Oryzon Genomics S.A. (BME:ORY) Screens Well But There Might Be A Catch

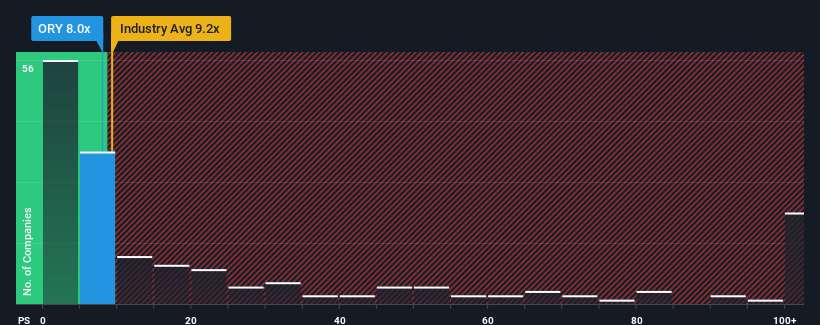

With a median price-to-sales (or "P/S") ratio of close to 9.2x in the Biotechs industry in Spain, you could be forgiven for feeling indifferent about Oryzon Genomics S.A.'s (BME:ORY) P/S ratio of 8x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/S.

View our latest analysis for Oryzon Genomics

What Does Oryzon Genomics' Recent Performance Look Like?

Recent times haven't been great for Oryzon Genomics as its revenue has been rising slower than most other companies. It might be that many expect the uninspiring revenue performance to strengthen positively, which has kept the P/S ratio from falling. However, if this isn't the case, investors might get caught out paying too much for the stock.

Want the full picture on analyst estimates for the company? Then our free report on Oryzon Genomics will help you uncover what's on the horizon.What Are Revenue Growth Metrics Telling Us About The P/S?

The only time you'd be comfortable seeing a P/S like Oryzon Genomics' is when the company's growth is tracking the industry closely.

Taking a look back first, we see that the company grew revenue by an impressive 45% last year. The strong recent performance means it was also able to grow revenue by 30% in total over the last three years. Accordingly, shareholders would have definitely welcomed those medium-term rates of revenue growth.

Looking ahead now, revenue is anticipated to climb by 128% each year during the coming three years according to the three analysts following the company. Meanwhile, the rest of the industry is forecast to only expand by 36% each year, which is noticeably less attractive.

With this information, we find it interesting that Oryzon Genomics is trading at a fairly similar P/S compared to the industry. Apparently some shareholders are skeptical of the forecasts and have been accepting lower selling prices.

The Key Takeaway

Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

We've established that Oryzon Genomics currently trades on a lower than expected P/S since its forecasted revenue growth is higher than the wider industry. There could be some risks that the market is pricing in, which is preventing the P/S ratio from matching the positive outlook. However, if you agree with the analysts' forecasts, you may be able to pick up the stock at an attractive price.

And what about other risks? Every company has them, and we've spotted 2 warning signs for Oryzon Genomics you should know about.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About BME:ORY

Oryzon Genomics

A clinical stage biopharmaceutical company, engages in the discovery and development of epigenetics-based therapeutics for patients with cancer and CNS (central nervous system) disorders.

High growth potential with excellent balance sheet.

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success