The Laboratorio Reig Jofre (BME:RJF) Share Price Has Gained 146%, So Why Not Pay It Some Attention?

The most you can lose on any stock (assuming you don't use leverage) is 100% of your money. But when you pick a company that is really flourishing, you can make more than 100%. Take, for example Laboratorio Reig Jofre, S.A. (BME:RJF). Its share price is already up an impressive 146% in the last twelve months. On top of that, the share price is up 51% in about a quarter. The company reported its financial results recently; you can catch up on the latest numbers by reading our company report. Looking back further, the stock price is 128% higher than it was three years ago.

Check out our latest analysis for Laboratorio Reig Jofre

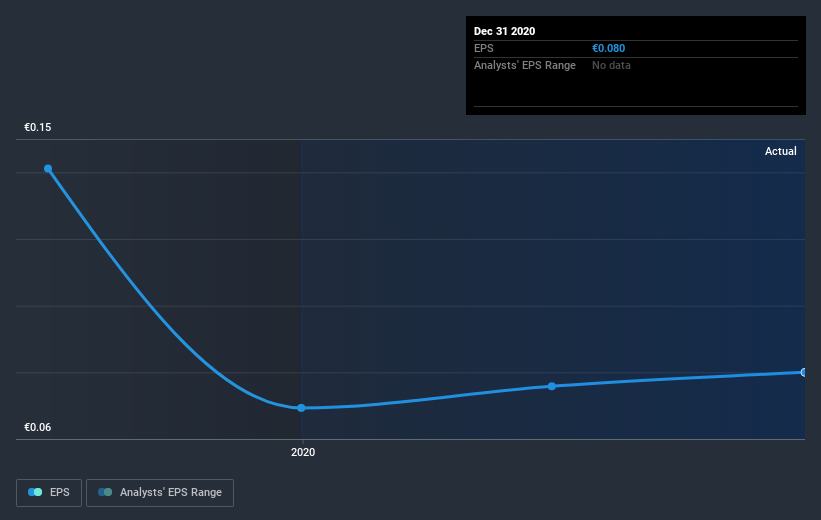

While markets are a powerful pricing mechanism, share prices reflect investor sentiment, not just underlying business performance. One flawed but reasonable way to assess how sentiment around a company has changed is to compare the earnings per share (EPS) with the share price.

Laboratorio Reig Jofre was able to grow EPS by 15% in the last twelve months. This EPS growth is significantly lower than the 146% increase in the share price. This indicates that the market is now more optimistic about the stock. The fairly generous P/E ratio of 70.75 also points to this optimism.

You can see how EPS has changed over time in the image below (click on the chart to see the exact values).

It might be well worthwhile taking a look at our free report on Laboratorio Reig Jofre's earnings, revenue and cash flow.

A Different Perspective

It's nice to see that Laboratorio Reig Jofre shareholders have received a total shareholder return of 148% over the last year. That gain is better than the annual TSR over five years, which is 11%. Therefore it seems like sentiment around the company has been positive lately. Given the share price momentum remains strong, it might be worth taking a closer look at the stock, lest you miss an opportunity. It's always interesting to track share price performance over the longer term. But to understand Laboratorio Reig Jofre better, we need to consider many other factors. Even so, be aware that Laboratorio Reig Jofre is showing 1 warning sign in our investment analysis , you should know about...

But note: Laboratorio Reig Jofre may not be the best stock to buy. So take a peek at this free list of interesting companies with past earnings growth (and further growth forecast).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on ES exchanges.

When trading Laboratorio Reig Jofre or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About BME:RJF

Laboratorio Reig Jofre

A pharmaceutical company, engages in the research, development, manufacture, and marketing of pharmaceutical products, raw materials, biotechnological products, nutritional supplements, health products, medical devices, cosmetics, parapharmacy, food, and animal food.

Flawless balance sheet unattractive dividend payer.

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success