If you're not sure where to start when looking for the next multi-bagger, there are a few key trends you should keep an eye out for. Typically, we'll want to notice a trend of growing return on capital employed (ROCE) and alongside that, an expanding base of capital employed. Basically this means that a company has profitable initiatives that it can continue to reinvest in, which is a trait of a compounding machine. With that in mind, the ROCE of Altia Consultores (BME:ALC) looks attractive right now, so lets see what the trend of returns can tell us.

What Is Return On Capital Employed (ROCE)?

For those who don't know, ROCE is a measure of a company's yearly pre-tax profit (its return), relative to the capital employed in the business. The formula for this calculation on Altia Consultores is:

Return on Capital Employed = Earnings Before Interest and Tax (EBIT) ÷ (Total Assets - Current Liabilities)

0.20 = €13m ÷ (€143m - €77m) (Based on the trailing twelve months to December 2022).

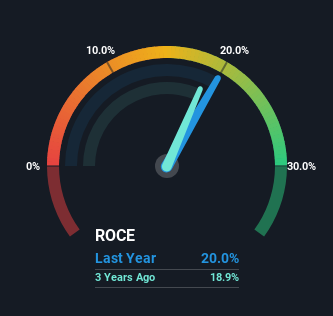

Therefore, Altia Consultores has an ROCE of 20%. That's a fantastic return and not only that, it outpaces the average of 14% earned by companies in a similar industry.

See our latest analysis for Altia Consultores

While the past is not representative of the future, it can be helpful to know how a company has performed historically, which is why we have this chart above. If you want to delve into the historical earnings, revenue and cash flow of Altia Consultores, check out these free graphs here.

The Trend Of ROCE

In terms of Altia Consultores' history of ROCE, it's quite impressive. The company has employed 87% more capital in the last five years, and the returns on that capital have remained stable at 20%. With returns that high, it's great that the business can continually reinvest its money at such appealing rates of return. If Altia Consultores can keep this up, we'd be very optimistic about its future.

On another note, while the change in ROCE trend might not scream for attention, it's interesting that the current liabilities have actually gone up over the last five years. This is intriguing because if current liabilities hadn't increased to 54% of total assets, this reported ROCE would probably be less than20% because total capital employed would be higher.The 20% ROCE could be even lower if current liabilities weren't 54% of total assets, because the the formula would show a larger base of total capital employed. Additionally, this high level of current liabilities isn't ideal because it means the company's suppliers (or short-term creditors) are effectively funding a large portion of the business.

The Bottom Line

In short, we'd argue Altia Consultores has the makings of a multi-bagger since its been able to compound its capital at very profitable rates of return. And since the stock has risen strongly over the last five years, it appears the market might expect this trend to continue. So even though the stock might be more "expensive" than it was before, we think the strong fundamentals warrant this stock for further research.

While Altia Consultores looks impressive, no company is worth an infinite price. The intrinsic value infographic in our free research report helps visualize whether ALC is currently trading for a fair price.

If you want to search for more stocks that have been earning high returns, check out this free list of stocks with solid balance sheets that are also earning high returns on equity.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About BME:ALC

Altia Consultores

Operates in the information and communication technologies (ICT) sector in Spain and internationally.

Excellent balance sheet with questionable track record.

Market Insights

Community Narratives

Recently Updated Narratives

Engineered for Stability. Positioned for Growth.

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026