The external fund manager backed by Berkshire Hathaway's Charlie Munger, Li Lu, makes no bones about it when he says 'The biggest investment risk is not the volatility of prices, but whether you will suffer a permanent loss of capital.' So it might be obvious that you need to consider debt, when you think about how risky any given stock is, because too much debt can sink a company. We note that Laboratorio Reig Jofre, S.A. (BME:RJF) does have debt on its balance sheet. But the real question is whether this debt is making the company risky.

What Risk Does Debt Bring?

Generally speaking, debt only becomes a real problem when a company can't easily pay it off, either by raising capital or with its own cash flow. Part and parcel of capitalism is the process of 'creative destruction' where failed businesses are mercilessly liquidated by their bankers. However, a more common (but still painful) scenario is that it has to raise new equity capital at a low price, thus permanently diluting shareholders. Of course, plenty of companies use debt to fund growth, without any negative consequences. The first step when considering a company's debt levels is to consider its cash and debt together.

Check out our latest analysis for Laboratorio Reig Jofre

What Is Laboratorio Reig Jofre's Net Debt?

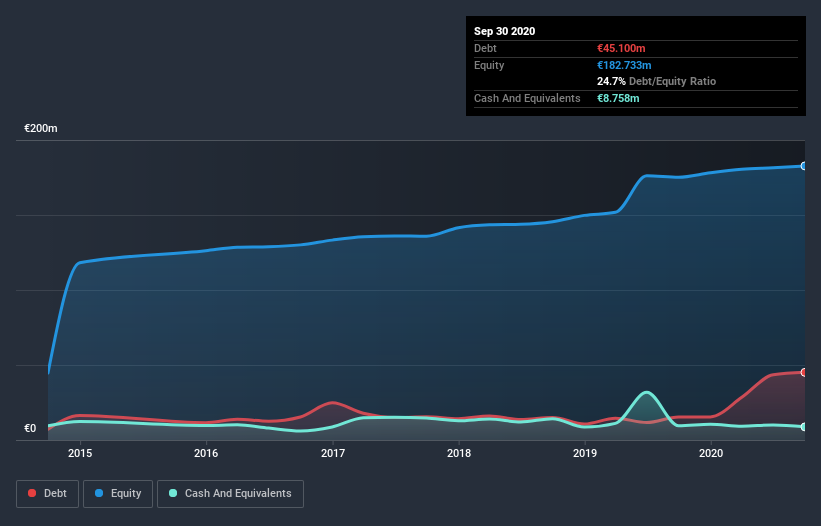

You can click the graphic below for the historical numbers, but it shows that as of September 2020 Laboratorio Reig Jofre had €45.1m of debt, an increase on €15.4m, over one year. However, it also had €8.76m in cash, and so its net debt is €36.3m.

A Look At Laboratorio Reig Jofre's Liabilities

Zooming in on the latest balance sheet data, we can see that Laboratorio Reig Jofre had liabilities of €76.4m due within 12 months and liabilities of €59.0m due beyond that. On the other hand, it had cash of €8.76m and €49.9m worth of receivables due within a year. So its liabilities outweigh the sum of its cash and (near-term) receivables by €76.6m.

This deficit isn't so bad because Laboratorio Reig Jofre is worth €342.3m, and thus could probably raise enough capital to shore up its balance sheet, if the need arose. But it's clear that we should definitely closely examine whether it can manage its debt without dilution.

We measure a company's debt load relative to its earnings power by looking at its net debt divided by its earnings before interest, tax, depreciation, and amortization (EBITDA) and by calculating how easily its earnings before interest and tax (EBIT) cover its interest expense (interest cover). Thus we consider debt relative to earnings both with and without depreciation and amortization expenses.

Laboratorio Reig Jofre's net debt is only 1.3 times its EBITDA. And its EBIT easily covers its interest expense, being 44.1 times the size. So you could argue it is no more threatened by its debt than an elephant is by a mouse. In addition to that, we're happy to report that Laboratorio Reig Jofre has boosted its EBIT by 81%, thus reducing the spectre of future debt repayments. When analysing debt levels, the balance sheet is the obvious place to start. But it is Laboratorio Reig Jofre's earnings that will influence how the balance sheet holds up in the future. So when considering debt, it's definitely worth looking at the earnings trend. Click here for an interactive snapshot.

But our final consideration is also important, because a company cannot pay debt with paper profits; it needs cold hard cash. So we clearly need to look at whether that EBIT is leading to corresponding free cash flow. During the last three years, Laboratorio Reig Jofre burned a lot of cash. While that may be a result of expenditure for growth, it does make the debt far more risky.

Our View

Based on what we've seen Laboratorio Reig Jofre is not finding it easy, given its conversion of EBIT to free cash flow, but the other factors we considered give us cause to be optimistic. In particular, we are dazzled with its interest cover. When we consider all the elements mentioned above, it seems to us that Laboratorio Reig Jofre is managing its debt quite well. But a word of caution: we think debt levels are high enough to justify ongoing monitoring. The balance sheet is clearly the area to focus on when you are analysing debt. But ultimately, every company can contain risks that exist outside of the balance sheet. Be aware that Laboratorio Reig Jofre is showing 1 warning sign in our investment analysis , you should know about...

When all is said and done, sometimes its easier to focus on companies that don't even need debt. Readers can access a list of growth stocks with zero net debt 100% free, right now.

When trading Laboratorio Reig Jofre or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About BME:RJF

Laboratorio Reig Jofre

A pharmaceutical company, engages in the research, development, manufacture, and marketing of pharmaceutical products, raw materials, biotechnological products, nutritional supplements, health products, medical devices, cosmetics, parapharmacy, food, and animal food.

Flawless balance sheet unattractive dividend payer.

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success