- Netherlands

- /

- Construction

- /

- ENXTAM:HEIJM

Inmocemento And 2 Other Undiscovered Gems With Strong Fundamentals

Reviewed by Simply Wall St

As European markets navigate a complex landscape marked by global growth concerns and currency fluctuations, the pan-European STOXX Europe 600 Index recently ended slightly lower. Amidst this backdrop, investors are increasingly drawn to stocks with robust fundamentals that can weather economic uncertainties. In this article, we explore three such undiscovered gems in Europe, including Inmocemento, which stand out for their strong financial health and potential resilience in challenging times.

Top 10 Undiscovered Gems With Strong Fundamentals In Europe

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| La Forestière Equatoriale | NA | -65.30% | 37.55% | ★★★★★★ |

| Grenobloise d'Electronique et d'Automatismes Société Anonyme | 0.01% | 7.01% | -1.81% | ★★★★★☆ |

| Inmocemento | 28.68% | 3.60% | 33.84% | ★★★★★☆ |

| Dekpol | 63.20% | 11.99% | 14.08% | ★★★★★☆ |

| Deutsche Balaton | 4.58% | -18.46% | -16.14% | ★★★★★☆ |

| Zespól Elektrocieplowni Wroclawskich KOGENERACJA | 14.04% | 21.73% | 17.76% | ★★★★★☆ |

| Viohalco | 93.48% | 11.98% | 14.19% | ★★★★☆☆ |

| ABG Sundal Collier Holding | 46.02% | -6.02% | -15.62% | ★★★★☆☆ |

| Practic | NA | 4.86% | 6.64% | ★★★★☆☆ |

| Eurofins-Cerep | 0.46% | 6.80% | 6.93% | ★★★★☆☆ |

We're going to check out a few of the best picks from our screener tool.

Inmocemento (BME:IMC)

Simply Wall St Value Rating: ★★★★★☆

Overview: Inmocemento S.A., with a market cap of €1.56 billion, operates in the real estate and cement sectors through its subsidiaries.

Operations: Inmocemento S.A. generates revenue primarily from its real estate and cement operations. The company has recorded a net profit margin of 12% in the most recent period, reflecting its profitability within these sectors.

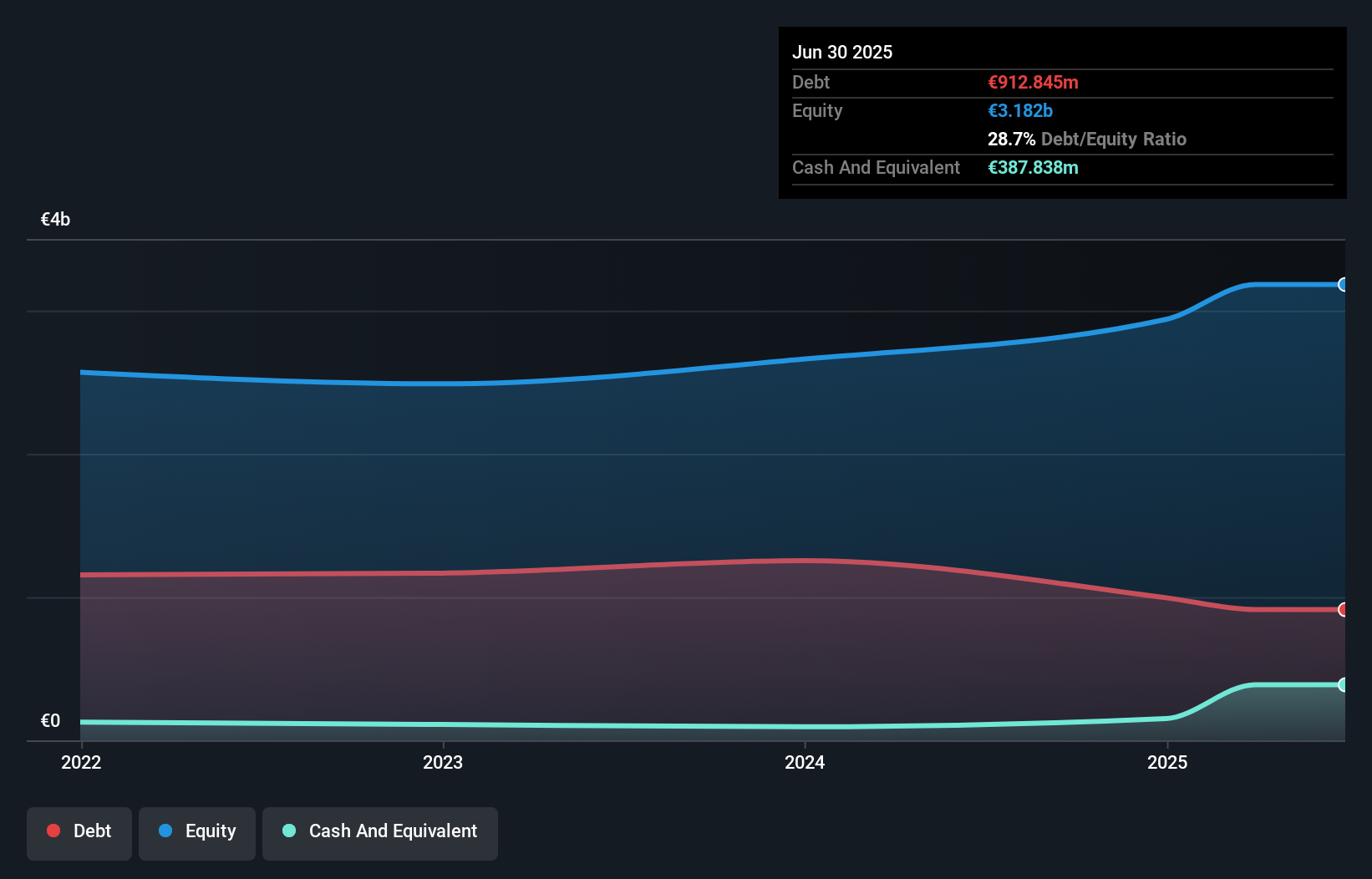

Inmocemento's recent performance highlights its potential as a small cap gem in Europe, with earnings growth of 62.6% over the past year, significantly outpacing the Basic Materials industry average of -0.2%. Trading at 63.1% below estimated fair value, it presents an intriguing opportunity for investors. The company's net income soared to €232.88 million for the first half of 2025 from €77.86 million a year earlier, reflecting high-quality earnings and robust financial health with satisfactory debt levels (net debt to equity ratio at 16.8%). While sales slightly decreased to €446.36 million from €448.08 million, Inmocemento's strong EBIT coverage (7.4x interest payments) underscores its solid position in managing financial obligations effectively.

Koninklijke Heijmans (ENXTAM:HEIJM)

Simply Wall St Value Rating: ★★★★★★

Overview: Koninklijke Heijmans N.V. operates in the real estate, construction, and infrastructure sectors both within the Netherlands and internationally, with a market capitalization of approximately €1.59 billion.

Operations: Heijmans generates revenue from three primary segments: Living (€1.00 billion), Work (€662.60 million), and Connecting (€1.05 billion).

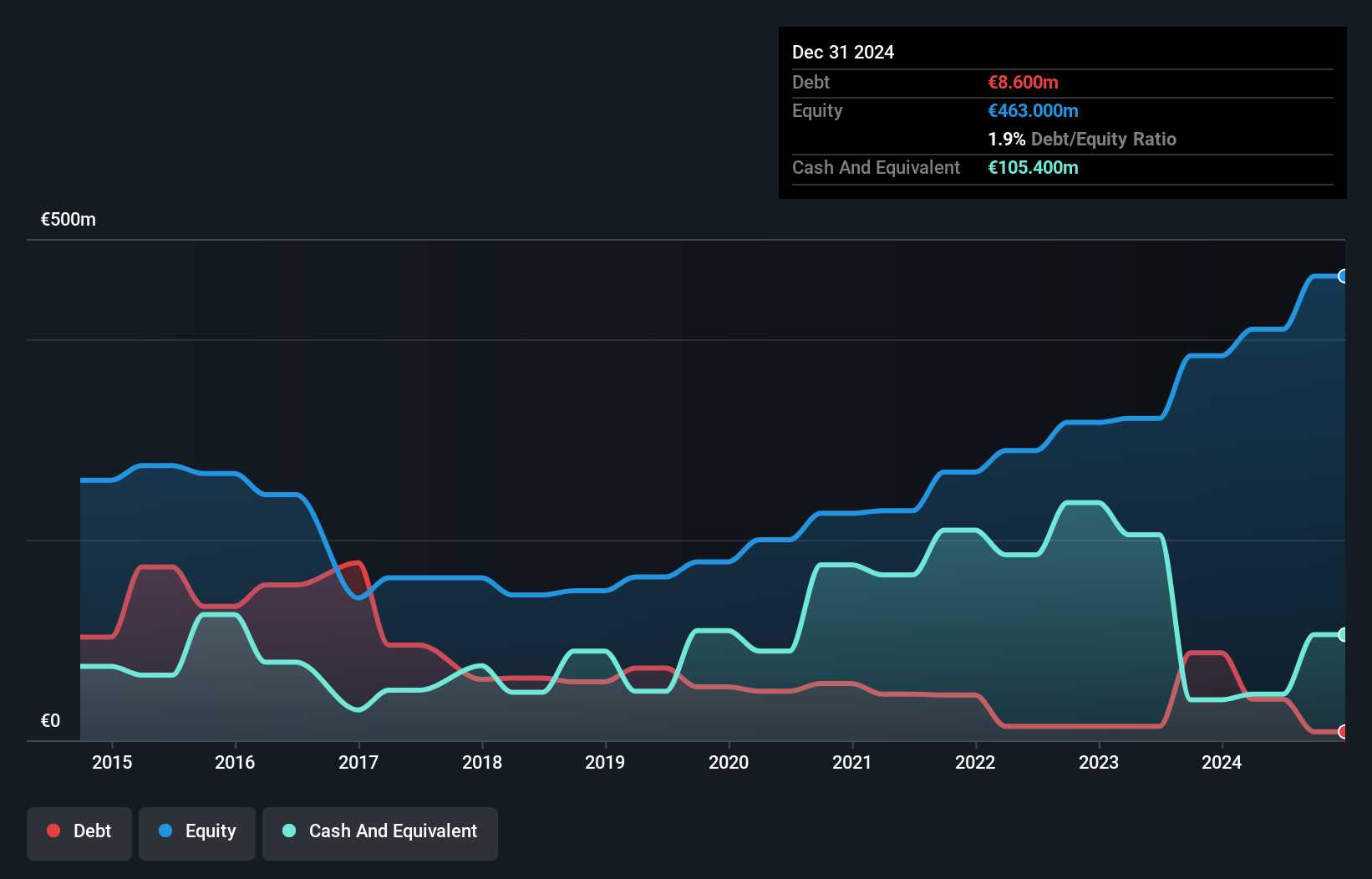

Heijmans, a nimble player in the construction sector, reported impressive earnings growth of 42% over the past year, outpacing industry peers. The firm achieved a net income of €59 million for H1 2025, up from €37 million last year, with basic earnings per share rising to €2.15 from €1.39. Trading at nearly 57% below its estimated fair value and backed by a robust debt-to-equity reduction from 24.5% to 2.1% over five years, Heijmans is poised for continued growth amid increasing public infrastructure investments and modular construction trends despite facing regulatory hurdles and labor shortages.

Caisse Régionale de Crédit Agricole Mutuel Alpes Provence Société coopérative (ENXTPA:CRAP)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Caisse Régionale de Crédit Agricole Mutuel Alpes Provence Société coopérative offers a range of banking products and services in France and has a market capitalization of approximately €1.05 billion.

Operations: The company generates revenue primarily from its retail banking segment, amounting to €457.98 million. The net profit margin is a key financial metric to monitor for assessing profitability trends over time.

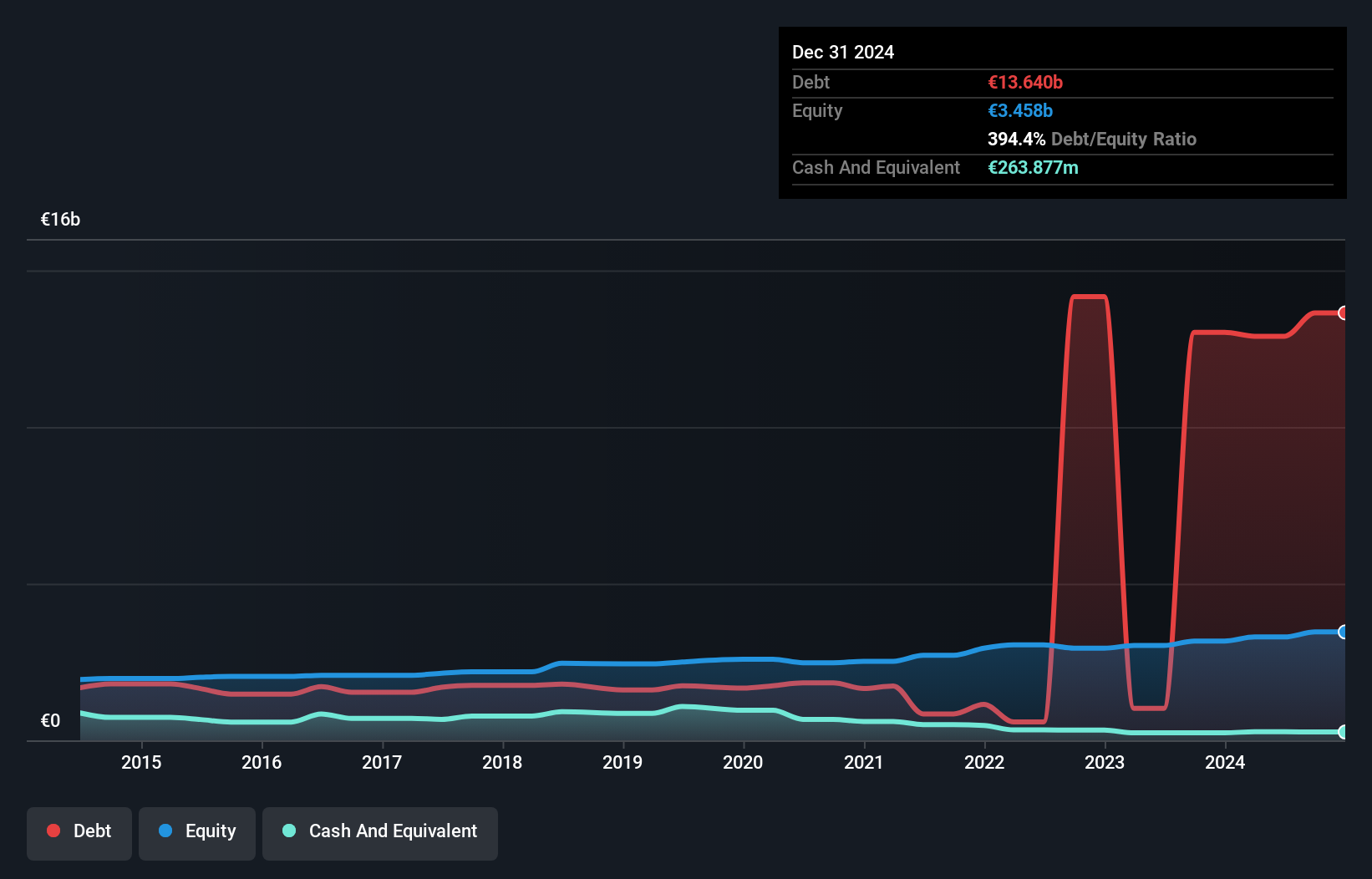

Caisse Régionale de Crédit Agricole Mutuel Alpes Provence, a cooperative bank, shows promising signs of growth and stability. With total assets of €26.8 billion and equity standing at €3.7 billion, the financial foundation is robust. The bank's earnings grew by 12.9% over the past year, outpacing the industry average of 3.2%. It trades at an attractive valuation, being 18% below its estimated fair value while maintaining a sufficient allowance for bad loans at 113%. However, with 60% of liabilities stemming from higher-risk funding sources like external borrowing, risk management remains crucial for sustained performance.

Summing It All Up

- Click through to start exploring the rest of the 325 European Undiscovered Gems With Strong Fundamentals now.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Koninklijke Heijmans might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTAM:HEIJM

Koninklijke Heijmans

Engages in the real estate, construction, and infrastructure businesses in the Netherlands and internationally.

Outstanding track record with flawless balance sheet.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success