Read This Before Buying Ercros, S.A. (BME:ECR) For Its Dividend

Is Ercros, S.A. (BME:ECR) a good dividend stock? How can we tell? Dividend paying companies with growing earnings can be highly rewarding in the long term. Unfortunately, it's common for investors to be enticed in by the seemingly attractive yield, and lose money when the company has to cut its dividend payments.

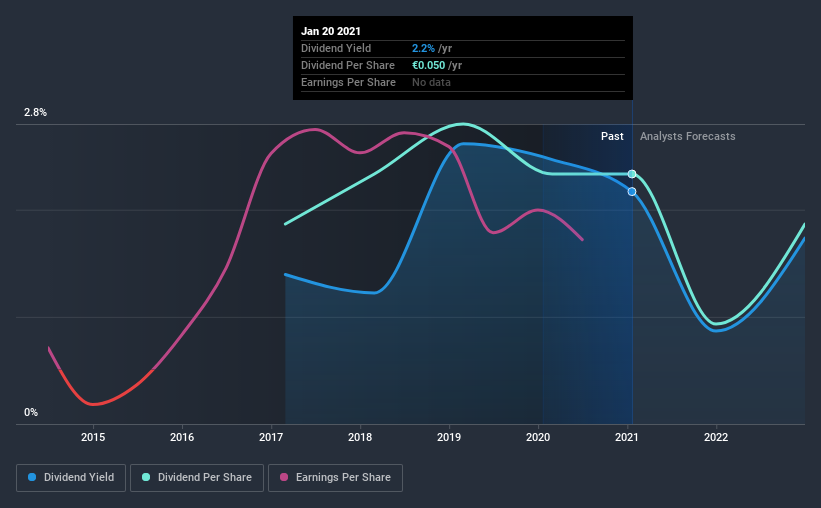

With a 2.2% yield and a four-year payment history, investors probably think Ercros looks like a reliable dividend stock. While the yield may not look too great, the relatively long payment history is interesting. The company also returned around 3.3% of its market capitalisation to shareholders in the form of stock buybacks over the past year. Some simple analysis can reduce the risk of holding Ercros for its dividend, and we'll focus on the most important aspects below.

Explore this interactive chart for our latest analysis on Ercros!

Payout ratios

Companies (usually) pay dividends out of their earnings. If a company is paying more than it earns, the dividend might have to be cut. As a result, we should always investigate whether a company can afford its dividend, measured as a percentage of a company's net income after tax. Looking at the data, we can see that 21% of Ercros' profits were paid out as dividends in the last 12 months. Given the low payout ratio, it is hard to envision the dividend coming under threat, barring a catastrophe.

In addition to comparing dividends against profits, we should inspect whether the company generated enough cash to pay its dividend. Ercros' cash payout ratio last year was 18%, which is quite low and suggests that the dividend was thoroughly covered by cash flow. It's positive to see that Ercros' dividend is covered by both profits and cash flow, since this is generally a sign that the dividend is sustainable, and a lower payout ratio usually suggests a greater margin of safety before the dividend gets cut.

We update our data on Ercros every 24 hours, so you can always get our latest analysis of its financial health, here.

Dividend Volatility

From the perspective of an income investor who wants to earn dividends for many years, there is not much point buying a stock if its dividend is regularly cut or is not reliable. Ercros has been paying a dividend for the past four years. The company has been paying a stable dividend for a few years now, but we'd like to see more evidence of consistency over a longer period. During the past four-year period, the first annual payment was €0.04 in 2017, compared to €0.05 last year. This works out to be a compound annual growth rate (CAGR) of approximately 5.7% a year over that time.

The dividend has been growing at a reasonable rate, which we like. We're conscious though that one of the best ways to detect a multi-decade consistent dividend-payer, is to watch a company pay dividends for 20 years - a distinction Ercros has not achieved yet.

Conclusion

When we look at a dividend stock, we need to form a judgement on whether the dividend will grow, if the company is able to maintain it in a wide range of economic circumstances, and if the dividend payout is sustainable. It's great to see that Ercros is paying out a low percentage of its earnings and cash flow. Unfortunately, there hasn't been any earnings growth, and the company's dividend history is shorter than the 10 years we ideally like to see before making a strong judgement. Ercros has a number of positive attributes, but it falls slightly short of our (admittedly high) standards. Were there evidence of a strong moat or an attractive valuation, it could still be well worth a look.

Investors generally tend to favour companies with a consistent, stable dividend policy as opposed to those operating an irregular one. At the same time, there are other factors our readers should be conscious of before pouring capital into a stock. For instance, we've picked out 2 warning signs for Ercros that investors should take into consideration.

If you are a dividend investor, you might also want to look at our curated list of dividend stocks yielding above 3%.

If you decide to trade Ercros, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if Ercros might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About BME:ECR

Ercros

Manufactures and sells basic chemicals, intermediate chemicals, and pharmaceuticals in Spain.

Reasonable growth potential and fair value.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

The "Molecular Pencil": Why Beam's Technology is Built to Win

ADNOC Gas future shines with a 21.4% revenue surge

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026