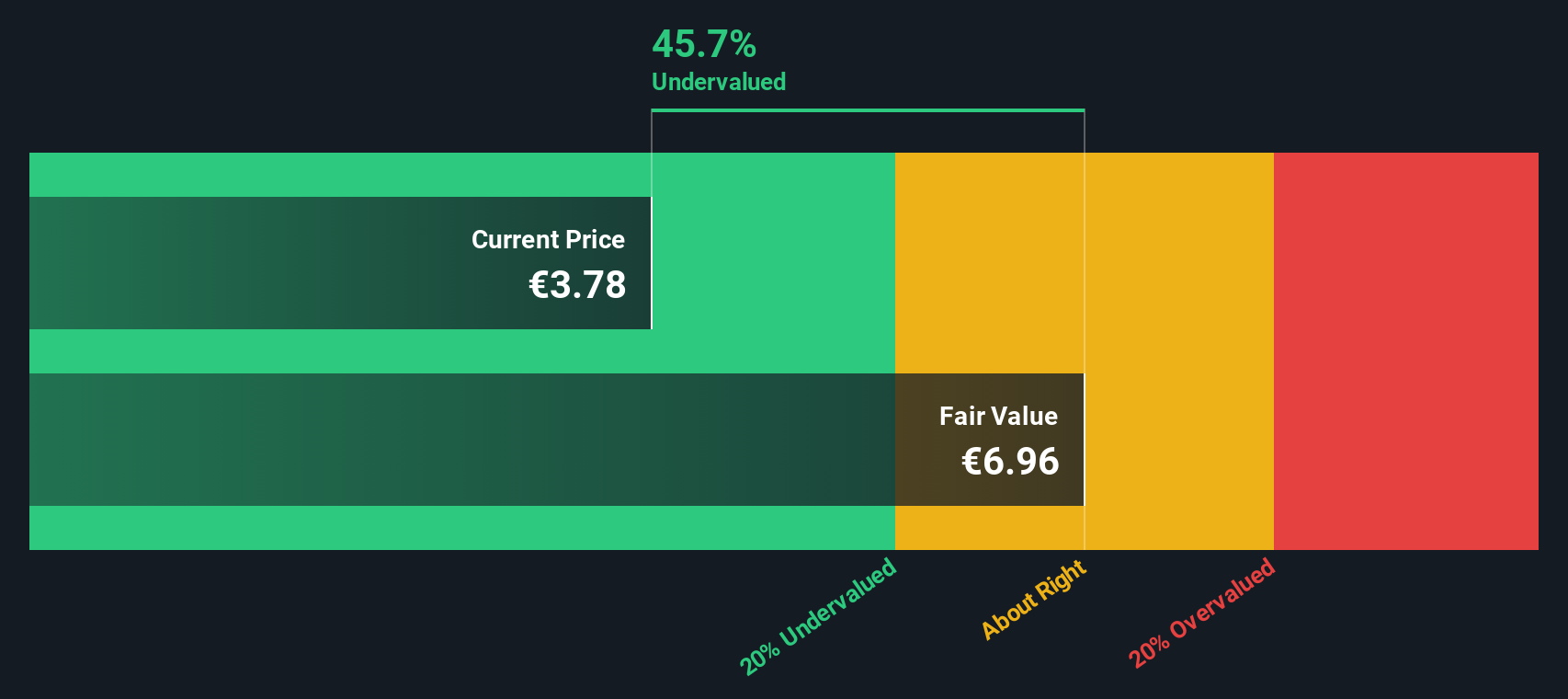

Using the 2 Stage Free Cash Flow to Equity method, the DCF calculates an intrinsic value of €6.96 for Telefónica’s share. Right now, the DCF model suggests the stock trades at a 46.3% discount to its intrinsic value. This indicates the stock could be significantly undervalued compared to where the company’s cash flows point its real worth should be.

This sizable discount may make Telefónica a value opportunity for long-term investors seeking discounted blue-chip exposure in the telecom sector.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Telefónica is undervalued by 46.3%. Track this in your watchlist or portfolio, or discover 926 more undervalued stocks based on cash flows.

