- Spain

- /

- Real Estate

- /

- BME:YAPS

Albirana Properties SOCIMI (BME:YAPS investor five-year losses grow to 30% as the stock sheds €39m this past week

Ideally, your overall portfolio should beat the market average. But even the best stock picker will only win with some selections. So we wouldn't blame long term Albirana Properties SOCIMI, S.A. (BME:YAPS) shareholders for doubting their decision to hold, with the stock down 30% over a half decade. The falls have accelerated recently, with the share price down 16% in the last three months.

With the stock having lost 15% in the past week, it's worth taking a look at business performance and seeing if there's any red flags.

See our latest analysis for Albirana Properties SOCIMI

Albirana Properties SOCIMI isn't currently profitable, so most analysts would look to revenue growth to get an idea of how fast the underlying business is growing. When a company doesn't make profits, we'd generally hope to see good revenue growth. Some companies are willing to postpone profitability to grow revenue faster, but in that case one would hope for good top-line growth to make up for the lack of earnings.

Over half a decade Albirana Properties SOCIMI reduced its trailing twelve month revenue by 34% for each year. That puts it in an unattractive cohort, to put it mildly. On the face of it we'd posit the share price fall of 5% compound, over five years is well justified by the fundamental deterioration. This loss means the stock shareholders are probably pretty annoyed. It is possible for businesses to bounce back but as Buffett says, 'turnarounds seldom turn'.

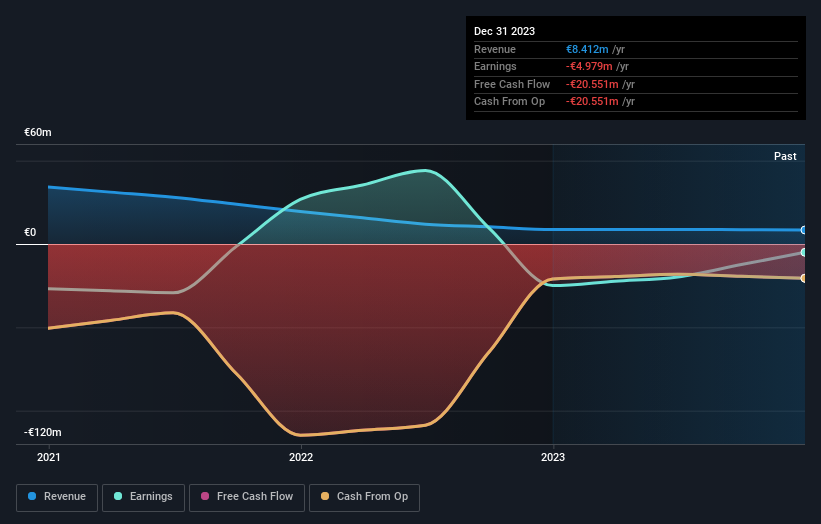

You can see how earnings and revenue have changed over time in the image below (click on the chart to see the exact values).

Balance sheet strength is crucial. It might be well worthwhile taking a look at our free report on how its financial position has changed over time.

A Different Perspective

Investors in Albirana Properties SOCIMI had a tough year, with a total loss of 16%, against a market gain of about 23%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. Regrettably, last year's performance caps off a bad run, with the shareholders facing a total loss of 5% per year over five years. Generally speaking long term share price weakness can be a bad sign, though contrarian investors might want to research the stock in hope of a turnaround. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. For instance, we've identified 1 warning sign for Albirana Properties SOCIMI that you should be aware of.

But note: Albirana Properties SOCIMI may not be the best stock to buy. So take a peek at this free list of interesting companies with past earnings growth (and further growth forecast).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Spanish exchanges.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About BME:YAPS

Albirana Properties SOCIMI

Operates as a real estate investment company in Spain and internationally.

Worrying balance sheet minimal.

Market Insights

Community Narratives