As European markets face uncertainty due to U.S. trade policy and recent ECB rate cuts, the pan-European STOXX Europe 600 Index has snapped a 10-week streak of gains, although increased defense and infrastructure spending in Germany and the EU have helped mitigate losses. In this environment, identifying high growth tech stocks involves looking for companies that can leverage innovation to navigate economic challenges and capitalize on shifts in consumer behavior or government spending priorities.

Top 10 High Growth Tech Companies In Europe

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Pharma Mar | 24.24% | 40.82% | ★★★★★★ |

| Elicera Therapeutics | 63.53% | 97.24% | ★★★★★★ |

| CD Projekt | 27.71% | 41.31% | ★★★★★★ |

| Yubico | 20.88% | 26.53% | ★★★★★★ |

| Truecaller | 20.10% | 24.70% | ★★★★★★ |

| XTPL | 97.45% | 117.95% | ★★★★★★ |

| Devyser Diagnostics | 27.27% | 98.23% | ★★★★★★ |

| Elliptic Laboratories | 49.76% | 88.21% | ★★★★★★ |

| Ascelia Pharma | 46.09% | 66.93% | ★★★★★★ |

| Skolon | 29.71% | 91.18% | ★★★★★★ |

We're going to check out a few of the best picks from our screener tool.

Grifols (BME:GRF)

Simply Wall St Growth Rating: ★★★★☆☆

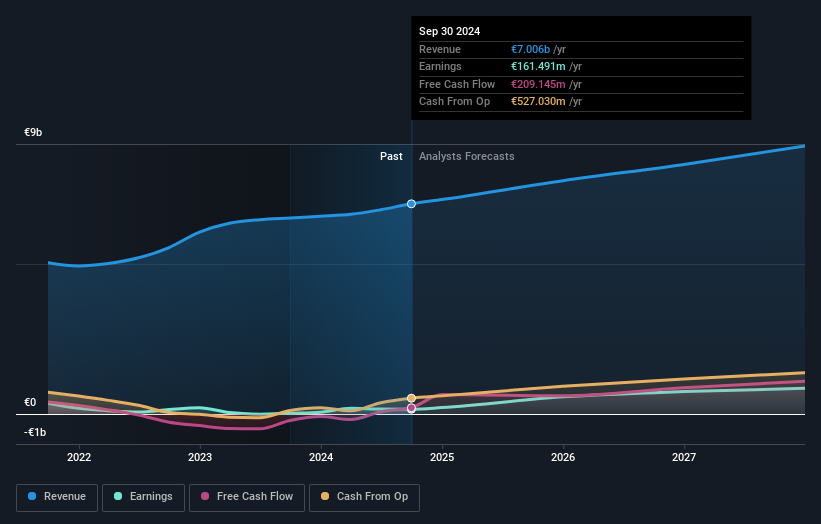

Overview: Grifols, S.A. is a plasma therapeutic company with operations in Spain, the United States, Canada, and internationally, and has a market cap of €6.40 billion.

Operations: Grifols generates revenue primarily from its Biopharma segment, which accounts for €6.14 billion, followed by the Diagnostic segment at €644.90 million and Bio Supplies at €215.66 million.

Grifols has demonstrated robust financial performance with a notable increase in annual sales to EUR 7.21 billion, up from EUR 6.59 billion last year, alongside a surge in net income from EUR 42.32 million to EUR 156.92 million. This growth trajectory is supported by an aggressive R&D stance, as evidenced by their recent strategic debt financing aimed at bolstering long-term investments and operational expansions. With leadership changes poised to enhance governance and strategic direction, Grifols is reinforcing its position in the biotech sector amid dynamic market conditions and competitive pressures.

- Navigate through the intricacies of Grifols with our comprehensive health report here.

Assess Grifols' past performance with our detailed historical performance reports.

Believe (ENXTPA:BLV)

Simply Wall St Growth Rating: ★★★★☆☆

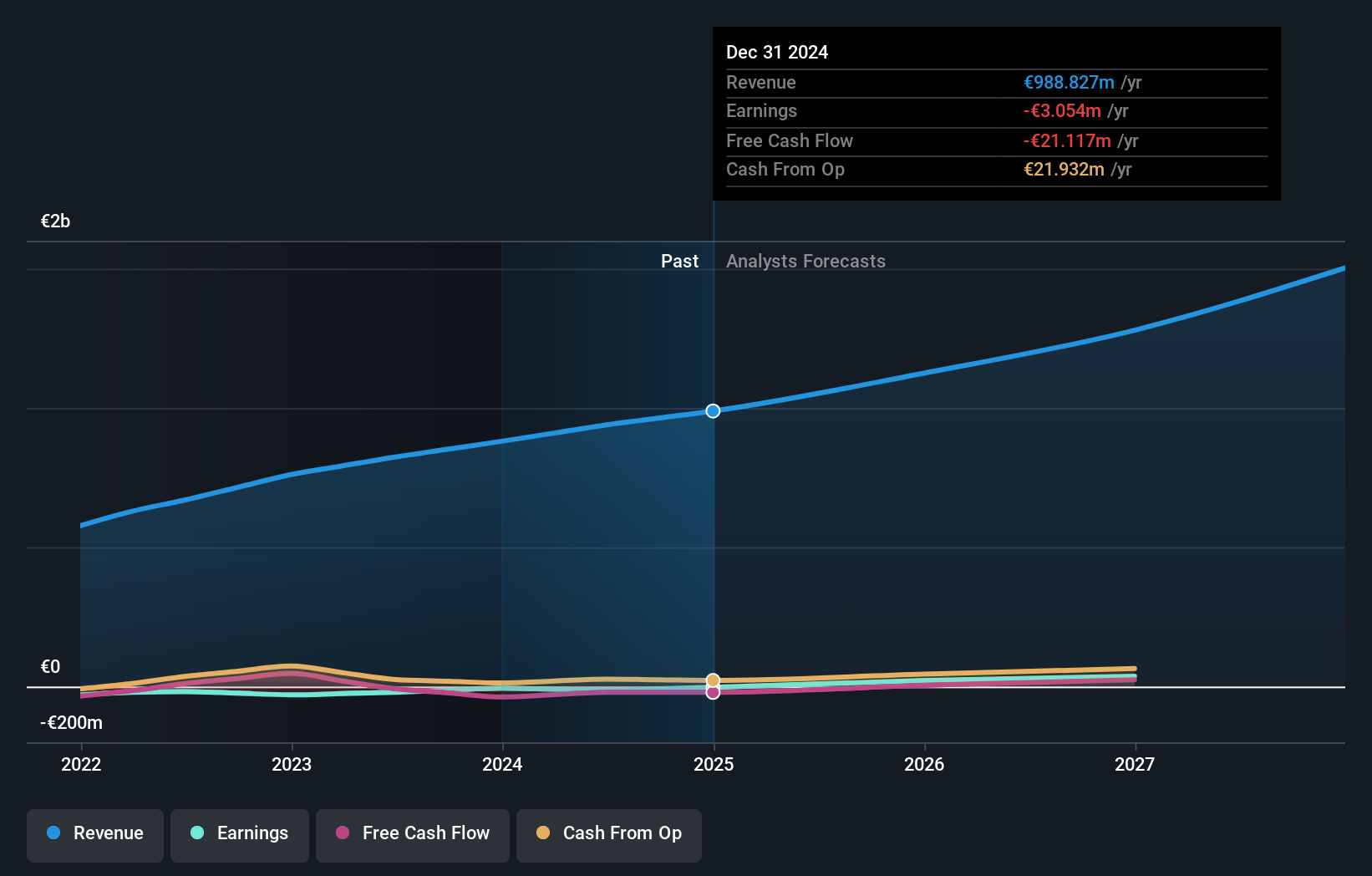

Overview: Believe S.A. is a company that offers digital music services to independent labels and local artists across various regions including France, Germany, the rest of Europe, the Americas, Asia, Oceania, and the Pacific with a market capitalization of approximately €1.49 billion.

Operations: The company generates revenue primarily through Premium Solutions (€877.53 million) and Automated Solutions (€61.50 million).

Believe, a player in the dynamic tech landscape of Europe, is navigating its growth trajectory with promising forecasts. Expected to outpace the French market with a revenue increase of 13% annually compared to the national average of 6%, Believe is also on track to shift from unprofitability to profitability within three years—a significant turnaround. This progress is underscored by an impressive projected annual earnings growth rate of 56.95%. While currently not generating free cash flow, these financial indicators suggest a robust capacity for future revenue generation and earnings expansion, positioning Believe favorably amidst competitive pressures in the tech sector.

- Click to explore a detailed breakdown of our findings in Believe's health report.

Gain insights into Believe's past trends and performance with our Past report.

AT & S Austria Technologie & Systemtechnik (WBAG:ATS)

Simply Wall St Growth Rating: ★★★★☆☆

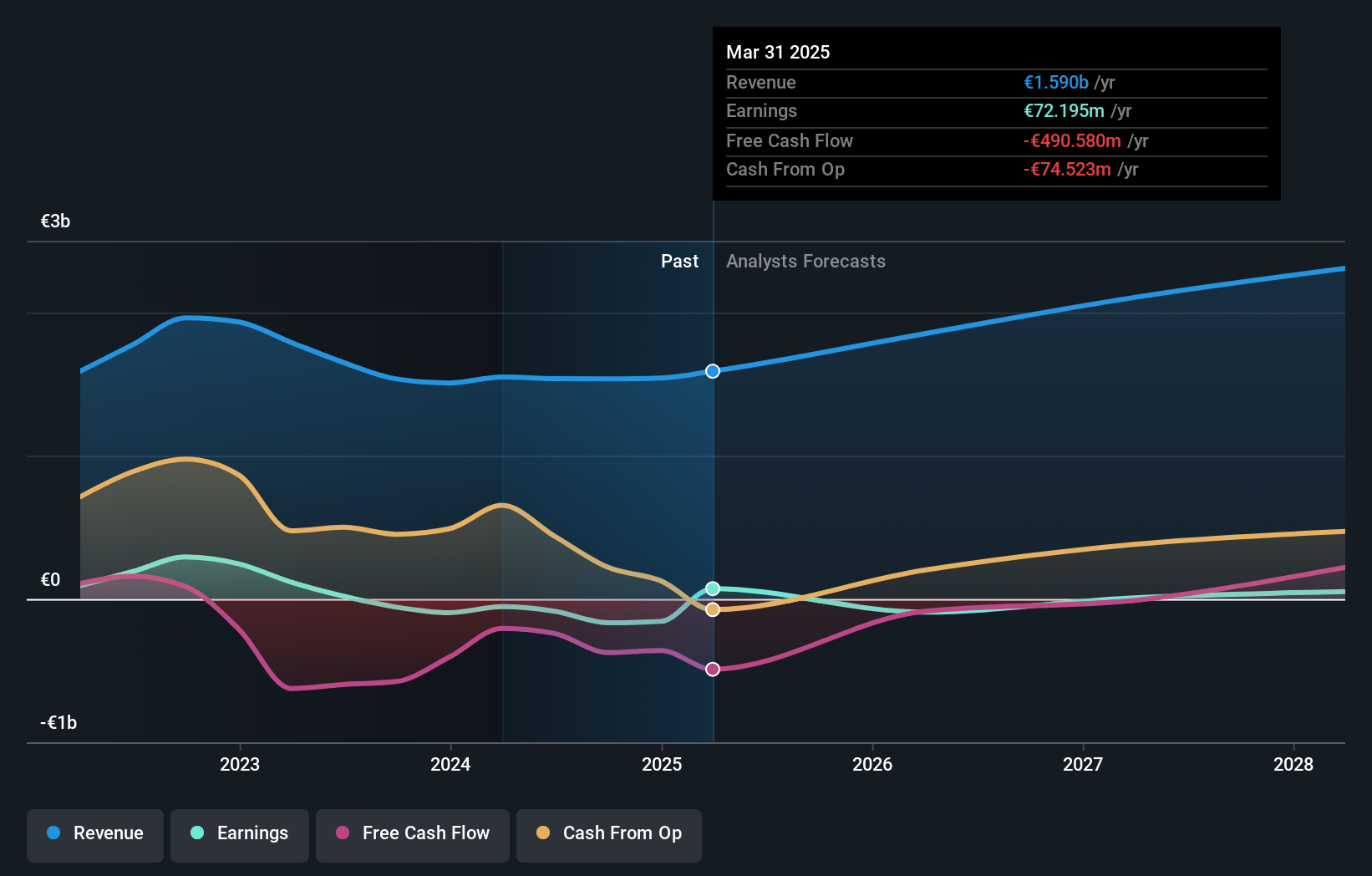

Overview: AT & S Austria Technologie & Systemtechnik Aktiengesellschaft, along with its subsidiaries, is involved in the manufacturing and distribution of printed circuit boards across various regions including Austria, Germany, Europe, China, Asia, and the Americas with a market cap of approximately €514.76 million.

Operations: The company generates revenue primarily from two segments: Microelectronics, contributing approximately €672.95 million, and Electronics Solutions, accounting for around €953.08 million. Notably, the Electronics Solutions segment is the larger contributor to their overall revenue stream.

AT & S Austria Technologie & Systemtechnik, amidst a challenging landscape, is steering towards profitability with an anticipated earnings growth of 102.3% annually. This growth trajectory is supported by robust R&D investments, which have consistently aligned with revenue increases—18.5% per year—outpacing the Austrian market's 1.4%. The recent appointment of Dr. Michael Mertin as CEO heralds a strategic pivot, potentially enhancing innovation and market adaptability in high-tech sectors critical to AT & S's future success.

- Get an in-depth perspective on AT & S Austria Technologie & Systemtechnik's performance by reading our health report here.

Understand AT & S Austria Technologie & Systemtechnik's track record by examining our Past report.

Where To Now?

- Unlock our comprehensive list of 245 European High Growth Tech and AI Stocks by clicking here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About WBAG:ATS

AT & S Austria Technologie & Systemtechnik

Manufactures, distributes, and sells printed circuit boards in Austria, Germany, rest of Europe, China, rest of Asia, and the Americas.

Undervalued with moderate growth potential.

Similar Companies

Market Insights

Community Narratives