Some say volatility, rather than debt, is the best way to think about risk as an investor, but Warren Buffett famously said that 'Volatility is far from synonymous with risk.' When we think about how risky a company is, we always like to look at its use of debt, since debt overload can lead to ruin. Importantly, Ercros, S.A. (BME:ECR) does carry debt. But is this debt a concern to shareholders?

When Is Debt Dangerous?

Debt and other liabilities become risky for a business when it cannot easily fulfill those obligations, either with free cash flow or by raising capital at an attractive price. If things get really bad, the lenders can take control of the business. While that is not too common, we often do see indebted companies permanently diluting shareholders because lenders force them to raise capital at a distressed price. Of course, plenty of companies use debt to fund growth, without any negative consequences. When we think about a company's use of debt, we first look at cash and debt together.

Check out our latest analysis for Ercros

How Much Debt Does Ercros Carry?

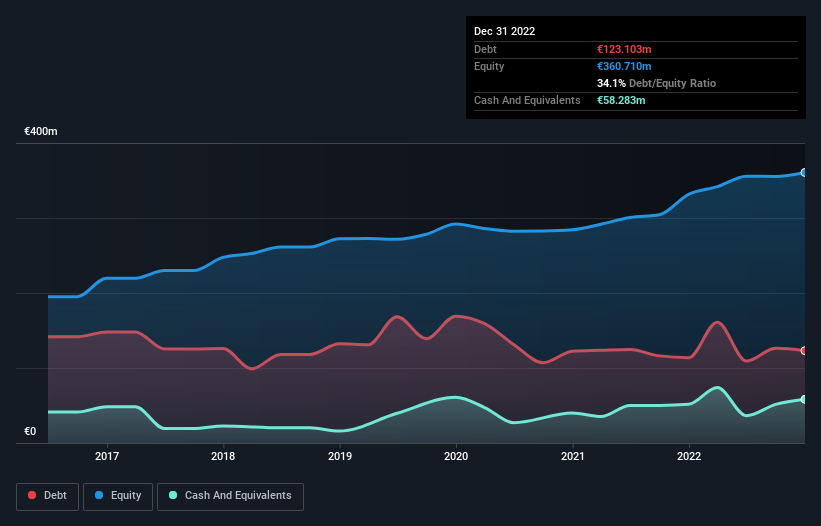

You can click the graphic below for the historical numbers, but it shows that as of December 2022 Ercros had €123.1m of debt, an increase on €113.8m, over one year. On the flip side, it has €58.3m in cash leading to net debt of about €64.8m.

A Look At Ercros' Liabilities

The latest balance sheet data shows that Ercros had liabilities of €222.6m due within a year, and liabilities of €163.3m falling due after that. On the other hand, it had cash of €58.3m and €101.9m worth of receivables due within a year. So its liabilities outweigh the sum of its cash and (near-term) receivables by €225.6m.

Ercros has a market capitalization of €405.7m, so it could very likely raise cash to ameliorate its balance sheet, if the need arose. But it's clear that we should definitely closely examine whether it can manage its debt without dilution.

We measure a company's debt load relative to its earnings power by looking at its net debt divided by its earnings before interest, tax, depreciation, and amortization (EBITDA) and by calculating how easily its earnings before interest and tax (EBIT) cover its interest expense (interest cover). The advantage of this approach is that we take into account both the absolute quantum of debt (with net debt to EBITDA) and the actual interest expenses associated with that debt (with its interest cover ratio).

Ercros has a low net debt to EBITDA ratio of only 0.60. And its EBIT covers its interest expense a whopping 23.2 times over. So we're pretty relaxed about its super-conservative use of debt. On top of that, Ercros grew its EBIT by 69% over the last twelve months, and that growth will make it easier to handle its debt. When analysing debt levels, the balance sheet is the obvious place to start. But it is future earnings, more than anything, that will determine Ercros's ability to maintain a healthy balance sheet going forward. So if you're focused on the future you can check out this free report showing analyst profit forecasts.

But our final consideration is also important, because a company cannot pay debt with paper profits; it needs cold hard cash. So the logical step is to look at the proportion of that EBIT that is matched by actual free cash flow. During the last three years, Ercros produced sturdy free cash flow equating to 74% of its EBIT, about what we'd expect. This cold hard cash means it can reduce its debt when it wants to.

Our View

The good news is that Ercros's demonstrated ability to cover its interest expense with its EBIT delights us like a fluffy puppy does a toddler. But, on a more sombre note, we are a little concerned by its level of total liabilities. Zooming out, Ercros seems to use debt quite reasonably; and that gets the nod from us. While debt does bring risk, when used wisely it can also bring a higher return on equity. When analysing debt levels, the balance sheet is the obvious place to start. But ultimately, every company can contain risks that exist outside of the balance sheet. For example, we've discovered 2 warning signs for Ercros (1 is significant!) that you should be aware of before investing here.

If you're interested in investing in businesses that can grow profits without the burden of debt, then check out this free list of growing businesses that have net cash on the balance sheet.

Valuation is complex, but we're here to simplify it.

Discover if Ercros might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About BME:ECR

Ercros

Manufactures and sells basic chemicals, intermediate chemicals, and pharmaceuticals in Spain.

Reasonable growth potential and fair value.

Similar Companies

Market Insights

Weekly Picks

Looking to be second time lucky with a game-changing new product

PlaySide Studios: Market Is Sleeping on a Potential 10M+ Unit Breakout Year, FY26 Could Be the Rerate of the Decade

Inotiv NAMs Test Center

This isn’t speculation — this is confirmation.A Schedule 13G was filed, not a 13D, meaning this is passive institutional capital, not acti

Recently Updated Narratives

Valuation Analysis of Palantir Technologies: Growth Assumptions and Market Expectations

Coca-Cola’s Enduring Moat in a Health-Conscious World: Steady Compounder Poised for 5-10% Annual Returns Through Emerging Market Dominance

Asset-Light but Valuation-Heavy: A Fundamental Breakdown of Marriott ($MAR)

Popular Narratives

Is Ubisoft the Market’s Biggest Pricing Error? Why Forensic Value Points to €33 Per Share

Analyst Commentary Highlights Microsoft AI Momentum and Upward Valuation Amid Growth and Competitive Risks