- Spain

- /

- Residential REITs

- /

- BME:YVIV

Vivenio Residencial SOCIMI (BME:YVIV): One-Off Gain Masks Margin Weakness, Challenging Value Narrative

Reviewed by Simply Wall St

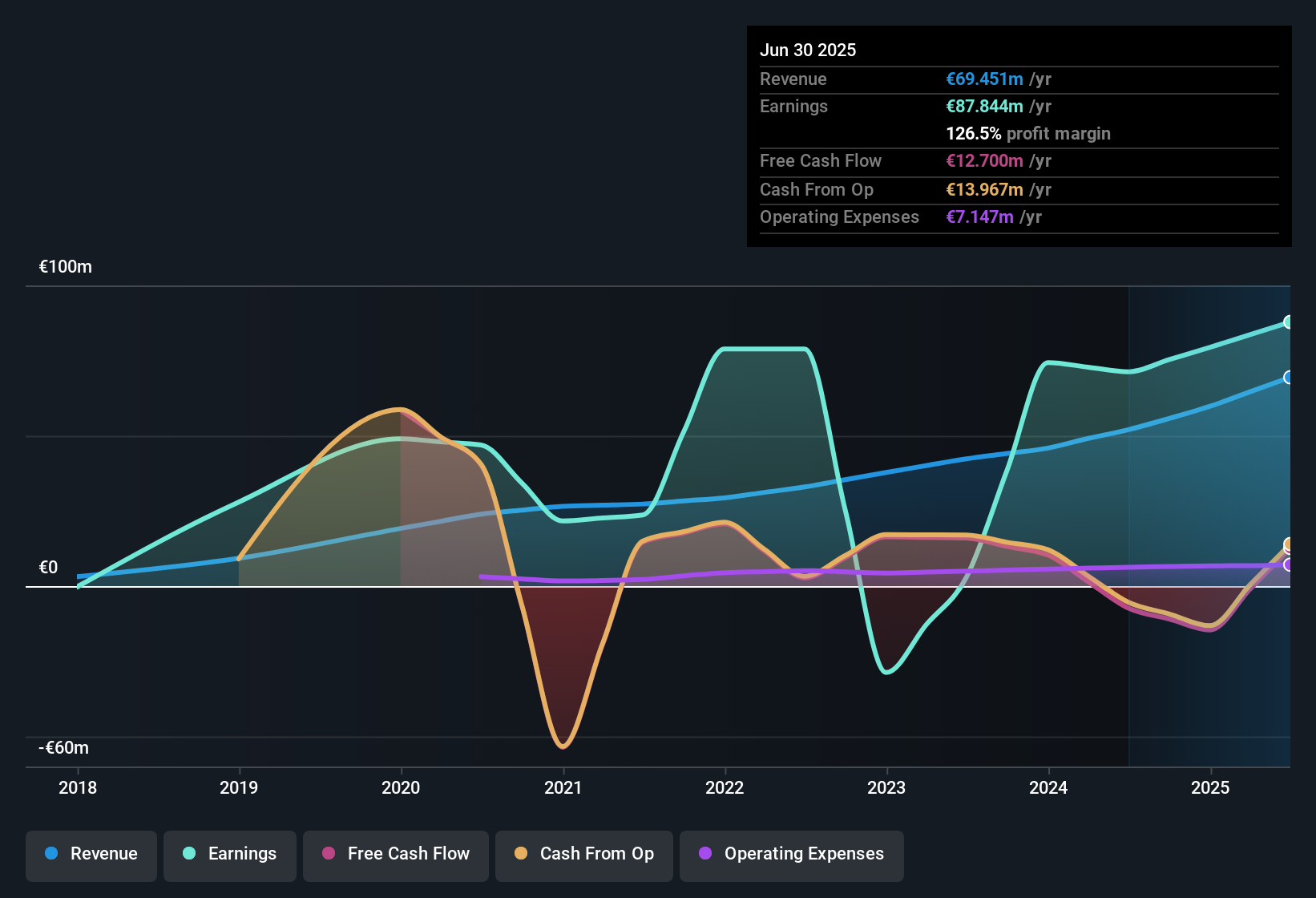

Vivenio Residencial SOCIMI (BME:YVIV) posted 6.9% earnings growth for the most recent year, a slowdown compared to its 13.9% compound annual rate over the past five years. Reported profits were partly boosted by a one-off gain of €87.7 million for the twelve months ending June 30, 2025, while net profit margins slipped from last year. The stock trades at a Price-To-Earnings Ratio of 12.5x, which is sharply below both the peer average of 31x and the global residential REITs industry average of 20.2x. This has fueled debate on whether there is value if core earnings can hold up once non-recurring items are excluded.

See our full analysis for Vivenio Residencial SOCIMI.The next section puts these headline results side by side with the community’s widely followed narratives, making it clear where the facts and crowd expectations line up and where they diverge.

Curious how numbers become stories that shape markets? Explore Community Narratives

Margins Narrow as Non-Recurring Gain Distorts Profits

- Net profit margins for the latest period are lower than last year, despite the reported 6.9% earnings growth, because results were amplified by a significant one-off gain of €87.7 million.

- While narrative analysis highlights Vivenio’s role as a defensive, income-generating company in a stable rental sector, the underlying margin compression is notable.

- Resilient residential rents and stable occupancy levels support the case for dependable income.

- However, the large non-recurring gain means current margins and reported profit are less reliable as signals for future performance.

Balance Sheet Pressures Raise Sustainability Questions

- Risk disclosures and recent filings indicate that Vivenio is not in a strong financial position, raising questions about the sustainability of its growth trajectory if underlying trends weaken.

- Bears point to flagged financial pressures.

- Main concerns include reliance on one-off items like the €87.7 million gain, which may mask vulnerability in core operations.

- There are also warnings that current profit levels may not be durable if the margin trend and leverage are not addressed.

Valuation Stands Out Versus Peers and Industry

- The Price-To-Earnings ratio of 12.5x is materially below the peer average of 31x and the global residential REITs industry average of 20.2x, suggesting Vivenio trades at a significant relative discount.

- Prevailing market analysis points out that this discount may attract value-oriented investors looking past short-term noise.

- However, ongoing margin weakness and flagged financial risks could keep the valuation gap in place until the quality of earnings is clearer.

- Optimal entry depends on whether profit margins can stabilize and non-recurring gains are not repeated in future years.

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on Vivenio Residencial SOCIMI's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

See What Else Is Out There

Ongoing margin compression and concerns over financial pressures suggest that Vivenio’s future profitability could be at risk if its core health does not improve.

Prefer sturdier finances? Find companies with lower leverage and strong balance sheets equipped to weather volatility by checking out solid balance sheet and fundamentals stocks screener (1984 results) now.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About BME:YVIV

Vivenio Residencial SOCIMI

Acquires, develops, and manages residential properties for renting in Spain.

Slightly overvalued with very low risk.

Market Insights

Community Narratives