- Spain

- /

- Real Estate

- /

- BME:MVC

Metrovacesa (BME:MVC) Share Prices Have Dropped 51% In The Last Three Years

Metrovacesa S.A. (BME:MVC) shareholders should be happy to see the share price up 12% in the last month. But that cannot eclipse the less-than-impressive returns over the last three years. Truth be told the share price declined 51% in three years and that return, Dear Reader, falls short of what you could have got from passive investing with an index fund.

Check out our latest analysis for Metrovacesa

Metrovacesa isn't currently profitable, so most analysts would look to revenue growth to get an idea of how fast the underlying business is growing. Generally speaking, companies without profits are expected to grow revenue every year, and at a good clip. That's because fast revenue growth can be easily extrapolated to forecast profits, often of considerable size.

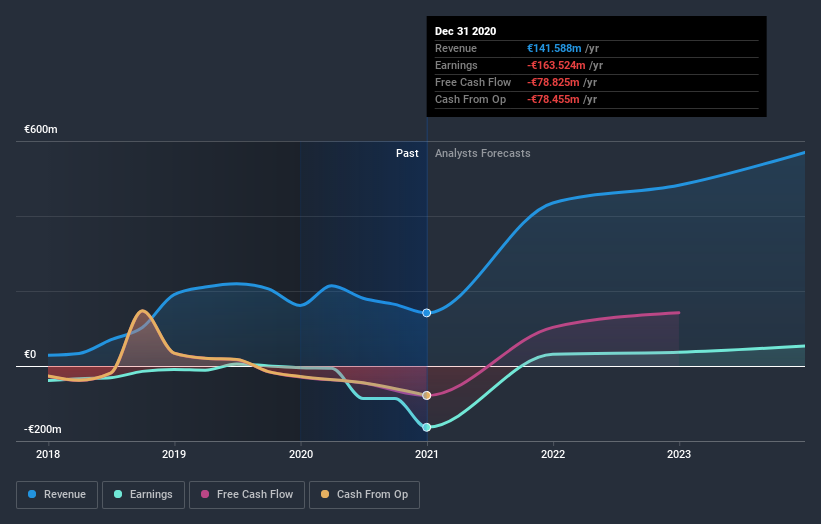

Over three years, Metrovacesa grew revenue at 30% per year. That is faster than most pre-profit companies. The share price has moved in quite the opposite direction, down 15% over that time, a bad result. It seems likely that the market is worried about the continual losses. When we see revenue growth, paired with a falling share price, we can't help wonder if there is an opportunity for those who are willing to dig deeper.

You can see how earnings and revenue have changed over time in the image below (click on the chart to see the exact values).

Take a more thorough look at Metrovacesa's financial health with this free report on its balance sheet.

A Different Perspective

Over the last year Metrovacesa shareholders have received a TSR of 21%. It's always nice to make money but this return falls short of the market return which was about 45% for the year. The silver lining is that the recent rise is far preferable to the annual loss of 14% that shareholders have suffered over the last three years. We hope the turnaround in fortunes continues. Shareholders might want to examine this detailed historical graph of past earnings, revenue and cash flow.

We will like Metrovacesa better if we see some big insider buys. While we wait, check out this free list of growing companies with considerable, recent, insider buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on ES exchanges.

If you decide to trade Metrovacesa, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About BME:MVC

Excellent balance sheet with reasonable growth potential.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Deep Value Multi Bagger Opportunity

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Unicycive Therapeutics (Nasdaq: UNCY) – Preparing for a Second Shot at Bringing a New Kidney Treatment to Market (TEST)

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026