- Germany

- /

- Specialty Stores

- /

- DB:YOU

European Market's May 2025 Stock Picks That Could Be Trading At A Discount

Reviewed by Simply Wall St

As the European markets experience a boost in sentiment following the recent de-escalation of trade tensions between the U.S. and China, major indices like Germany's DAX and France's CAC 40 have seen notable gains. In this environment of renewed optimism, investors may be on the lookout for stocks trading at a discount, which often present opportunities when market conditions are favorable for growth potential and stability.

Top 10 Undervalued Stocks Based On Cash Flows In Europe

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Laboratorios Farmaceuticos Rovi (BME:ROVI) | €52.75 | €105.29 | 49.9% |

| Airbus (ENXTPA:AIR) | €161.84 | €322.14 | 49.8% |

| adidas (XTRA:ADS) | €220.70 | €439.05 | 49.7% |

| Lectra (ENXTPA:LSS) | €23.75 | €47.40 | 49.9% |

| Absolent Air Care Group (OM:ABSO) | SEK214.00 | SEK417.39 | 48.7% |

| Boreo Oyj (HLSE:BOREO) | €15.65 | €30.99 | 49.5% |

| Lumibird (ENXTPA:LBIRD) | €11.90 | €23.51 | 49.4% |

| Claranova (ENXTPA:CLA) | €2.82 | €5.47 | 48.4% |

| BHG Group (OM:BHG) | SEK27.20 | SEK53.71 | 49.4% |

| HBX Group International (BME:HBX) | €9.90 | €19.37 | 48.9% |

We'll examine a selection from our screener results.

Laboratorio Reig Jofre (BME:RJF)

Overview: Laboratorio Reig Jofre, S.A. is a pharmaceutical company involved in the research, development, manufacture, and marketing of pharmaceutical products and specialties along with authorized foodstuffs, dietary and personal care products, and cosmetics; it has a market cap of €244.18 million.

Operations: Laboratorio Reig Jofre's revenue is derived from its activities in pharmaceuticals, including research, development, manufacturing, and marketing of pharmaceutical products and specialties, as well as dietary and personal care items and cosmetics.

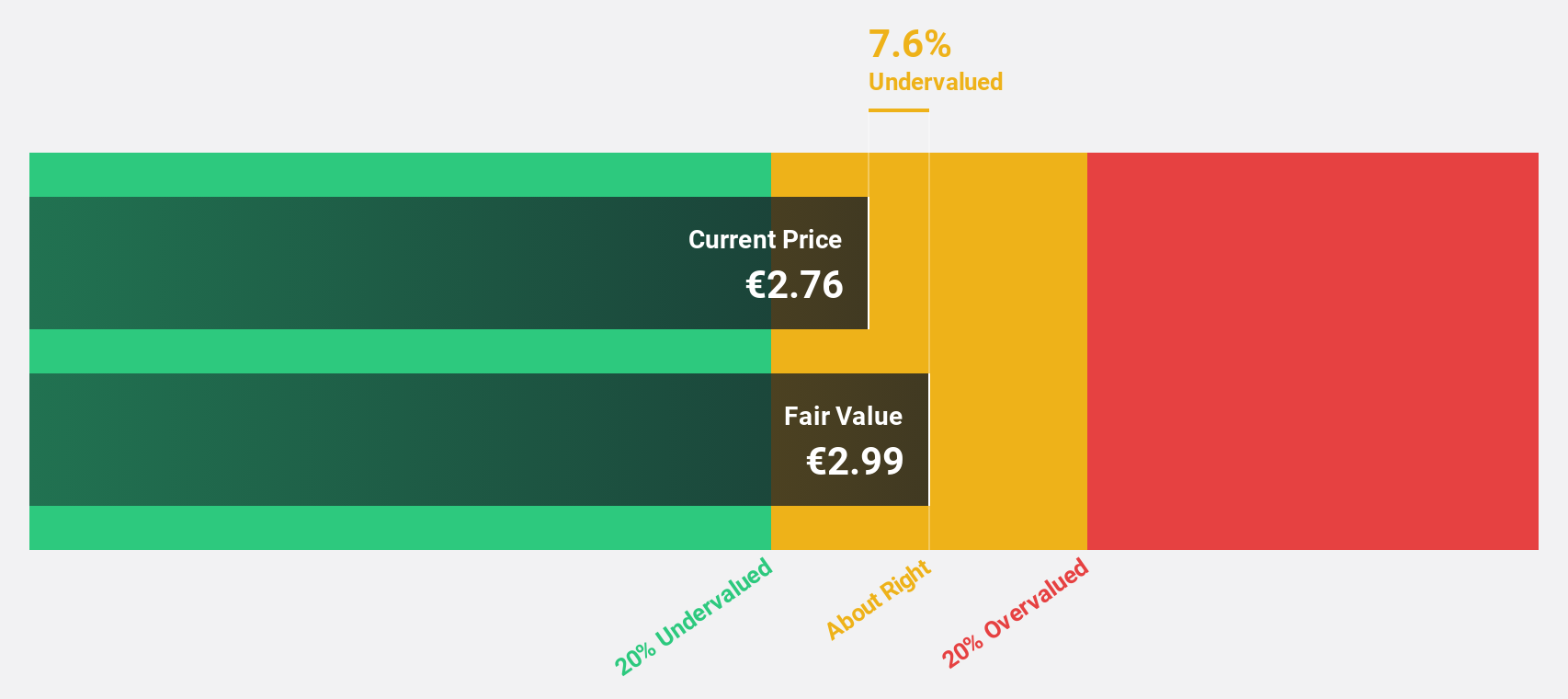

Estimated Discount To Fair Value: 18.2%

Laboratorio Reig Jofre, S.A. is trading at €3.05, which is 18.2% below its estimated fair value of €3.73, suggesting potential undervaluation based on cash flows despite not being highly undervalued. Recent earnings show a net income increase to €3.66 million for Q1 2025 from €3.27 million the previous year, with forecasted earnings growth of 25% annually outpacing both revenue growth and the Spanish market average, indicating robust future cash flow potential amidst a recent stock split event.

- Insights from our recent growth report point to a promising forecast for Laboratorio Reig Jofre's business outlook.

- Dive into the specifics of Laboratorio Reig Jofre here with our thorough financial health report.

About You Holding (DB:YOU)

Overview: About You Holding SE is a fashion and technology company that operates fashion e-commerce platforms in Europe, with a market cap of €1.18 billion.

Operations: The company's revenue is generated from three main segments: TME (€191 million), ABOUT YOU RoE (€935 million), and ABOUT YOU DACH (€990.40 million).

