- Spain

- /

- Real Estate

- /

- BME:ISUR

We Think Inmobiliaria del Sur (BME:ISUR) Is Taking Some Risk With Its Debt

The external fund manager backed by Berkshire Hathaway's Charlie Munger, Li Lu, makes no bones about it when he says 'The biggest investment risk is not the volatility of prices, but whether you will suffer a permanent loss of capital.' It's only natural to consider a company's balance sheet when you examine how risky it is, since debt is often involved when a business collapses. We can see that Inmobiliaria del Sur, S.A. (BME:ISUR) does use debt in its business. But the real question is whether this debt is making the company risky.

Why Does Debt Bring Risk?

Generally speaking, debt only becomes a real problem when a company can't easily pay it off, either by raising capital or with its own cash flow. Ultimately, if the company can't fulfill its legal obligations to repay debt, shareholders could walk away with nothing. However, a more frequent (but still costly) occurrence is where a company must issue shares at bargain-basement prices, permanently diluting shareholders, just to shore up its balance sheet. Of course, the upside of debt is that it often represents cheap capital, especially when it replaces dilution in a company with the ability to reinvest at high rates of return. The first step when considering a company's debt levels is to consider its cash and debt together.

Check out our latest analysis for Inmobiliaria del Sur

What Is Inmobiliaria del Sur's Net Debt?

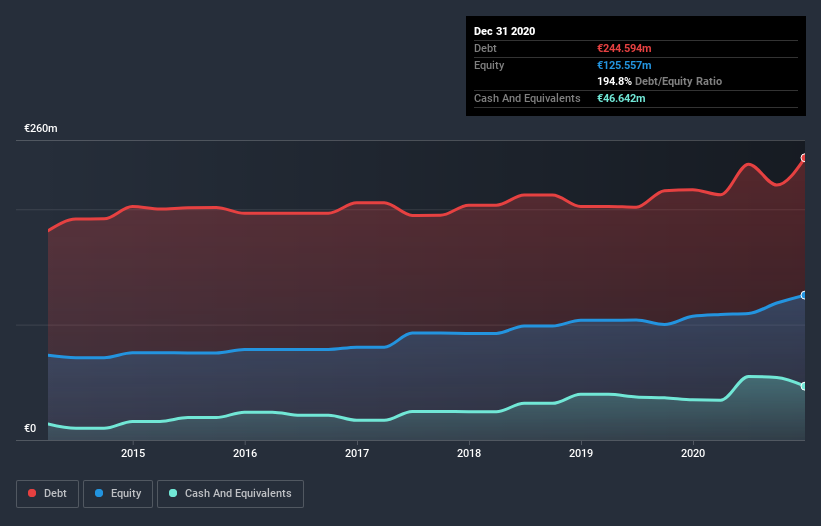

You can click the graphic below for the historical numbers, but it shows that as of December 2020 Inmobiliaria del Sur had €244.6m of debt, an increase on €217.0m, over one year. However, because it has a cash reserve of €46.6m, its net debt is less, at about €197.9m.

How Strong Is Inmobiliaria del Sur's Balance Sheet?

The latest balance sheet data shows that Inmobiliaria del Sur had liabilities of €108.7m due within a year, and liabilities of €199.7m falling due after that. Offsetting these obligations, it had cash of €46.6m as well as receivables valued at €27.0m due within 12 months. So its liabilities total €234.7m more than the combination of its cash and short-term receivables.

This deficit casts a shadow over the €134.6m company, like a colossus towering over mere mortals. So we'd watch its balance sheet closely, without a doubt. At the end of the day, Inmobiliaria del Sur would probably need a major re-capitalization if its creditors were to demand repayment.

In order to size up a company's debt relative to its earnings, we calculate its net debt divided by its earnings before interest, tax, depreciation, and amortization (EBITDA) and its earnings before interest and tax (EBIT) divided by its interest expense (its interest cover). This way, we consider both the absolute quantum of the debt, as well as the interest rates paid on it.

Inmobiliaria del Sur has a rather high debt to EBITDA ratio of 7.1 which suggests a meaningful debt load. But the good news is that it boasts fairly comforting interest cover of 4.7 times, suggesting it can responsibly service its obligations. It is well worth noting that Inmobiliaria del Sur's EBIT shot up like bamboo after rain, gaining 94% in the last twelve months. That'll make it easier to manage its debt. The balance sheet is clearly the area to focus on when you are analysing debt. But ultimately the future profitability of the business will decide if Inmobiliaria del Sur can strengthen its balance sheet over time. So if you want to see what the professionals think, you might find this free report on analyst profit forecasts to be interesting.

Finally, a business needs free cash flow to pay off debt; accounting profits just don't cut it. So the logical step is to look at the proportion of that EBIT that is matched by actual free cash flow. In the last three years, Inmobiliaria del Sur's free cash flow amounted to 35% of its EBIT, less than we'd expect. That weak cash conversion makes it more difficult to handle indebtedness.

Our View

To be frank both Inmobiliaria del Sur's net debt to EBITDA and its track record of staying on top of its total liabilities make us rather uncomfortable with its debt levels. But at least it's pretty decent at growing its EBIT; that's encouraging. Overall, we think it's fair to say that Inmobiliaria del Sur has enough debt that there are some real risks around the balance sheet. If all goes well, that should boost returns, but on the flip side, the risk of permanent capital loss is elevated by the debt. The balance sheet is clearly the area to focus on when you are analysing debt. But ultimately, every company can contain risks that exist outside of the balance sheet. To that end, you should learn about the 3 warning signs we've spotted with Inmobiliaria del Sur (including 2 which make us uncomfortable) .

If, after all that, you're more interested in a fast growing company with a rock-solid balance sheet, then check out our list of net cash growth stocks without delay.

If you decide to trade Inmobiliaria del Sur, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About BME:ISUR

Inmobiliaria del Sur

Operates as a property development and management company in Spain.

Undervalued with proven track record and pays a dividend.

Market Insights

Community Narratives