Is MERLIN Properties (BME:MRL) Still Undervalued? Examining Market Narratives and Fair Value Estimates

Reviewed by Simply Wall St

Most Popular Narrative: 11.2% Undervalued

According to the most widely followed narrative, MERLIN Properties SOCIMI is considered undervalued, with analysts projecting a fair value price target noticeably above current levels.

The rapid expansion and commercialization of data centers, fueled by exponential demand for digital infrastructure and supported by the company's early-mover advantage (for example, EU giga-factory competition), is set to significantly diversify revenue streams and drive robust rental income growth and value appreciation starting from 2027, when data center income will materially ramp up.

Want to know what’s really powering this bullish outlook? The narrative rests on surprisingly bold growth forecasts and future profitability assumptions that could shift the value equation dramatically. Curious which numbers analysts believe will unlock the next leg higher for MERLIN? The full narrative holds the key drivers behind this valuation call.

Result: Fair Value of €14.11 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, risks such as heavy reliance on office assets and the capital intensity of data center expansion could quickly change the narrative if conditions shift.

Find out about the key risks to this MERLIN Properties SOCIMI narrative.Another View: Discounted Cash Flow Tells a Different Story

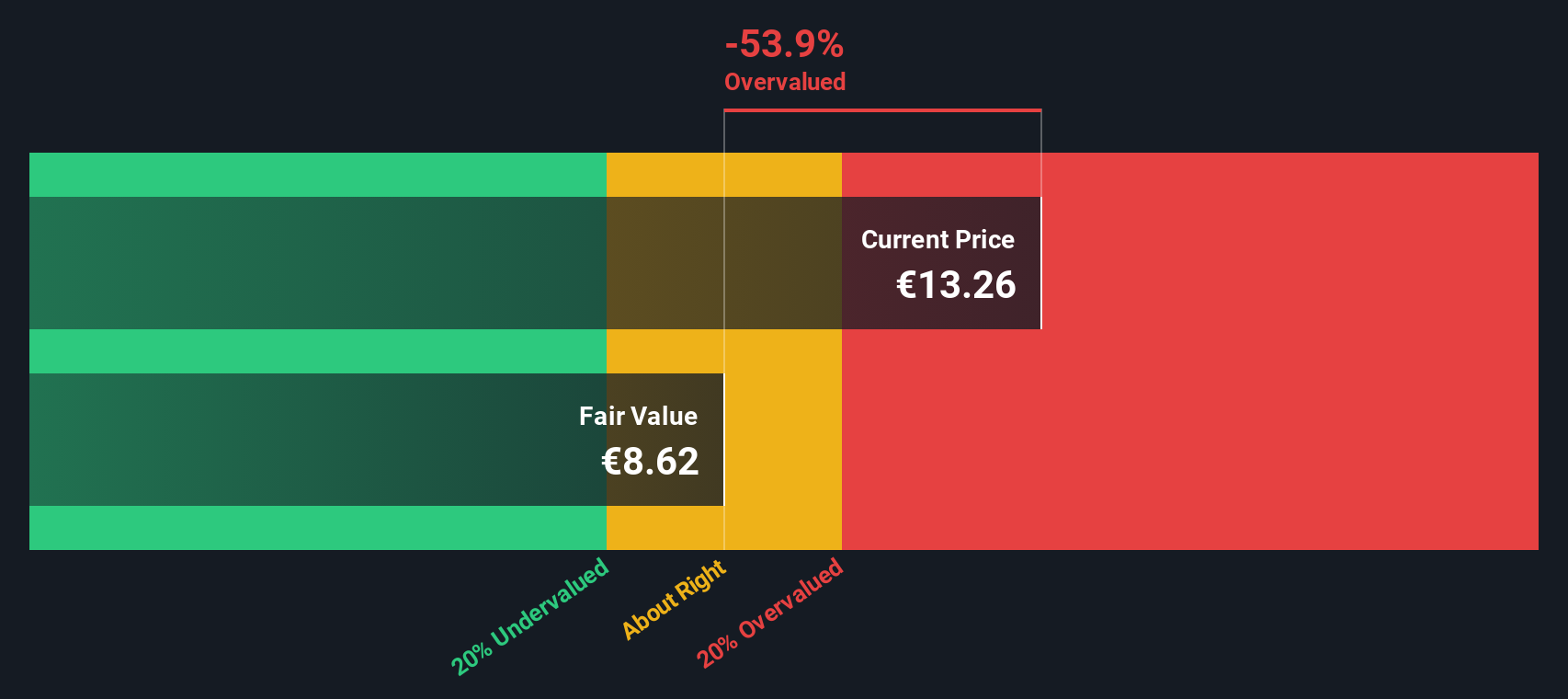

When switching lenses to our DCF model, a more conservative picture emerges. This method points to the shares being overvalued, which challenges the optimism of analysts. Could the market be missing something? Is caution warranted?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own MERLIN Properties SOCIMI Narrative

If you see things differently or want to dig into the numbers yourself, you can shape your own story in just a few minutes. Do it your way.

A great starting point for your MERLIN Properties SOCIMI research is our analysis highlighting 4 key rewards and 3 important warning signs that could impact your investment decision.

Looking for More Winning Investment Ideas?

Smart investors never settle for one opportunity. Supercharge your next move by targeting stocks with fresh upside using our handpicked screeners. Your future self will thank you for it.

- Tap into high-yielding opportunities by reviewing dividend stocks with yields over 3% using dividend stocks with yields > 3%.

- Get ahead of the AI curve and spot companies driving breakthroughs in artificial intelligence with AI penny stocks.

- Catch undervalued gems before the crowd by searching for stocks trading below their intrinsic value at undervalued stocks based on cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Kshitija Bhandaru

Kshitija (or Keisha) Bhandaru is an Equity Analyst at Simply Wall St and has over 6 years of experience in the finance industry and describes herself as a lifelong learner driven by her intellectual curiosity. She previously worked with Market Realist for 5 years as an Equity Analyst.

About BME:MRL

MERLIN Properties SOCIMI

MERLIN Properties SOCIMI, S.A. (MC:MRL) is the largest real estate and infrastructure company trading on the Spanish Stock Exchange.

Good value with proven track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success