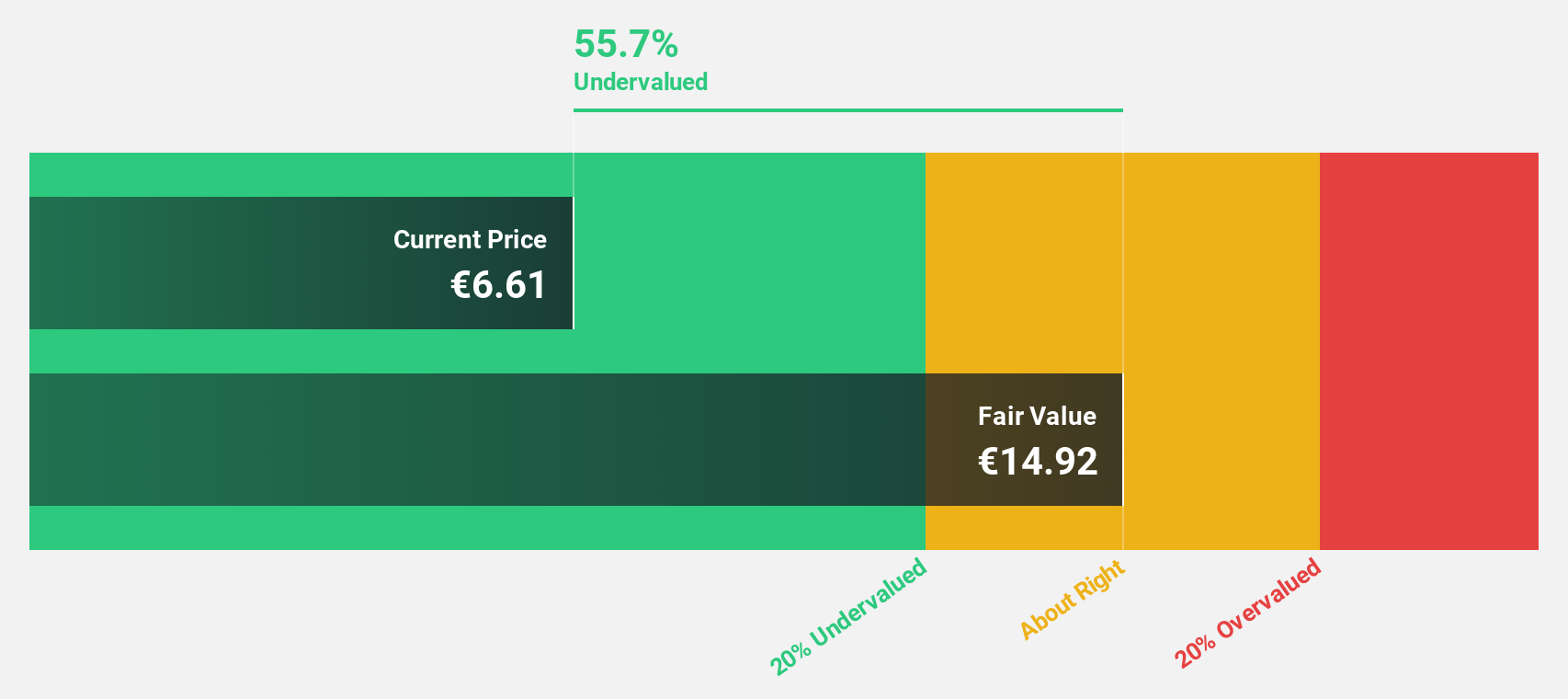

Estimated Discount To Fair Value: 46.6%

About You Holding is trading at €6.77, significantly below its estimated fair value of €12.68, indicating potential undervaluation based on cash flows. The company reported an annual net loss of €106.7 million, slightly improved from the previous year, with sales reaching €2 billion. Although removed from the Germany SDAX Index recently, it is expected to achieve profitability within three years with revenue growth projected at 7.5% annually, outpacing the German market average.

- In light of our recent growth report, it seems possible that About You Holding's financial performance will exceed current levels.

- Delve into the full analysis health report here for a deeper understanding of About You Holding.

Byggmax Group (OM:BMAX)

Overview: Byggmax Group AB (publ) is a company that sells building materials and related products for DIY projects in Sweden, Norway, and internationally, with a market cap of SEK3.08 billion.

Operations: The company's revenue is primarily derived from its Byggmax segment, totaling SEK6.07 billion.

Estimated Discount To Fair Value: 39.4%

Byggmax Group, trading at SEK 52.5, is valued below its estimated fair value of SEK 86.64, highlighting potential undervaluation based on cash flows. The company forecasts significant earnings growth of over 52% annually, surpassing the Swedish market average. Despite a net loss reduction to SEK 112 million in Q1 2025 from SEK 147 million a year earlier and improved sales figures, revenue growth remains modest at 5.4% per year.

- Upon reviewing our latest growth report, Byggmax Group's projected financial performance appears quite optimistic.

- Get an in-depth perspective on Byggmax Group's balance sheet by reading our health report here.

Taking Advantage

- Click through to start exploring the rest of the 180 Undervalued European Stocks Based On Cash Flows now.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About DB:YOU

ABOUT YOU Holding

ABOUT YOU Holding SE retails lifestyle and fashion products for women, men, babies, girls, and boys.

Flawless balance sheet and slightly overvalued.

Similar Companies

Market Insights

Community Narratives