How Much Did Atresmedia Corporación de Medios de Comunicación's(BME:A3M) Shareholders Earn From Share Price Movements Over The Last Five Years?

Atresmedia Corporación de Medios de Comunicación, S.A. (BME:A3M) shareholders will doubtless be very grateful to see the share price up 36% in the last quarter. But that is little comfort to those holding over the last half decade, sitting on a big loss. In fact, the share price has declined rather badly, down some 62% in that time. So we're hesitant to put much weight behind the short term increase. But it could be that the fall was overdone.

Check out our latest analysis for Atresmedia Corporación de Medios de Comunicación

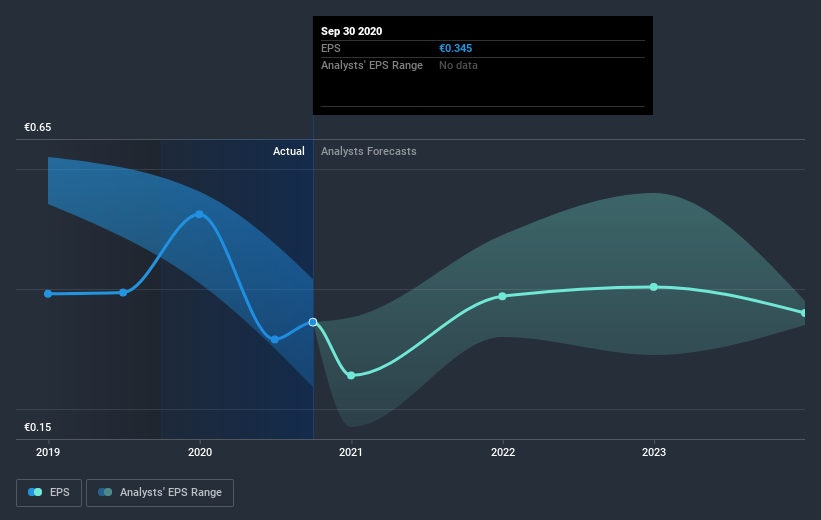

To paraphrase Benjamin Graham: Over the short term the market is a voting machine, but over the long term it's a weighing machine. One imperfect but simple way to consider how the market perception of a company has shifted is to compare the change in the earnings per share (EPS) with the share price movement.

What about the Total Shareholder Return (TSR)?

Investors should note that there's a difference between Atresmedia Corporación de Medios de Comunicación's total shareholder return (TSR) and its share price change, which we've covered above. Arguably the TSR is a more complete return calculation because it accounts for the value of dividends (as if they were reinvested), along with the hypothetical value of any discounted capital that have been offered to shareholders. Its history of dividend payouts mean that Atresmedia Corporación de Medios de Comunicación's TSR, which was a 51% drop over the last 5 years, was not as bad as the share price return.

A Different Perspective

It's good to see that Atresmedia Corporación de Medios de Comunicación has rewarded shareholders with a total shareholder return of 1.5% in the last twelve months. That certainly beats the loss of about 9% per year over the last half decade. We generally put more weight on the long term performance over the short term, but the recent improvement could hint at a (positive) inflection point within the business. It's always interesting to track share price performance over the longer term. But to understand Atresmedia Corporación de Medios de Comunicación better, we need to consider many other factors. Consider risks, for instance. Every company has them, and we've spotted 2 warning signs for Atresmedia Corporación de Medios de Comunicación you should know about.

But note: Atresmedia Corporación de Medios de Comunicación may not be the best stock to buy. So take a peek at this free list of interesting companies with past earnings growth (and further growth forecast).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on ES exchanges.

If you decide to trade Atresmedia Corporación de Medios de Comunicación, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About BME:A3M

Atresmedia Corporación de Medios de Comunicación

An audiovisual company, engages in the television, radio, digital and multimedia development, cinema, and events organization businesses in Spain and internationally.

Flawless balance sheet and good value.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Constellation Energy Dividends and Growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026