Want to participate in a short research study? Help shape the future of investing tools and you could win a $250 gift card!

Stock market crashes are an opportune time to buy. High quality companies, such as Vidrala, S.A., are impacted by general market panic and sell-off, but the fundamentals of these companies stay the same. In other words, now is the time to buy strong, well-proven stocks at an attractive discount.

See our latest analysis for Vidrala

Vidrala, S.A. manufactures and sells glass containers in Spain, the United Kingdom/Ireland, France, Italy, Portugal, and internationally. Established in 1965, and run by CEO Gorka Schmitt Zalbide, the company currently employs 3.79k people and with the stock's market cap sitting at €2.1b, it comes under the mid-cap stocks category. Generally, large-cap stocks are well-resourced and well-established meaning that a bear market will cause it to rejig some short-term capital allocations, but stock market volatility is hardly detrimental to its financial health and business operations. Therefore large-cap stocks are a safe bet to buy more of when the wider market is going down and down.

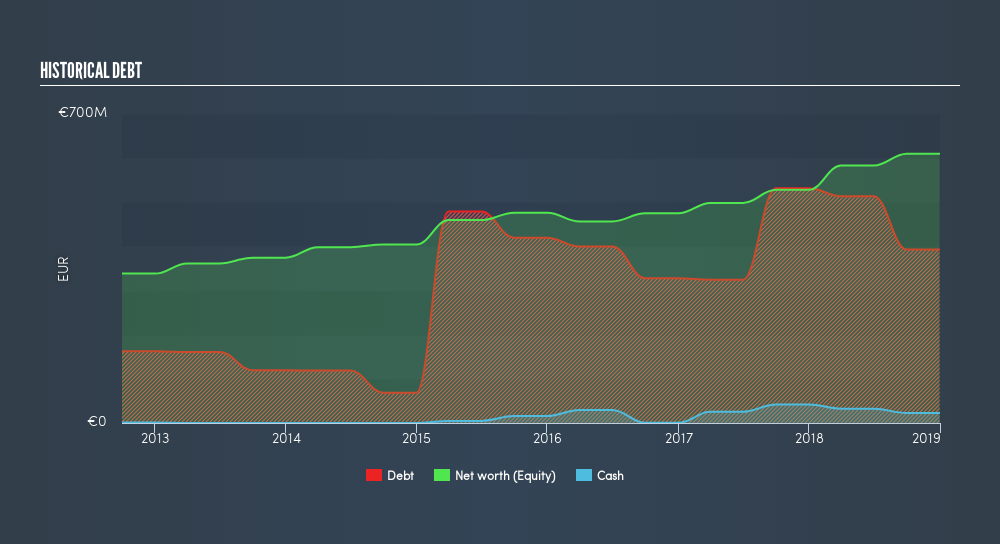

Currently Vidrala has €434m on its balance sheet, which requires regular interest payments. This requires the business to have enough cash to meet these upcoming interest expenses. With an interest coverage ratio of 22.2x, Vidrala produces sufficient earnings (EBIT) to cover its interest payments. Anything above 3x is considered safe practice. Furthermore, its cash flows from operations copiously covers it debt by 47%, above the safe minimum of 20%. Its cash and short-term investment is also sufficient to cover other upcoming liabilities, which means VID is financially robust in the face of a volatile market.

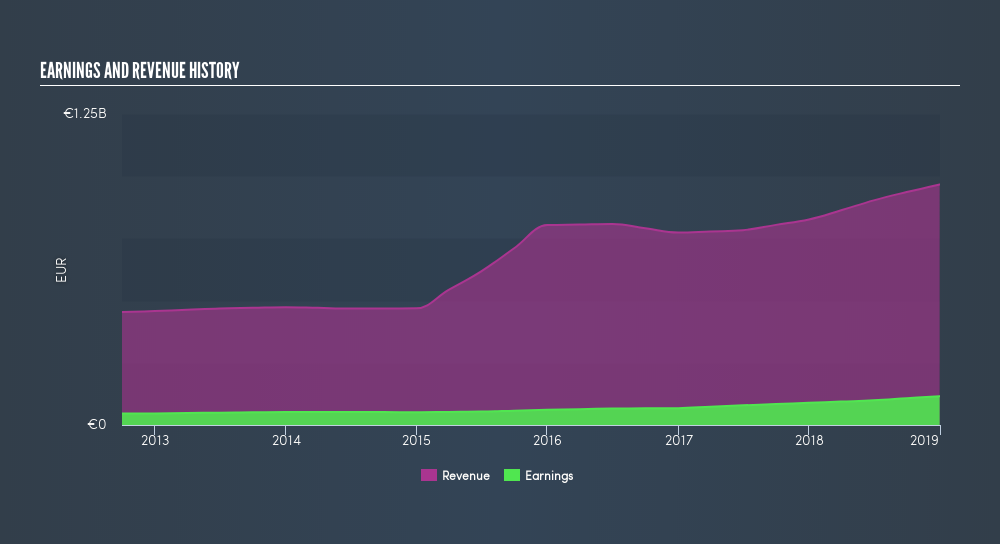

VID’s annual earnings growth rate has been positive over the last five years, with an average rate of 17%, overtaking the industry growth rate of 13%. It has also returned an ROE of 19% recently, above the industry return of 10%. Vidrala's strong performance over time is a demonstration of its ability to grow through cycles, raising my confidence in the company as a long-term investment.

Next Steps:

Vidrala makes for a robust long-term investment based on its scale, financial health and track record. Remember, in bear markets, sell-offs can be unjustified. Ask yourself, has anything really changed with Vidrala? If not, then why not scoop it up at a discount? Lining your portfolio with a few well-established companies can reduce your risk and help you scale your wealth in the long run. One thing you should remember though, is to do your homework. Do your own research, come up with your point of view. Below is a list I've put together of other things you should consider before you buy:- Future Outlook: What are well-informed industry analysts predicting for VID’s future growth? Take a look at our free research report of analyst consensus for VID’s outlook.

- Valuation: What is VID worth today? Is the stock undervalued, even when its growth outlook is factored into its intrinsic value? The intrinsic value infographic in our free research report helps visualize whether VID is currently mispriced by the market.

- Other High-Performing Stocks: Are there other stocks that provide better prospects with proven track records? Explore our free list of these great stocks here.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About BME:VID

Vidrala

Manufactures and sells glass containers for food and beverage products in the United Kingdom, Ireland, Italy, Iberian Peninsula, rest of Europe, and Brazil.

Flawless balance sheet with proven track record and pays a dividend.

Market Insights

Community Narratives