Faes Farma (BME:FAE) Earnings Growth and Undervaluation Reinforce Bullish Narrative

Reviewed by Simply Wall St

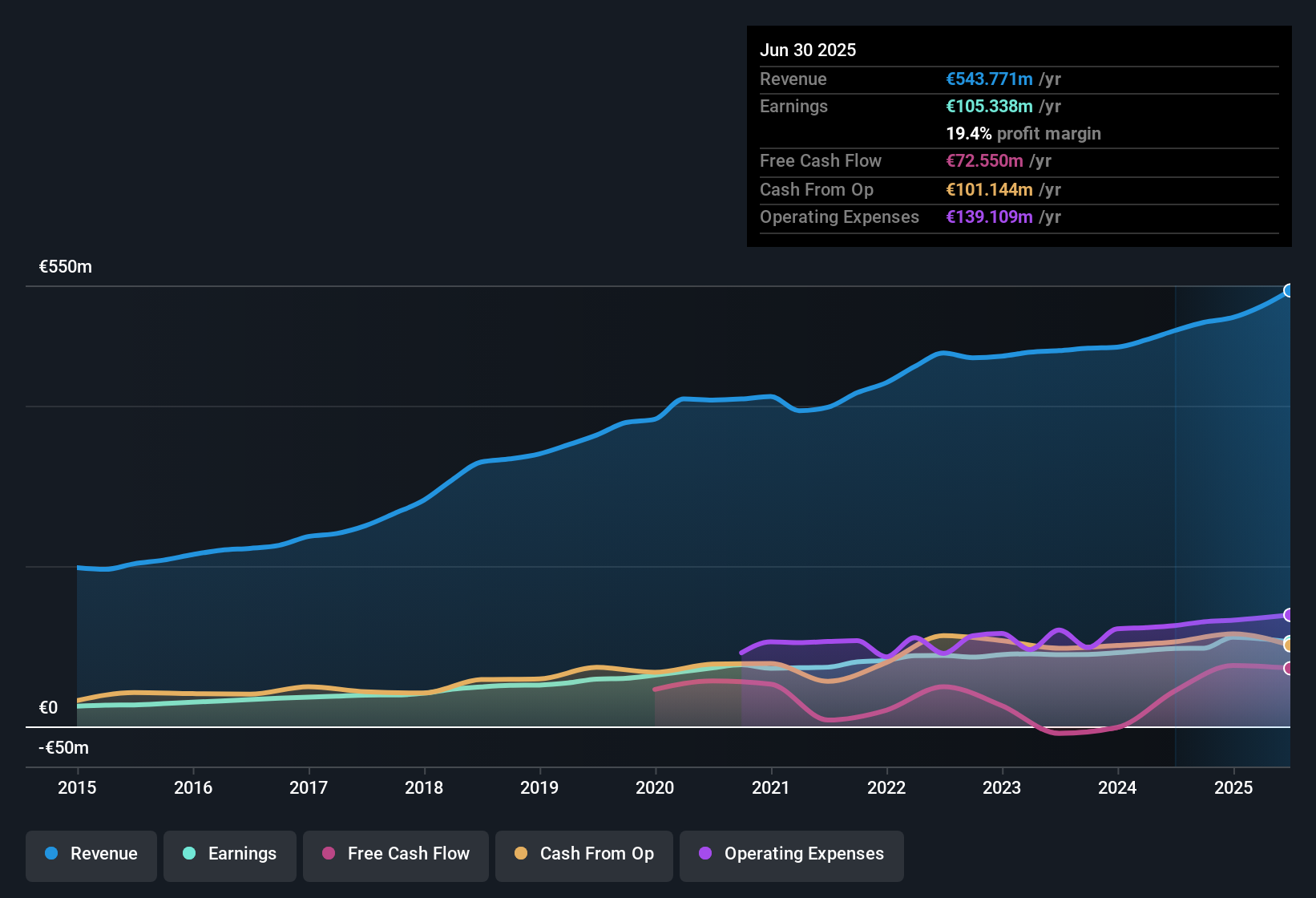

Faes Farma (BME:FAE) is forecasting earnings growth of 12.4% per year, significantly outpacing the broader Spanish market’s 5.1% expectation. Over the past five years, the company has delivered consistent profit growth, with earnings up 8% per year and a recent 8.3% increase, while net profit margins remain strong at 19.4%. With revenue projected to climb at 7.6% annually and shares trading below fair value, investors can weigh attractive momentum, sustained profitability, and a favorable valuation profile. However, dividend sustainability could warrant a second look for income-focused holders.

See our full analysis for Faes Farma.Next, we will see how these headline figures stack up against the key narratives shaping investor expectations. This will highlight where sentiment aligns with the facts and where surprises emerge.

Curious how numbers become stories that shape markets? Explore Community Narratives

Profit Margins Dip Slightly, Remain Resilient

- Net profit margins reached 19.4%, just under last year's 19.7%. This indicates Faes Farma is maintaining strong operational efficiency despite a modest decrease.

- Momentum from accelerating earnings growth heavily supports the bullish case even with a slight margin dip.

- Market-leading annual earnings growth of 8.3% and five-year compound growth of 8% suggest the margin stability is built on a robust profit engine.

- What is surprising is that, despite a small margin contraction, the company’s profit growth is both consistent and above historical averages, challenging concerns over profitability sustainability.

Dividend Flag Adds Small Risk

- The only minor red flag cited in the filings is that dividend sustainability may need a closer look for income investors, as ongoing profit growth does not automatically guarantee future payout increases.

- Critics highlight that, even with strong revenue and profit trends, questions linger over whether dividend growth can keep pace with earnings.

- Net margins remain strong at 19.4%, yet marginally lower than last year. This could impact the company’s ability to sustain or raise its dividend over time.

- What stands out here is that the risk is flagged as minor, not material. This contrasts with situations where payout ratios are stretched or profits are falling sharply.

Valuation Looks Attractive Versus Peers

- Shares trade at 13x earnings, well below both the European Pharmaceuticals industry average of 22.8x and the peer group at 53x. The current share price is €4.39 compared to a DCF fair value of €7.34.

- The gap between current price and DCF fair value heavily supports the argument for a favorable valuation profile.

- Despite the price discount, Faes Farma continues to outperform Spanish market benchmarks for both revenue and earnings growth, strengthening the case for possible upward price movement.

- It is notable that absolute and relative valuation checks both identify the stock as undervalued, while quality of past earnings also stands out as a plus for value-focused investors.

See what the community is saying about Faes Farma See what the community is saying about Faes Farma

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on Faes Farma's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

See What Else Is Out There

While Faes Farma boasts steady earnings and an attractive valuation, the sustainability of its dividend growth remains uncertain and could disappoint income-focused investors.

If growing payouts are a priority, check out these 1984 dividend stocks with yields > 3% to uncover companies offering stronger and more reliable dividend histories right now.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About BME:FAE

Faes Farma

Researches, develops, produces, and markets pharmaceutical products, healthcare products, and raw materials internationally.

Undervalued with excellent balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives