Prisa (BME:PRS): Loss Reduction Highlights Mixed Narrative as Balance Sheet Risks Persist

Reviewed by Simply Wall St

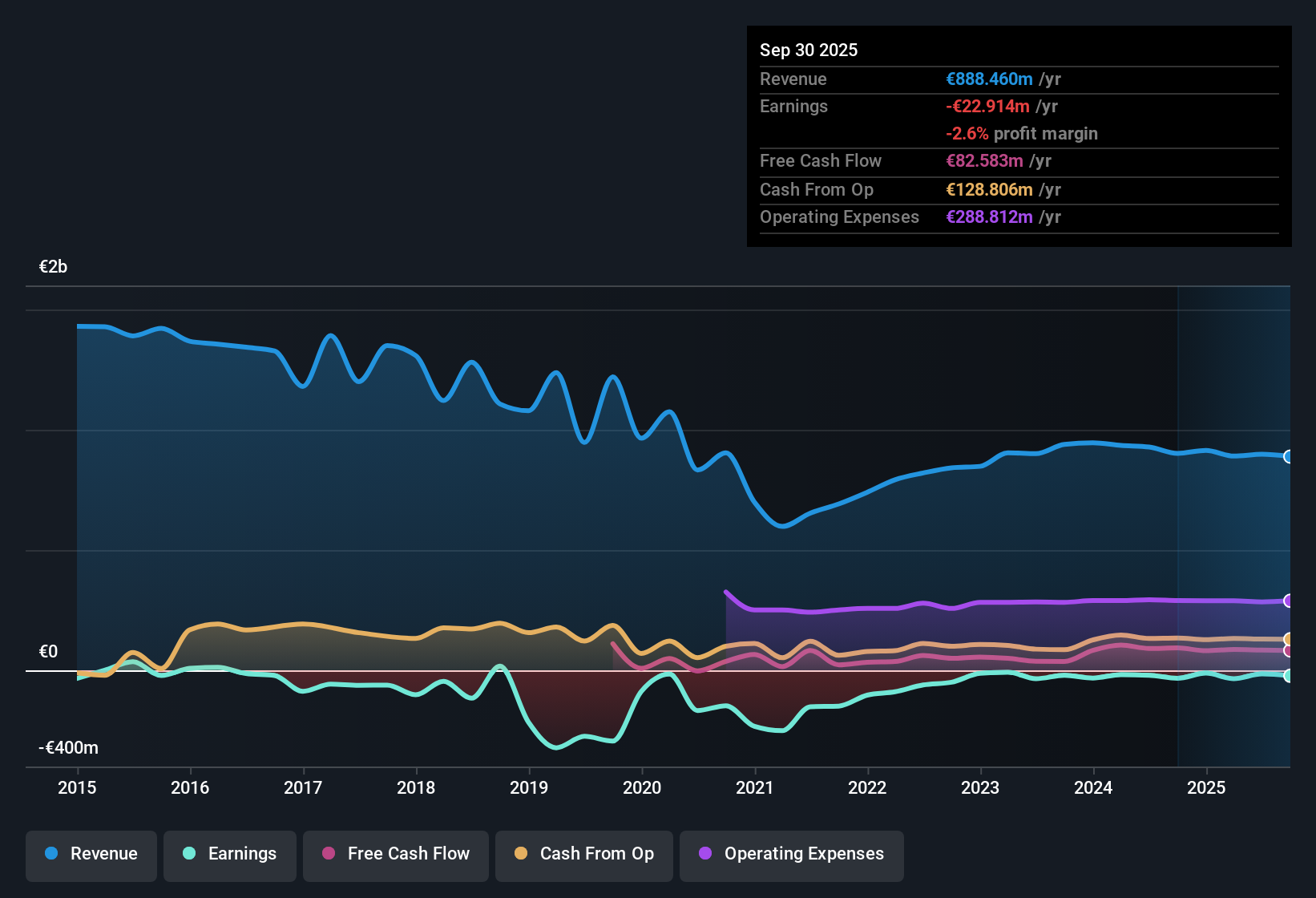

Promotora de Informaciones (BME:PRS) remains in the red, but it has narrowed its losses at an impressive annual rate of 54% over the past five years. Investors are watching closely, as the company is forecast to achieve profitability within the next three years and deliver a sharp 116.15% annual growth in earnings. Even with revenue expected to grow more slowly at 3.1% per year compared to the broader Spanish market’s 4.7%, there is clear momentum in profitability that stands out.

See our full analysis for Promotora de Informaciones.Next, we will see how these headline results stack up against the main narratives driving sentiment in the market, and where the numbers might challenge those prevailing views.

See what the community is saying about Promotora de Informaciones

Margins Poised to Swing Positive

- Profit margins are expected to jump from -1.7% now to 5.3% in three years. This major swing could bring PRS into solid profitability for the first time in years.

- Analysts' consensus view highlights that this rapid margin expansion is enabled by strict cost controls and a leaner, more digital business model.

- Streamlined operations and recent debt refinancing are already lowering interest costs, directly supporting improved EBITDA.

- Consensus also underscores the risk that, despite these gains, margin growth depends on digital revenue continuing to outpace declines in print, which is still uncertain industry-wide.

- Sense check these analyst forecasts against your own expectations by diving deeper into margin drivers and future risks. Read the full consensus narrative for context. 📊 Read the full Promotora de Informaciones Consensus Narrative.

High Leverage Remains a Drag

- Net financial debt sits at €777 million, with a net debt-to-EBITDA ratio of 4.26x, leaving PRS highly leveraged compared to many media peers.

- The consensus narrative warns that this high leverage restricts financial flexibility and elevates risk in the event of missed deleveraging targets or unexpected declines in earnings.

- Critics note that persistently high debt can pressure net margins and earnings growth if refinancing becomes more costly or operational improvements stall.

- Currency headwinds in markets like Argentina and Brazil already caused a €30 million revenue hit and an €8 to 9 million EBITDA drag, heightening concern about the debt burden.

Valuation: Discounted Yet Above DCF Fair Value

- PRS trades at a price-to-sales ratio of 0.6x, matching the European Media industry average and considerably below peers’ 1.2x. At €0.37 per share, the current price is still 75% above the DCF fair value of €0.21.

- According to the consensus narrative, this pricing suggests the market recognizes value in PRS’s turnaround story but remains cautious due to the gap with DCF-based valuation and the balance sheet risk.

- The analyst consensus price target is €0.44, reflecting expectations of future earnings growth but only a modest 19% premium over today’s market price.

- To justify that target, PRS needs to lift revenues to €1.1 billion and deliver €57.5 million in earnings by 2028. These are ambitious goals that depend on continued digital momentum and manageable debt.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Promotora de Informaciones on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Spot something the analysts missed? Share your insight and shape the story from your perspective. It only takes a few minutes. Do it your way

A great starting point for your Promotora de Informaciones research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

See What Else Is Out There

While PRS is narrowing its losses and pivoting to digital, its heavy debt load and high leverage still present major financial risks for investors.

If you’re looking for stronger balance sheets, discover healthier alternatives with solid balance sheet and fundamentals stocks screener (1988 results), which have lower debt and greater financial resilience than PRS.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About BME:PRS

Promotora de Informaciones

Engages in the exploitation of media in Spain and internationally.

Fair value with moderate growth potential.

Similar Companies

Market Insights

Community Narratives