- Spain

- /

- Real Estate

- /

- BME:MVC

3 European Companies That Could Be Trading Below Their Estimated Value

Reviewed by Simply Wall St

As European markets navigate through a period of economic stagnation and mixed investor sentiment, the pan-European STOXX Europe 600 Index recently experienced a decline of 2.57%, reflecting broader concerns about trade deals and economic growth. In this environment, identifying stocks that may be trading below their estimated value can present opportunities for investors seeking to capitalize on potential market inefficiencies.

Top 10 Undervalued Stocks Based On Cash Flows In Europe

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Talenom Oyj (HLSE:TNOM) | €3.46 | €6.88 | 49.7% |

| Sparebank 68° Nord (OB:SB68) | NOK176.50 | NOK348.17 | 49.3% |

| Qt Group Oyj (HLSE:QTCOM) | €57.40 | €113.83 | 49.6% |

| Profoto Holding (OM:PRFO) | SEK21.60 | SEK42.40 | 49.1% |

| Pluxee (ENXTPA:PLX) | €17.33 | €33.98 | 49% |

| Ion Beam Applications (ENXTBR:IBAB) | €11.80 | €23.21 | 49.2% |

| Hanza (OM:HANZA) | SEK108.40 | SEK213.64 | 49.3% |

| Green Oleo (BIT:GRN) | €0.835 | €1.63 | 48.6% |

| Diagnostyka (WSE:DIA) | PLN184.80 | PLN362.30 | 49% |

| Camurus (OM:CAMX) | SEK675.00 | SEK1344.78 | 49.8% |

Let's review some notable picks from our screened stocks.

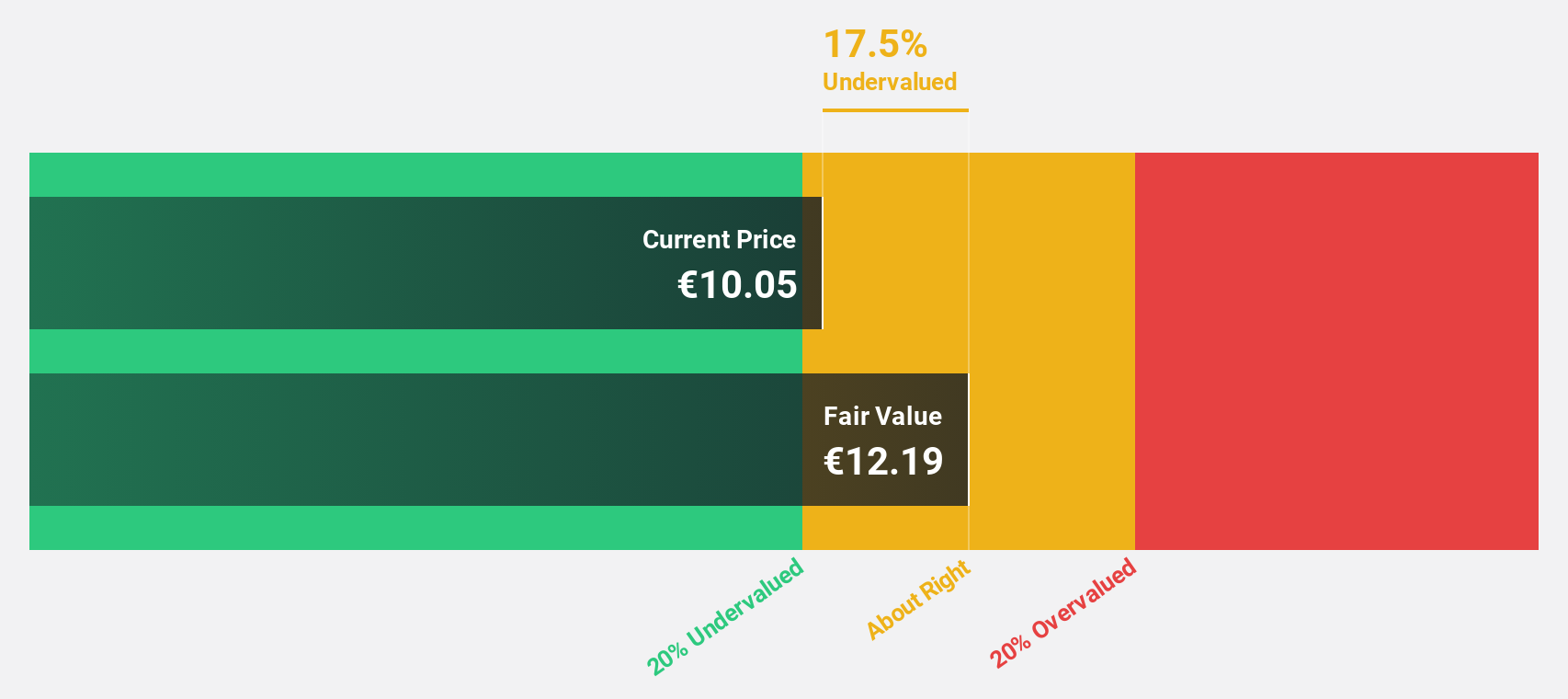

Metrovacesa (BME:MVC)

Overview: Metrovacesa S.A. is a real estate development company operating in Spain with a market cap of €1.53 billion.

Operations: The company's revenue is primarily generated from its residential segment at €516.37 million, complemented by €38.88 million from the tertiary sector.

Estimated Discount To Fair Value: 19.5%

Metrovacesa is trading at €10.1, below its estimated fair value of €12.55, indicating undervaluation based on cash flows. Despite a forecasted revenue growth of 8% per year, which outpaces the Spanish market's 4.6%, the company reported a net loss of €15.49 million for H1 2025 compared to a profit last year, impacting short-term performance. However, it is expected to become profitable in three years with above-average market growth potential in profits.

- The growth report we've compiled suggests that Metrovacesa's future prospects could be on the up.

- Navigate through the intricacies of Metrovacesa with our comprehensive financial health report here.

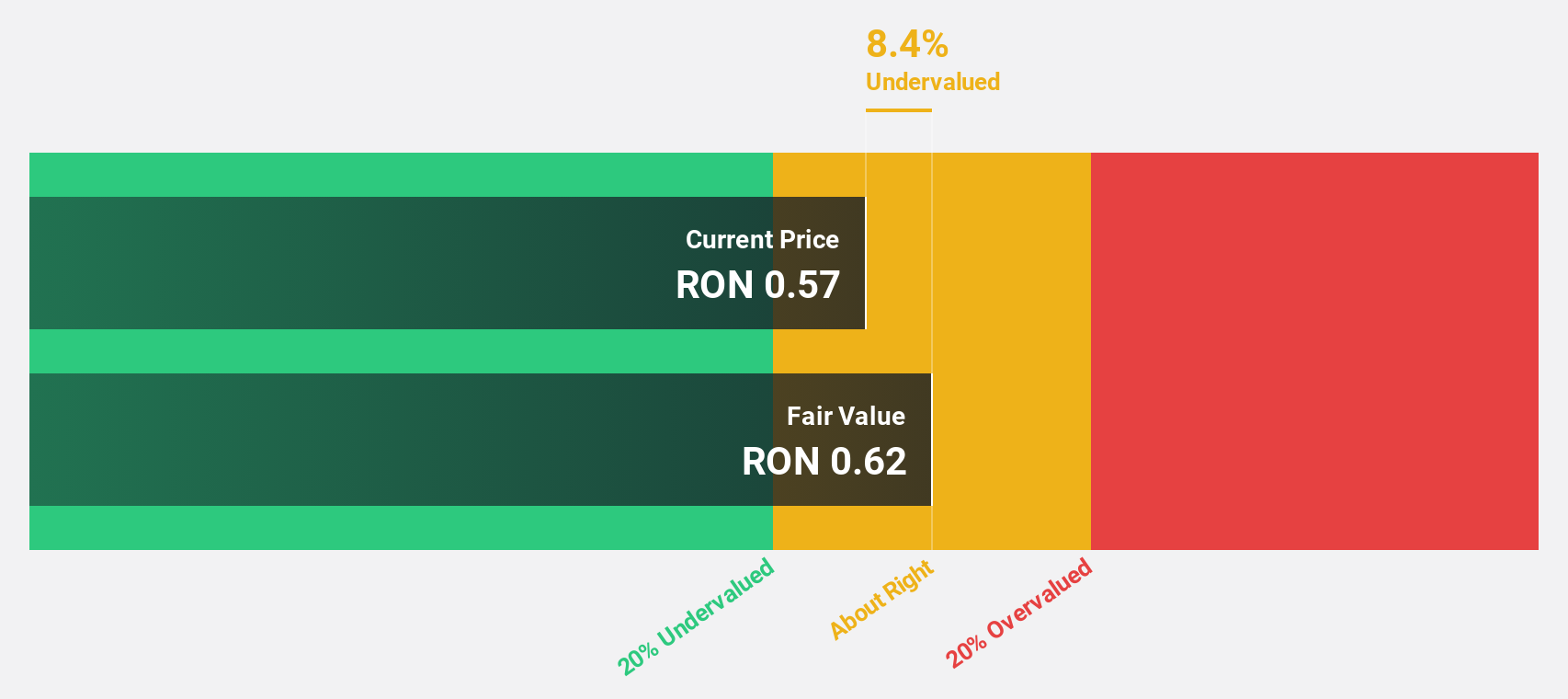

Teraplast (BVB:TRP)

Overview: Teraplast S.A., along with its subsidiaries, produces and distributes construction materials and PVC granules both in Romania and internationally, with a market capitalization of RON1.33 billion.

Operations: The company's revenue is primarily derived from its Installations and Recycling segment, which generated RON698.18 million, followed by the Flexible Packaging segment at RON123.63 million, Granules including Recycled at RON96.19 million, and Carpentry Joinery at RON52.27 million.

Estimated Discount To Fair Value: 16.4%

Teraplast is trading at RON 0.55, below its estimated fair value of RON 0.66, reflecting undervaluation based on cash flows. Recent earnings show a net income of RON 1.29 million for Q1 2025, reversing a loss from the previous year. While revenue growth is forecasted at 11.6% annually, surpassing the Romanian market's pace, interest payments remain poorly covered by earnings and Return on Equity is projected to be low at 7% in three years.

