- Italy

- /

- Medical Equipment

- /

- BIT:ELN

Discovering Europe's Undiscovered Gems In March 2025

Reviewed by Simply Wall St

As of March 2025, the European market has seen a modest recovery with the STOXX Europe 600 Index gaining 0.56%, buoyed by expectations of increased government spending, though tempered by concerns over impending U.S. tariffs. Amid this backdrop of mixed economic signals and cautious central bank policies, investors are increasingly looking towards small-cap stocks that demonstrate resilience and potential for growth as undiscovered gems in Europe's diverse market landscape.

Top 10 Undiscovered Gems With Strong Fundamentals In Europe

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| AB Traction | NA | 3.81% | 3.66% | ★★★★★★ |

| Nederman Holding | 69.60% | 11.43% | 16.35% | ★★★★★★ |

| La Forestière Equatoriale | NA | -58.49% | 45.78% | ★★★★★★ |

| Intellego Technologies | 11.59% | 68.05% | 72.76% | ★★★★★★ |

| Moury Construct | 2.93% | 10.28% | 30.93% | ★★★★★☆ |

| HOMAG Group | NA | -31.14% | 23.43% | ★★★★★☆ |

| Procimmo Group | 157.49% | 0.65% | 4.94% | ★★★★☆☆ |

| Castellana Properties Socimi | 53.49% | 6.64% | 21.96% | ★★★★☆☆ |

| Practic | NA | 3.63% | 6.85% | ★★★★☆☆ |

| Inversiones Doalca SOCIMI | 15.57% | 6.53% | 7.16% | ★★★★☆☆ |

We're going to check out a few of the best picks from our screener tool.

EL.En (BIT:ELN)

Simply Wall St Value Rating: ★★★★★★

Overview: EL.En. S.p.A. is involved in the research, development, production, sale, and distribution of laser solutions across Italy, Europe, and internationally with a market cap of €731.04 million.

Operations: EL.En. S.p.A. generates revenue through the sale and distribution of laser solutions in Italy, Europe, and internationally. The company focuses on research and development to enhance its product offerings in the laser industry. With a market capitalization of €731.04 million, it operates across various regions to expand its reach and customer base.

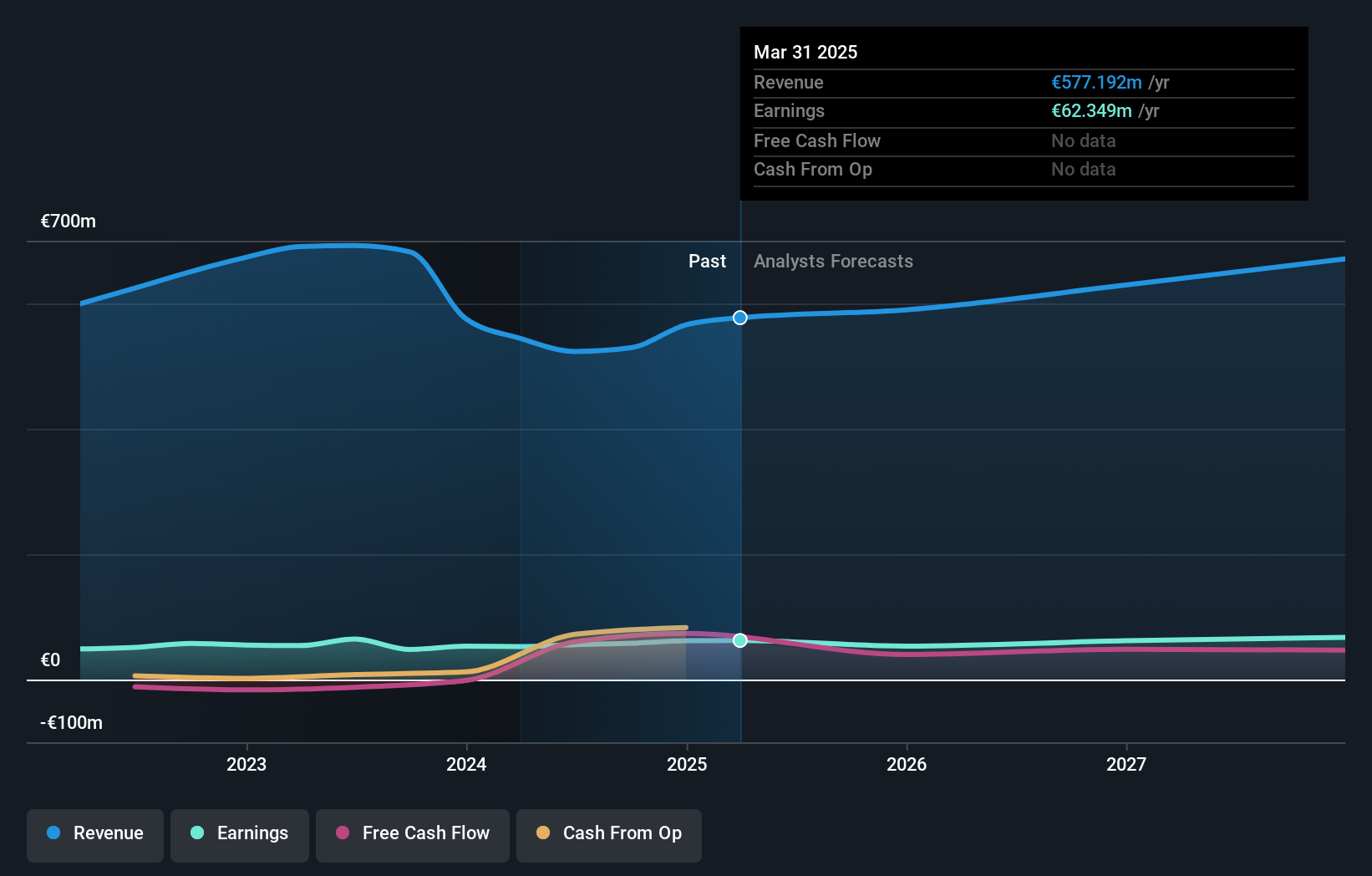

EL.En's recent performance paints an intriguing picture, with a notable shift in strategic focus. Despite a challenging year marked by a -29.5% earnings growth, the company is pivoting towards its medical sector, potentially enhancing profitability through divestment of its laser cutting business. Their debt-to-equity ratio impressively dropped from 11.1% to 0.3% over five years, signaling strong financial health. The price-to-earnings ratio stands at 21x, below the industry average of 32x, suggesting potential value for investors. Recent moves include share repurchases and an annual dividend increase to €0.22 per share payable in May 2025, reflecting confidence in future prospects.

Miquel y Costas & Miquel (BME:MCM)

Simply Wall St Value Rating: ★★★★★★

Overview: Miquel y Costas & Miquel, S.A. is involved in the production and distribution of fine and specialty lightweight papers globally, with a market capitalization of €510.70 million.

Operations: Miquel y Costas & Miquel generates revenue primarily from the tobacco industry, contributing €195.97 million, and industrial products at €89.73 million. The company's financial performance is notably influenced by its net profit margin trends over recent periods.

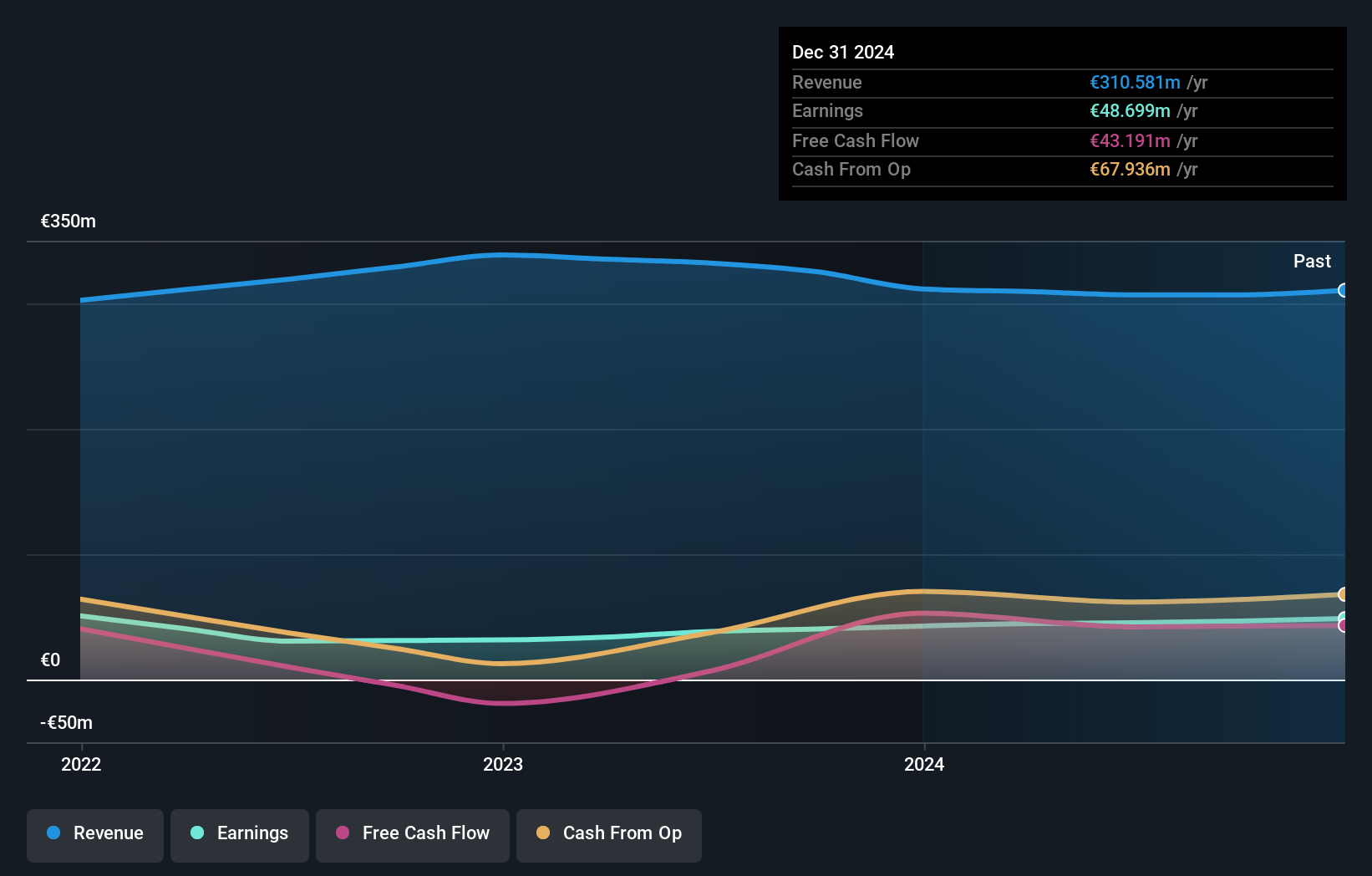

With a net debt to equity ratio of 0.7%, Miquel y Costas & Miquel's financial health appears solid, reflecting a prudent approach to leverage. The company's earnings grew by 14% over the past year, outpacing the Forestry industry, which saw a -22.6% downturn. Despite a slight dip in sales from €311.56 million to €310.58 million, net income improved significantly to €48.7 million from €42.71 million last year, indicating efficient cost management or operational improvements might be at play here. With high-quality earnings and positive free cash flow, it seems well-positioned for future challenges and opportunities in its sector.

- Click to explore a detailed breakdown of our findings in Miquel y Costas & Miquel's health report.

Assess Miquel y Costas & Miquel's past performance with our detailed historical performance reports.

Akastor (OB:AKAST)

Simply Wall St Value Rating: ★★★★★★

Overview: Akastor ASA is an oilfield services investment company operating in Norway and internationally, with a market capitalization of NOK3.61 billion.

Operations: Akastor generates revenue primarily from its DDW Offshore and Other Holdings segments, with contributions of NOK278 million and NOK644 million, respectively.

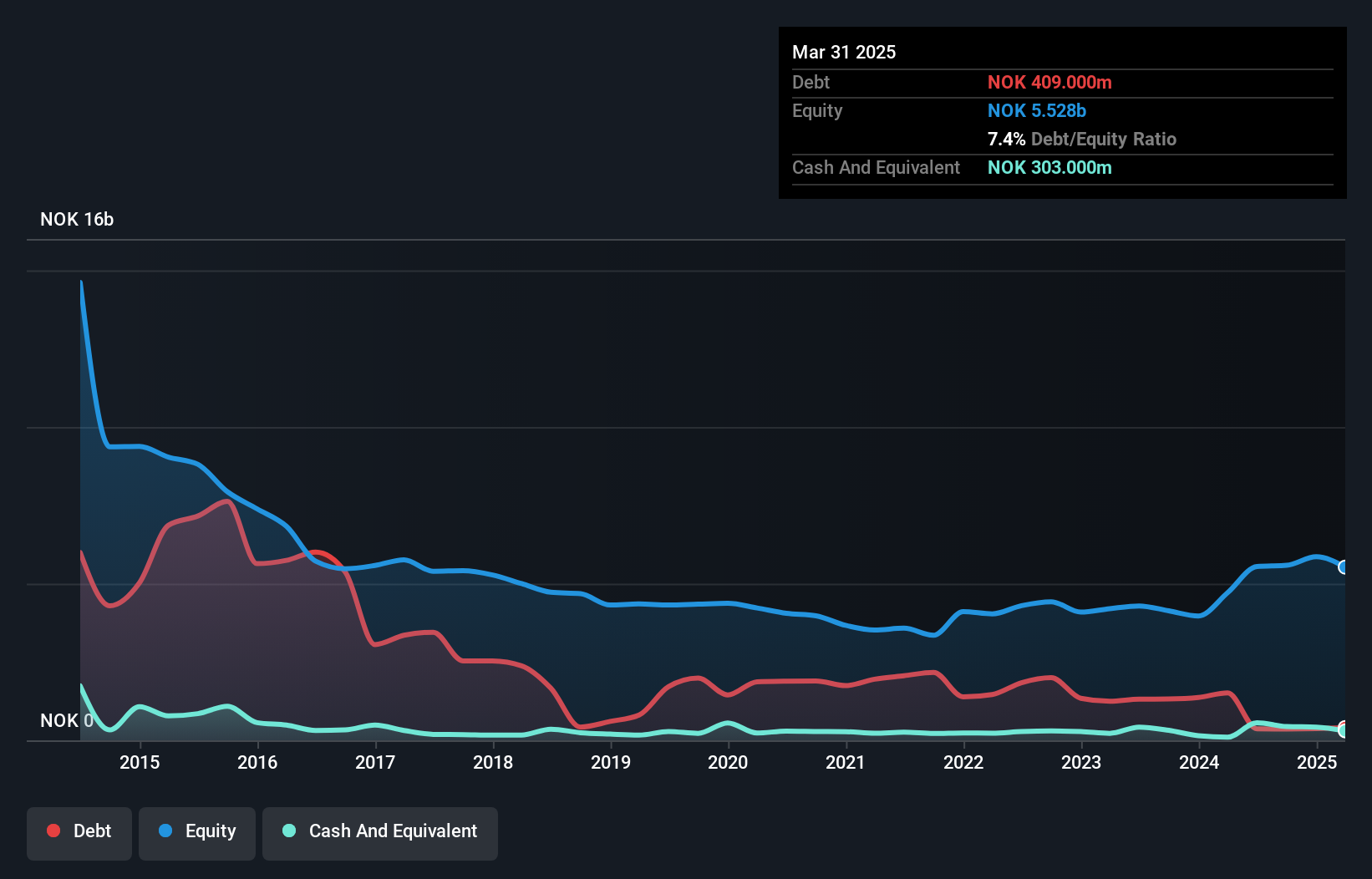

Akastor, a nimble player in the energy services sector, has recently turned profitable, boasting net income of NOK 1.65 billion for 2024 compared to a net loss of NOK 264 million the previous year. The company is trading at an impressive discount, about 98.6% below its estimated fair value, and maintains robust financial health with more cash than total debt. Its debt-to-equity ratio has improved significantly from 33.1% to just 6.4% over five years, while interest payments are well covered by EBIT at a multiple of 17.7x, indicating strong financial management and operational efficiency.

- Navigate through the intricacies of Akastor with our comprehensive health report here.

Review our historical performance report to gain insights into Akastor's's past performance.

Make It Happen

- Unlock our comprehensive list of 348 European Undiscovered Gems With Strong Fundamentals by clicking here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if EL.En might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About BIT:ELN

EL.En

Engages in the research, development, production, sale, and distribution of laser solutions in Italy, rest of Europe, and internationally.

Flawless balance sheet with proven track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives