A Look at Almirall (BME:ALM) Valuation Following Breakthrough Dermatology Study Results and Pipeline Progress

Reviewed by Kshitija Bhandaru

Most Popular Narrative: 14.4% Undervalued

According to the most widely followed narrative, Almirall is currently seen as trading below its estimated fair value by a wide margin. This perspective emphasizes the company’s growth potential, which is driven by its expanding dermatology pipeline and strong momentum in its core therapeutic areas.

Strong and sustained expansion of the dermatology portfolio (notably Ebglyss and Ilumetri) is supported by the growing prevalence of chronic skin and autoimmune diseases due to demographic shifts. Aggressive pipeline launches and label expansions are expected to drive double-digit net sales growth through 2030.

Curious about the numbers fueling this optimistic outlook? The narrative is underpinned by bold expectations for profit margins and earnings that could put Almirall in a league with sector leaders. What key financial leaps are being projected, and how might they justify the gap between current price and target value? Discover the critical assumptions behind this “undervalued” call that could reshape the company’s future.

Result: Fair Value of €13.3 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, this optimistic scenario could quickly change if Almirall’s key dermatology drugs face tougher competition or if expected margin improvements do not materialize.

Find out about the key risks to this Almirall narrative.Another View: Looking at Price Ratios

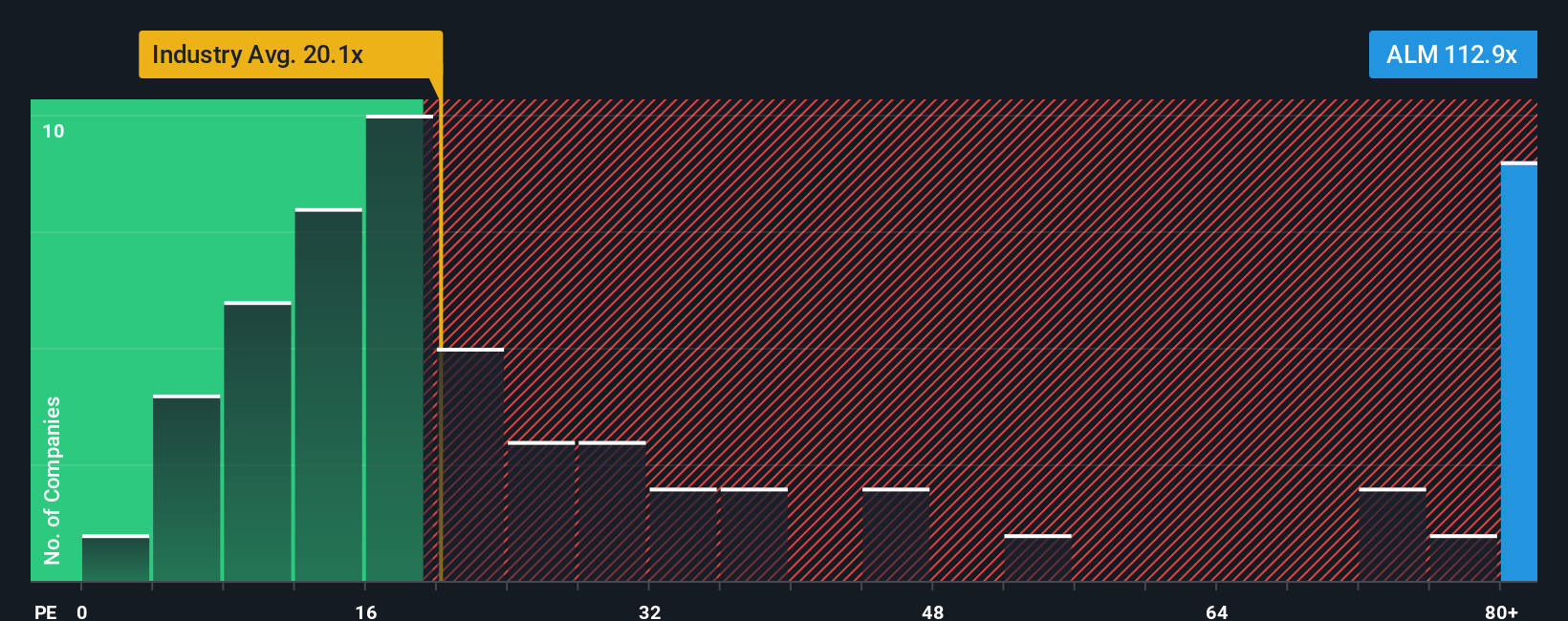

While analysts call Almirall undervalued based on future profits and growth, a simple look at its current price against company earnings tells a very different story. This suggests the shares might actually be expensive. Which side will prove right?

See what the numbers say about this price — find out in our valuation breakdown.

Stay updated when valuation signals shift by adding Almirall to your watchlist or portfolio. Alternatively, explore our screener to discover other companies that fit your criteria.

Build Your Own Almirall Narrative

If you want to dig into the numbers yourself or would rather form your own conclusions, the tools to build your own story are at your fingertips. Do it your way.

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding Almirall.

Looking for More Investment Ideas?

Don’t limit your gains to just one company. Great opportunities await if you keep an open mind and seize the next big trend before others catch on.

- Tap into fast-growth potential by tracking penny stocks with strong financials using penny stocks with strong financials to catch early movers gaining traction before the market notices.

- Supercharge your portfolio by targeting undervalued stocks based on cash flows with undervalued stocks based on cash flows and get ahead of the curve on hidden value plays.

- Ride the artificial intelligence wave in healthcare by seeking out tomorrow’s leaders among healthcare AI stocks and align with innovation shaping the future of medicine.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About BME:ALM

Almirall

Operates as a skin health-focused biopharmaceutical company in Spain, Europe, the Middle East, the United States, Asia, and Africa.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives