As European markets show resilience with major indices like the STOXX Europe 600 and Germany's DAX posting gains, investors are increasingly looking for opportunities that align with current economic conditions. In this environment, growth companies with high insider ownership can be particularly appealing as they often signal strong management confidence and alignment of interests between shareholders and company executives.

Top 10 Growth Companies With High Insider Ownership In Europe

| Name | Insider Ownership | Earnings Growth |

| Pharma Mar (BME:PHM) | 12% | 43.9% |

| MilDef Group (OM:MILDEF) | 13.7% | 83% |

| MedinCell (ENXTPA:MEDCL) | 12.5% | 90.4% |

| Magnora (OB:MGN) | 10.4% | 75.4% |

| KebNi (OM:KEBNI B) | 36.3% | 69.2% |

| Egetis Therapeutics (OM:EGTX) | 10.3% | 85% |

| CTT Systems (OM:CTT) | 17.5% | 52% |

| Circus (XTRA:CA1) | 24.1% | 67.1% |

| CD Projekt (WSE:CDR) | 29.7% | 49.6% |

| Bonesupport Holding (OM:BONEX) | 10.4% | 51.4% |

Underneath we present a selection of stocks filtered out by our screen.

Ercros (BME:ECR)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Ercros, S.A. is a Spanish company engaged in the manufacturing and sale of basic chemicals, intermediate chemicals, and pharmaceuticals, with a market cap of €241.39 million.

Operations: The company's revenue is derived from three main segments: Pharmaceuticals (€64.49 million), Chlorine Derivatives (€378.78 million), and Intermediate Chemicals (€186.56 million).

Insider Ownership: 15.9%

Ercros, S.A. is positioned for revenue growth at 8.6% annually, outpacing the Spanish market's 4.7%. Despite high volatility and a low forecasted Return on Equity of 5.3%, it offers good relative value compared to peers. Recent events include the cancellation of a €350 million acquisition by Esseco Industrial S.P.A., which may impact sentiment but leaves Ercros' management intact to pursue its growth trajectory independently in Europe.

- Click to explore a detailed breakdown of our findings in Ercros' earnings growth report.

- Our expertly prepared valuation report Ercros implies its share price may be lower than expected.

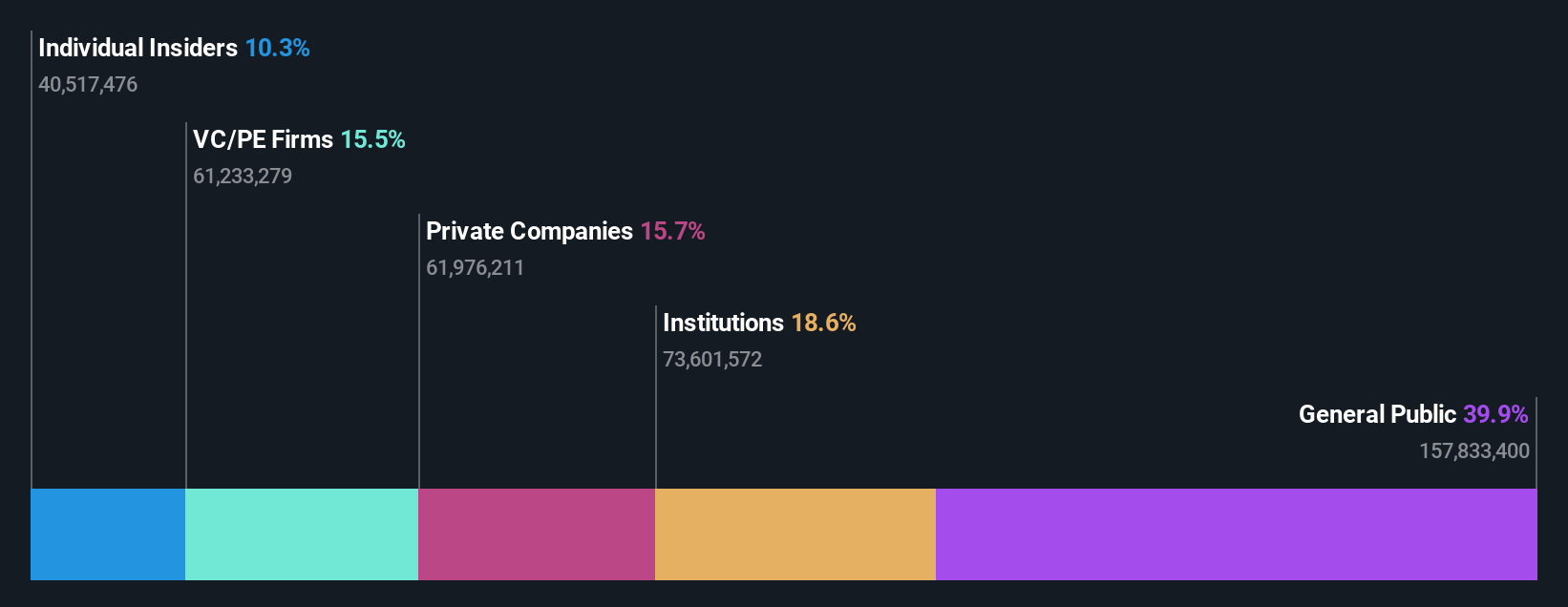

Egetis Therapeutics (OM:EGTX)

Simply Wall St Growth Rating: ★★★★★★

Overview: Egetis Therapeutics AB is a pharmaceutical company specializing in late-stage development projects for treating serious diseases with unmet medical needs in the orphan drug segment, with a market cap of approximately SEK2.49 billion.

Operations: The company's revenue is primarily derived from the orphan drug segment, with Emcitate generating SEK47.20 million.

Insider Ownership: 10.3%

Egetis Therapeutics is poised for significant growth, with revenue expected to increase by 59.6% annually, surpassing the Swedish market average. Despite recent shareholder dilution through a SEK 183 million equity offering, the company trades significantly below its estimated fair value. Analysts forecast an 82.3% price rise and high future return on equity at 43.8%. Recent FDA interactions regarding Emcitate® for MCT8 deficiency highlight potential regulatory advancements that could accelerate profitability within three years.

- Delve into the full analysis future growth report here for a deeper understanding of Egetis Therapeutics.

- The analysis detailed in our Egetis Therapeutics valuation report hints at an deflated share price compared to its estimated value.

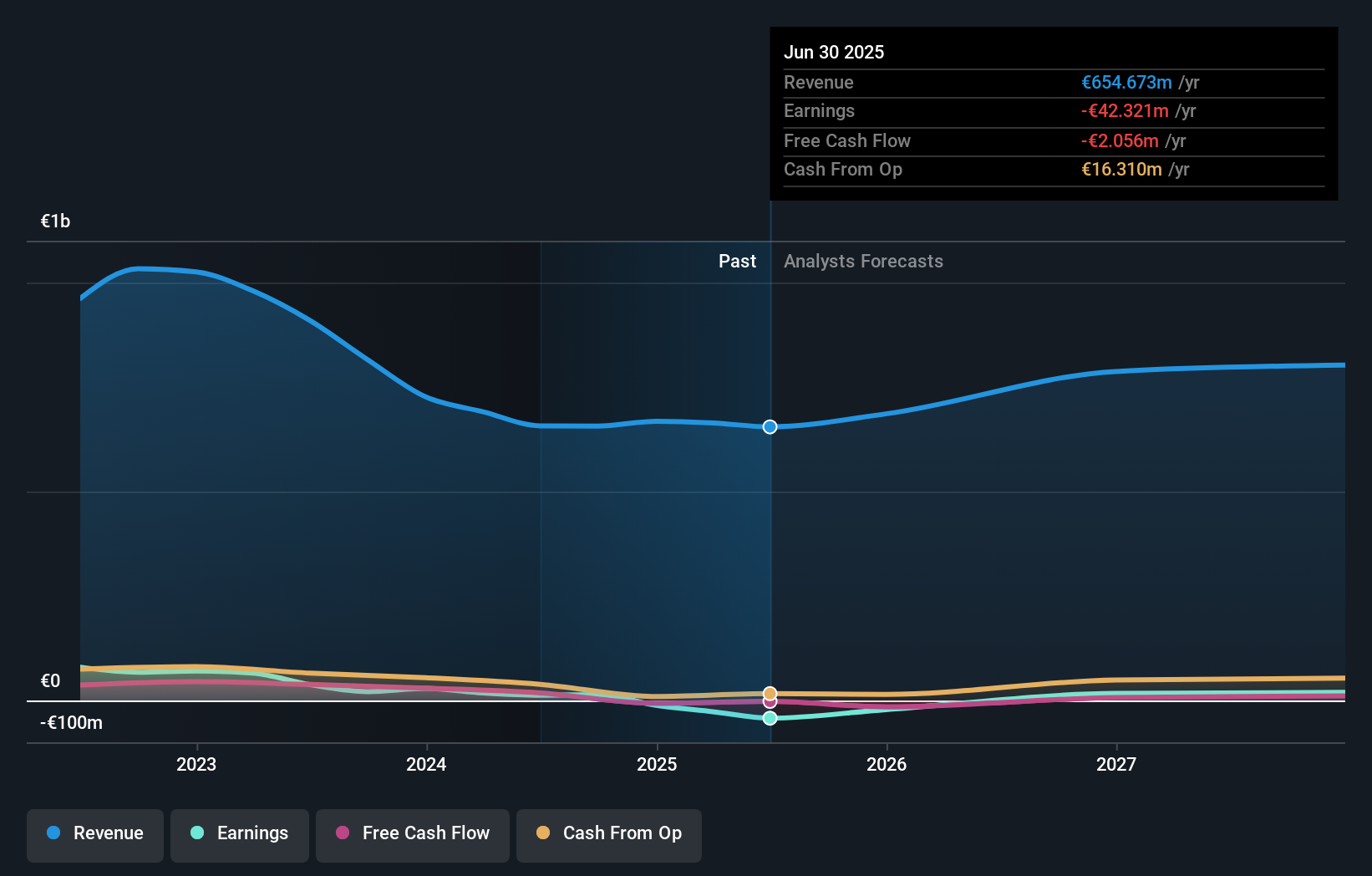

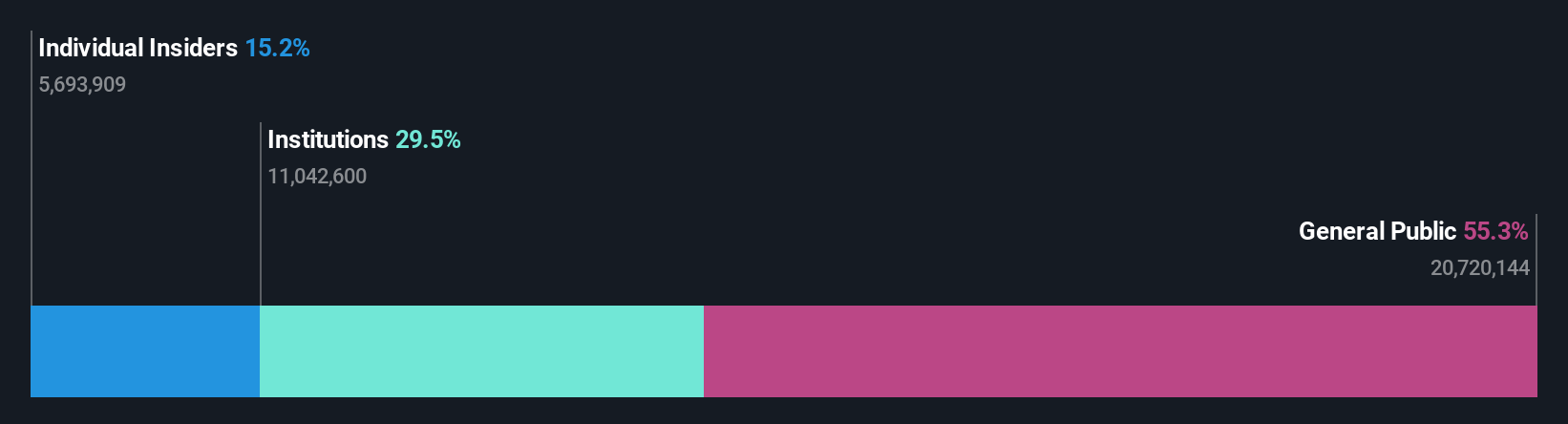

Smart Eye (OM:SEYE)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Smart Eye AB (publ) develops AI technology solutions to understand and predict human behavior across various global markets, with a market cap of SEK3.22 billion.

Operations: The company's revenue segments include Behavioral Research, generating SEK249.10 million, and Automotive Solutions, contributing SEK112.45 million.

Insider Ownership: 15.2%

Smart Eye is positioned for substantial growth, with revenue forecasted to grow 46.1% annually, outpacing the Swedish market. Despite a current net loss of SEK 37.44 million for Q2 2025, profitability is expected within three years. The company's recent collaboration with Sony enhances its driver monitoring systems, aligning with regulatory demands and offering OEMs advanced safety and personalization features. Trading at a significant discount to fair value, Smart Eye shows potential for future gains in shareholder value.

- Take a closer look at Smart Eye's potential here in our earnings growth report.

- Our valuation report here indicates Smart Eye may be undervalued.

Where To Now?

- Discover the full array of 189 Fast Growing European Companies With High Insider Ownership right here.

- Curious About Other Options? We've found 21 US stocks that are forecast to pay a dividend yeild of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Valuation is complex, but we're here to simplify it.

Discover if Ercros might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About BME:ECR

Ercros

Manufactures and sells basic chemicals, intermediate chemicals, and pharmaceuticals in Spain.

Reasonable growth potential and fair value.

Similar Companies

Market Insights

Community Narratives