- Our expertly prepared growth report on Teraplast implies its future financial outlook may be stronger than recent results.

- Take a closer look at Teraplast's balance sheet health here in our report.

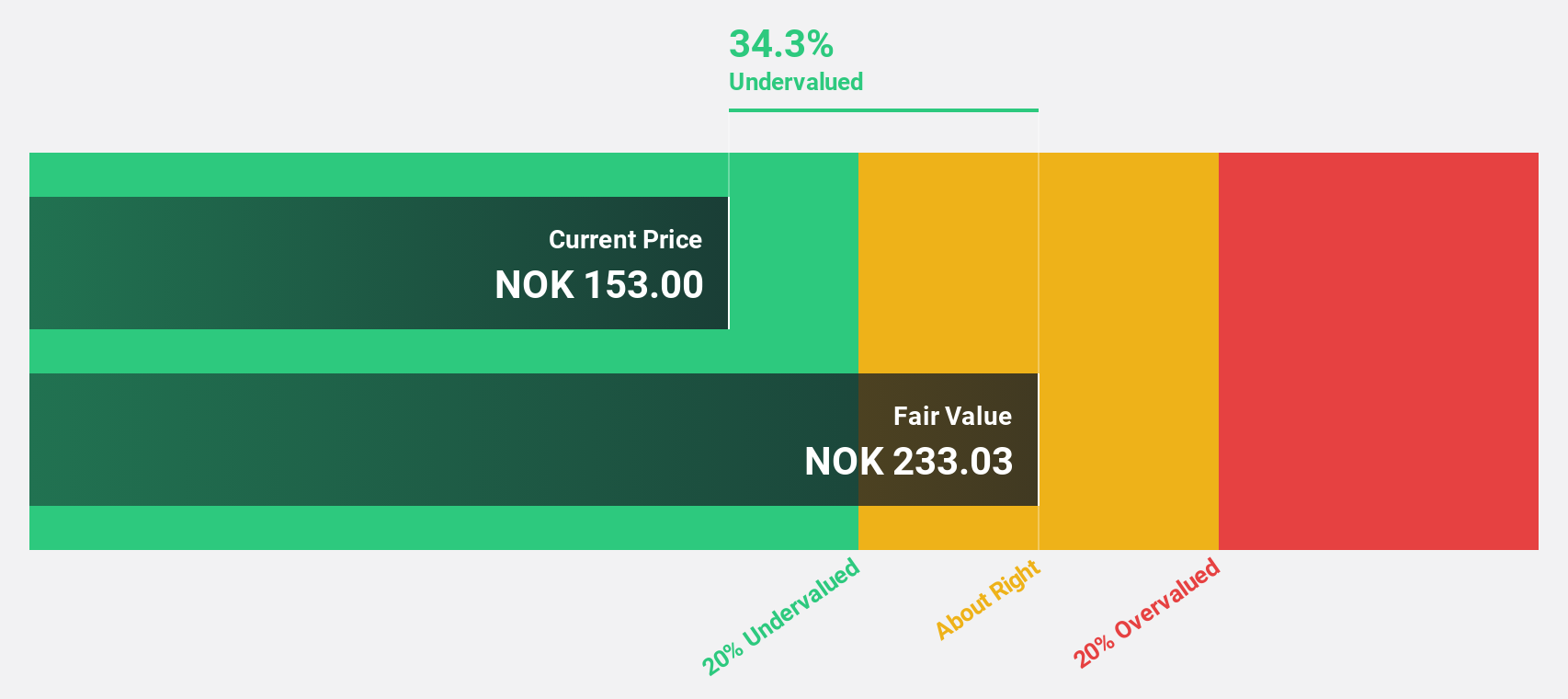

Kid (OB:KID)

Overview: Kid ASA, along with its subsidiaries, operates as a home textile retailer in Norway, Sweden, Finland, and Estonia with a market cap of NOK5.99 billion.

Operations: The company's revenue is primarily derived from its Hemtex segment, which generated NOK1.47 billion, and its KID Interior segment, which contributed NOK2.35 billion.

Estimated Discount To Fair Value: 34.2%

Kid ASA is trading at NOK 147.6, significantly below its estimated fair value of NOK 224.44, highlighting undervaluation based on cash flows. Despite a net loss in Q1 2025, revenue growth outpaces the Norwegian market at an expected 7.7% annually. Recent Q2 results show a revenue increase to MNOK 856.4 from MNOK 815.4 year-on-year, although dividends remain unstable with recent approval of NOK 5 per share payout amidst these financial dynamics.

- Upon reviewing our latest growth report, Kid's projected financial performance appears quite optimistic.

- Unlock comprehensive insights into our analysis of Kid stock in this financial health report.

Seize The Opportunity

- Click here to access our complete index of 193 Undervalued European Stocks Based On Cash Flows.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About BME:MVC

Excellent balance sheet with reasonable growth potential.

Market Insights

Community Narratives