Approach 2: Telefónica Price vs Sales

The Price-to-Sales (P/S) ratio is a particularly useful valuation metric for companies like Telefónica, especially when earnings are negative or unpredictable from year to year. By comparing the stock price to its revenues, investors get a sense of how much the market is willing to pay for every euro of the company’s sales, regardless of reported profits.

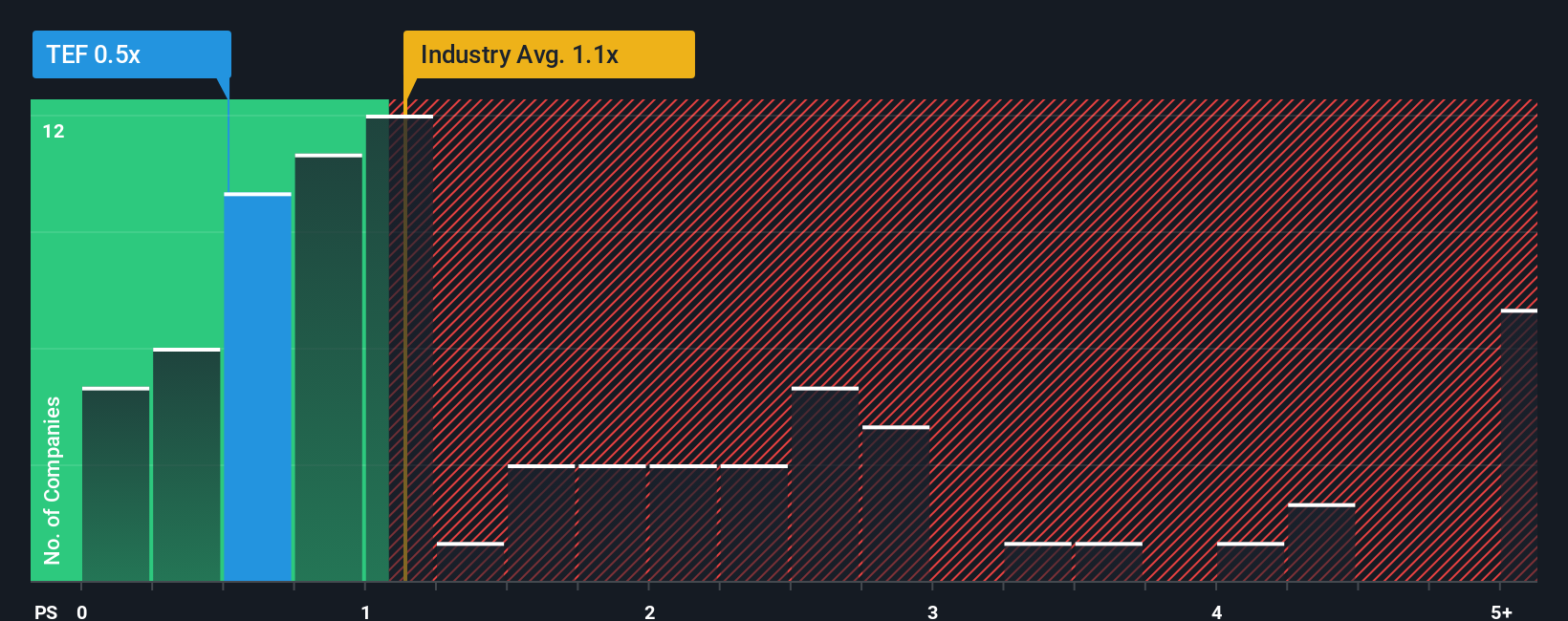

While it is common to compare a company’s P/S ratio to industry averages and peers, these benchmarks can be misleading if they ignore growth expectations or risk. Generally, a higher growth outlook or lower risk warrants a higher “fair” multiple, while slower growth or heightened risks suggest a lower one. For Telefónica, the current P/S ratio stands at just 0.51x, which is well below the telecom industry average of 1.39x and the peer average of 2.23x.

Simply Wall St’s proprietary “Fair Ratio” refines this comparison by accounting for Telefónica’s specific growth prospects, profit margins, risk profile, industry, and market capitalization. This makes the Fair Ratio, currently calculated at 1.50x for Telefónica, a much more tailored yardstick than a broad industry or peer group average.

When Telefónica’s actual P/S of 0.51x is compared to its Fair Ratio of 1.50x, the stock appears clearly undervalued on a sales basis. This notable gap could catch the attention of value-focused investors.

Result: UNDERVALUED

PS ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1433 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Telefónica Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let’s introduce you to Narratives, a smarter, story-driven approach built right into Simply Wall St’s Community page.

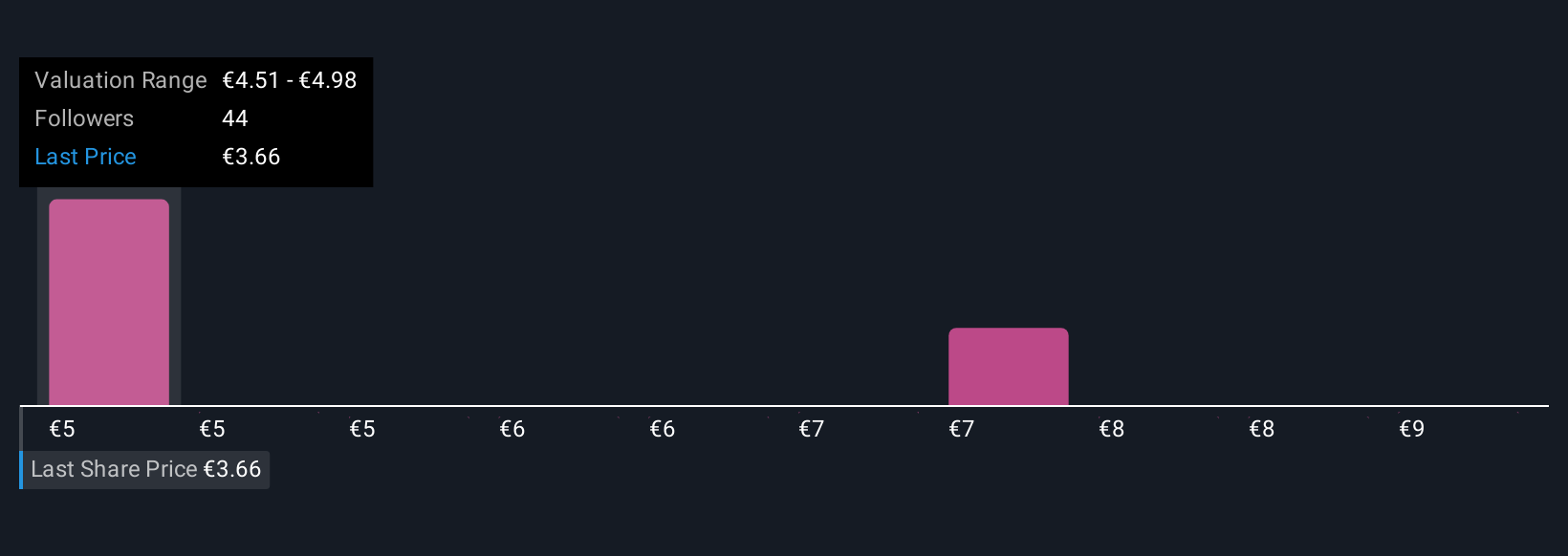

A Narrative is your personal story about a company. It is your perspective on what makes Telefónica valuable, including honest expectations for future revenue, profit margins, and fair value, all connected to the company’s underlying business story.

This method links the big picture of Telefónica’s strategic moves, strengths, and risks directly to a forward-looking financial forecast, then automatically calculates a fair value based on your assumptions.

Narratives are incredibly accessible. Millions of investors use them and you can easily build or explore different views in the platform’s Community, allowing you to compare your thinking with others at a glance.

Whenever news breaks or new quarterly results are announced, Narratives update automatically so your investment thesis stays current and actionable in real time.

For example, some investors might believe Telefónica’s expanding 5G and fiber services will drive big revenue and margin improvements, setting a fair value closer to €5.40 per share. Others may focus on high debt and market challenges and place their fair value around €3.00. By comparing these Narratives to the current share price, you gain clarity on what to do next.

Do you think there's more to the story for Telefónica? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Telefónica might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About BME:TEF

Telefónica

Provides telecommunications services in Europe and Latin America.

Undervalued with moderate growth potential.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success