- China

- /

- Electronic Equipment and Components

- /

- SZSE:002947

Undiscovered Gems And 2 Other Promising Small Caps With Strong Fundamentals

Reviewed by Simply Wall St

In the current climate, global markets have been navigating a complex landscape marked by cautious Federal Reserve commentary and political uncertainty, leading to declines in major U.S. stock indices with small-cap stocks experiencing notable challenges. Despite these headwinds, the underlying strength of economic indicators such as robust retail sales and job growth offers a glimmer of hope for discerning investors seeking opportunities in smaller companies with solid fundamentals. For those interested in identifying promising small-cap stocks amidst this volatility, focusing on strong financial health and resilience can be crucial. In this article, we'll explore three lesser-known small-cap companies that exhibit these characteristics and could potentially weather the broader market uncertainties effectively.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| AB Vilkyskiu pienine | 35.79% | 17.20% | 49.04% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| Hermes Transportes Blindados | 50.88% | 4.57% | 3.33% | ★★★★★☆ |

| Intellego Technologies | 12.32% | 73.44% | 78.22% | ★★★★★☆ |

| HOMAG Group | NA | -31.14% | 23.43% | ★★★★★☆ |

| Inverfal PerúA | 31.20% | 10.56% | 17.83% | ★★★★★☆ |

| La Positiva Seguros y Reaseguros | 0.04% | 8.44% | 27.31% | ★★★★☆☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

| Lavipharm | 39.21% | 9.47% | -15.70% | ★★★★☆☆ |

Underneath we present a selection of stocks filtered out by our screen.

Realia Business (BME:RLIA)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Realia Business, S.A. is involved in the development, management, and rental of real estate in Spain and Romania with a market cap of €817.95 million.

Operations: Realia Business generates revenue primarily through real estate development, management, and rental activities in Spain and Romania. The company focuses on leveraging its real estate assets to drive income while managing associated costs.

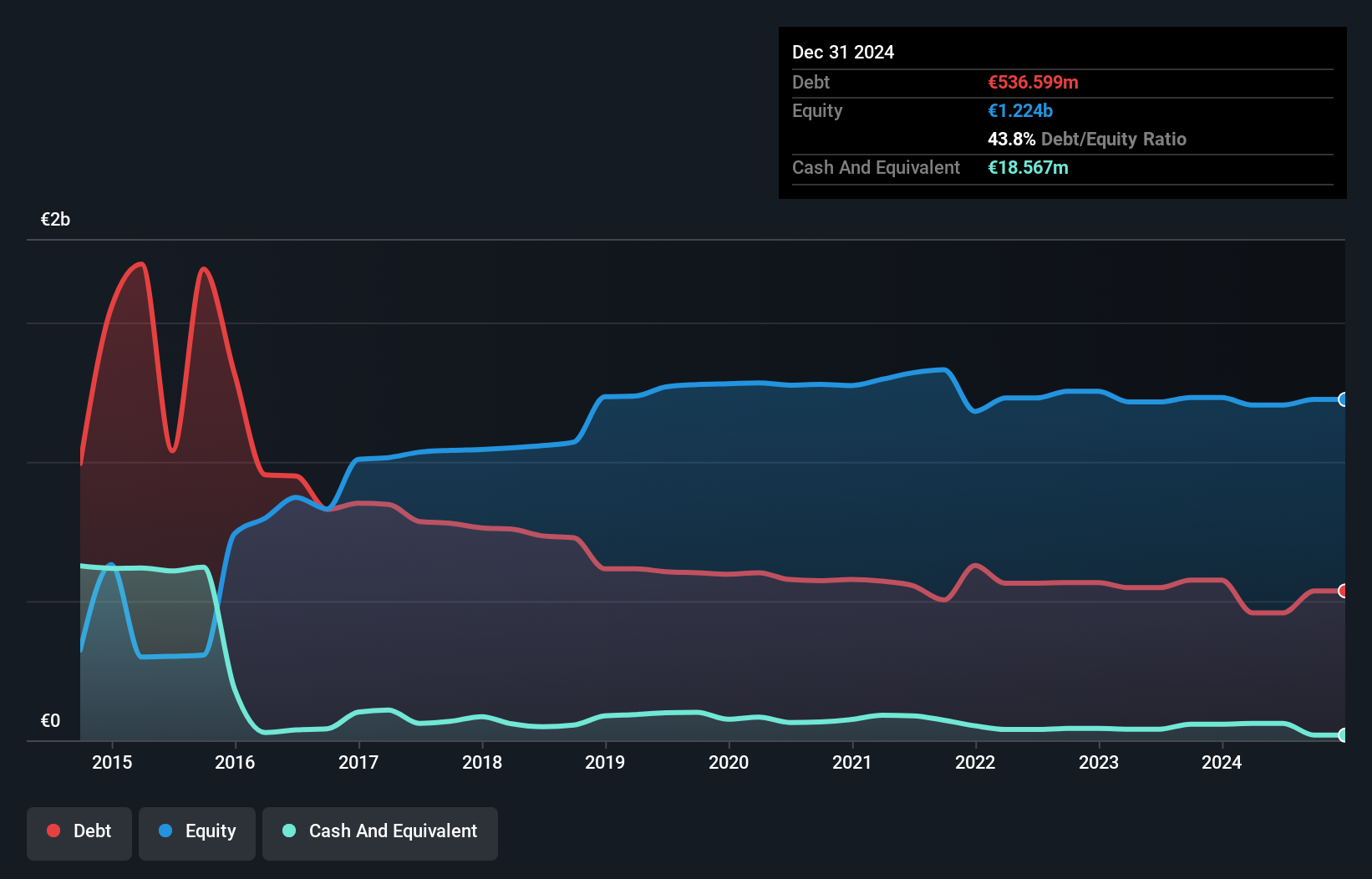

Realia's financial landscape paints an intriguing picture, with its debt to equity ratio improving from 47.7% to 38% over five years, indicating a more balanced approach to leverage. The company's earnings surged by 59.7% in the past year, outpacing the broader real estate sector's growth of 23.7%. However, a significant one-off loss of €24M has impacted recent results. Interest payments are comfortably covered at 3.6 times by EBIT, suggesting robust operational efficiency despite challenges in free cash flow data availability and potential cash runway concerns amidst evolving market conditions.

- Dive into the specifics of Realia Business here with our thorough health report.

Examine Realia Business' past performance report to understand how it has performed in the past.

East Pipes Integrated Company for Industry (SASE:1321)

Simply Wall St Value Rating: ★★★★★★

Overview: East Pipes Integrated Company for Industry focuses on manufacturing and selling pipes, tubes, and hollow shapes made from iron and steel in Saudi Arabia, with a market capitalization of SAR4.34 billion.

Operations: East Pipes generates revenue primarily from its Machinery - Pumps segment, amounting to SAR2.18 billion.

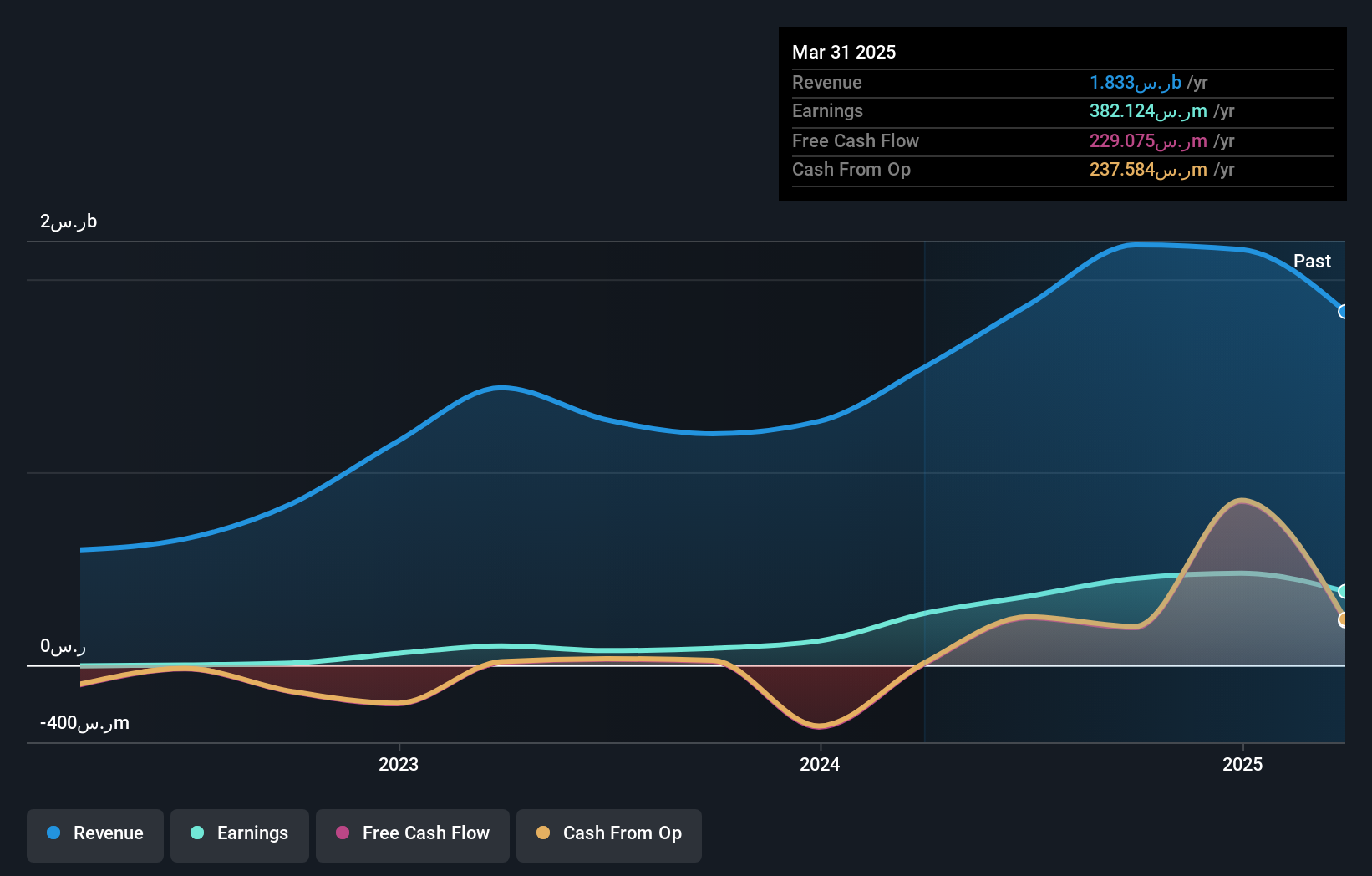

East Pipes Integrated Company for Industry has shown a robust performance, with earnings growth of 418.3% over the past year, outpacing the Metals and Mining industry average of 114%. The company reported impressive sales figures for its recent quarter at SAR 540.15 million, significantly up from SAR 230.27 million in the previous year. Net income also surged to SAR 112.85 million from SAR 20.79 million a year ago, highlighting strong profitability with basic earnings per share rising to SAR 3.58 from SAR 0.66 previously. Trading at nearly half its estimated fair value suggests potential undervaluation opportunities for investors seeking growth prospects in this sector.

Suzhou Hengmingda Electronic Technology (SZSE:002947)

Simply Wall St Value Rating: ★★★★★☆

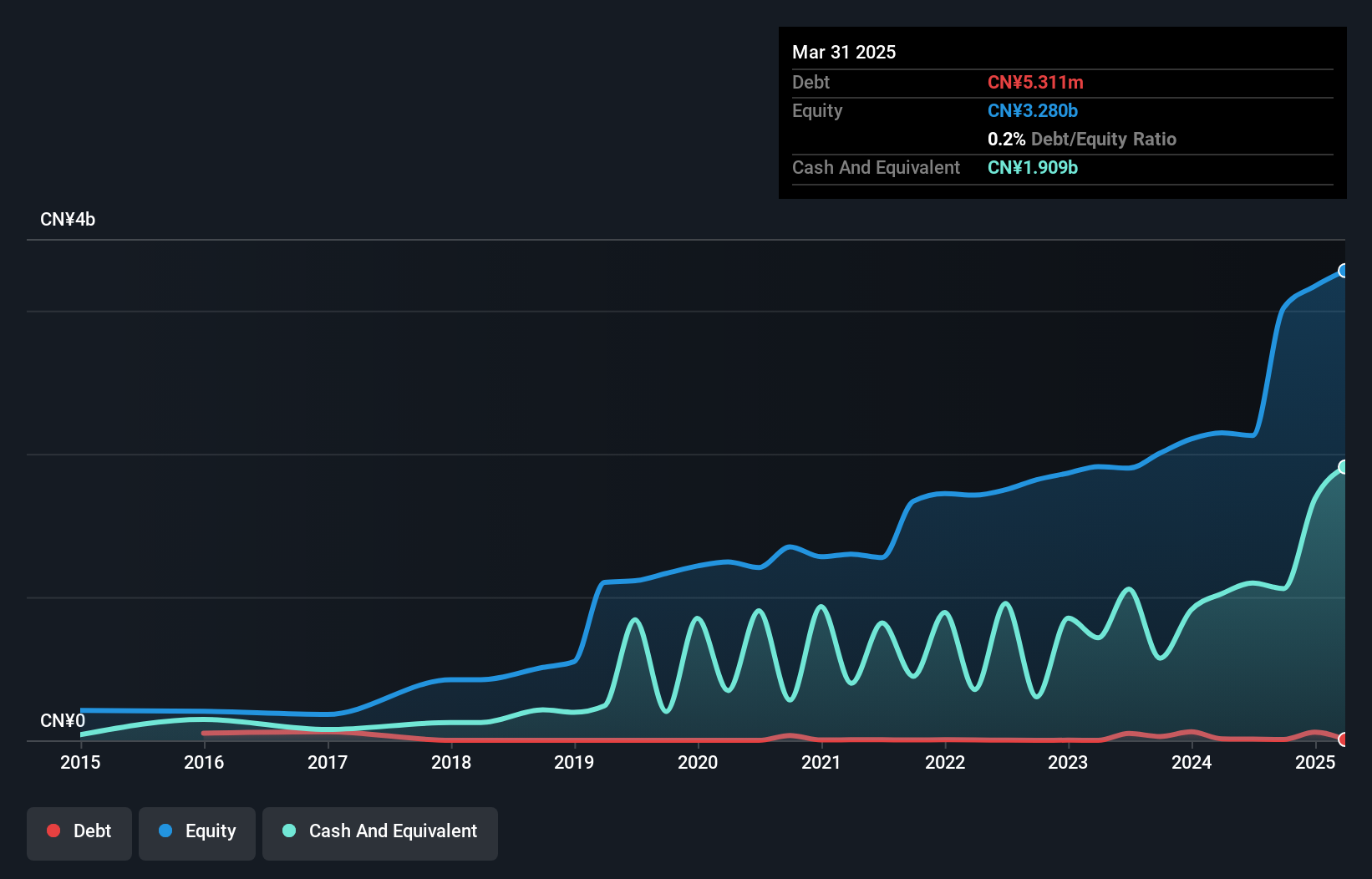

Overview: Suzhou Hengmingda Electronic Technology Co., Ltd. engages in the development and production of electronic components, with a market cap of CN¥9.02 billion.

Operations: The company generates revenue primarily from the sale of electronic components.

Suzhou Hengmingda Electronic Technology has shown remarkable growth, with earnings surging by 67.8% over the past year, outpacing the electronic industry's modest 1.9%. The company reported a net income of CNY 310.81 million for the first nine months of 2024, up from CNY 195.11 million in the same period last year, reflecting its strong performance and profitability. Its price-to-earnings ratio stands at a favorable 22.7x compared to the broader CN market's 35.3x, suggesting potential value for investors looking into this small but promising player in electronics manufacturing.

- Take a closer look at Suzhou Hengmingda Electronic Technology's potential here in our health report.

Seize The Opportunity

- Access the full spectrum of 4633 Undiscovered Gems With Strong Fundamentals by clicking on this link.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:002947

Suzhou Hengmingda Electronic Technology

Suzhou Hengmingda Electronic Technology Co., Ltd.

Undervalued with excellent balance sheet.

Market Insights

Community Narratives