- Norway

- /

- Marine and Shipping

- /

- OB:EWIND

European Growth Companies With High Insider Ownership August 2025

Reviewed by Simply Wall St

Amid recent market turbulence, European stocks have faced challenges, with the STOXX Europe 600 Index dropping by 2.57% due to dissatisfaction over a trade agreement framework between the U.S. and EU. In this environment of cautious economic sentiment and modest growth rates, companies with high insider ownership can offer a unique appeal as they often reflect strong confidence from those who know the business best, potentially aligning interests with shareholders and fostering long-term growth strategies.

Top 10 Growth Companies With High Insider Ownership In Europe

| Name | Insider Ownership | Earnings Growth |

| Xbrane Biopharma (OM:XBRANE) | 21.8% | 56.8% |

| Pharma Mar (BME:PHM) | 11.8% | 44.2% |

| MedinCell (ENXTPA:MEDCL) | 13.9% | 94% |

| Marinomed Biotech (WBAG:MARI) | 29.7% | 20.2% |

| KebNi (OM:KEBNI B) | 38.3% | 65% |

| Elliptic Laboratories (OB:ELABS) | 24.4% | 79% |

| CTT Systems (OM:CTT) | 17.5% | 37.9% |

| Circus (XTRA:CA1) | 24.7% | 94.8% |

| Bonesupport Holding (OM:BONEX) | 10.4% | 62.3% |

| Bergen Carbon Solutions (OB:BCS) | 12% | 63.2% |

We're going to check out a few of the best picks from our screener tool.

Ercros (BME:ECR)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Ercros, S.A. is a Spanish company that manufactures and sells basic chemicals, intermediate chemicals, and pharmaceuticals with a market cap of €283 million.

Operations: The company's revenue is derived from pharmaceuticals (€64.49 million), chlorine derivatives (€378.78 million), and intermediate chemicals (€186.56 million).

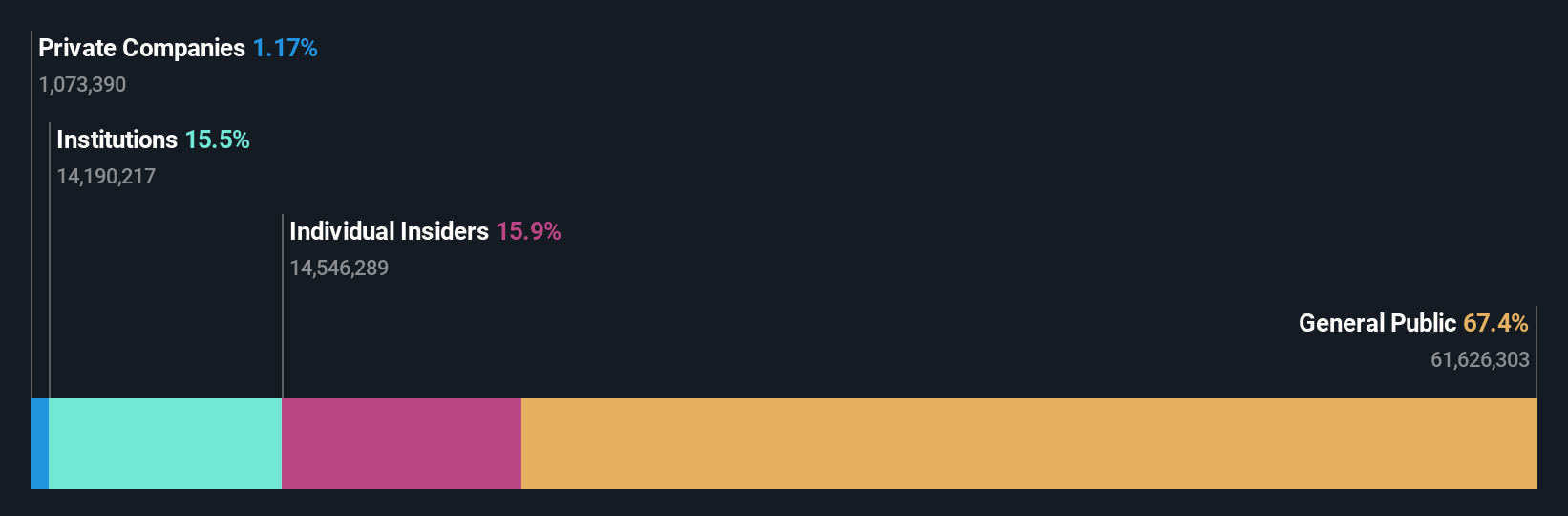

Insider Ownership: 15.9%

Ercros is forecast to achieve above-average market profit growth over the next three years, despite recent financial challenges. The company reported a net loss of €29.27 million for the first half of 2025, with revenue declining to €358.55 million from the previous year. While Ercros' revenue growth is expected to surpass the Spanish market rate, its dividend coverage remains weak and debt coverage by operating cash flow is inadequate. The stock trades at a good relative value compared to peers.

- Navigate through the intricacies of Ercros with our comprehensive analyst estimates report here.

- The analysis detailed in our Ercros valuation report hints at an deflated share price compared to its estimated value.

Edda Wind (OB:EWIND)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Edda Wind ASA develops, builds, owns, operates, and charters service operation vessels (SOVs) and commissioning service operation vessels (CSOVs) for offshore wind farms globally, with a market cap of NOK2.94 billion.

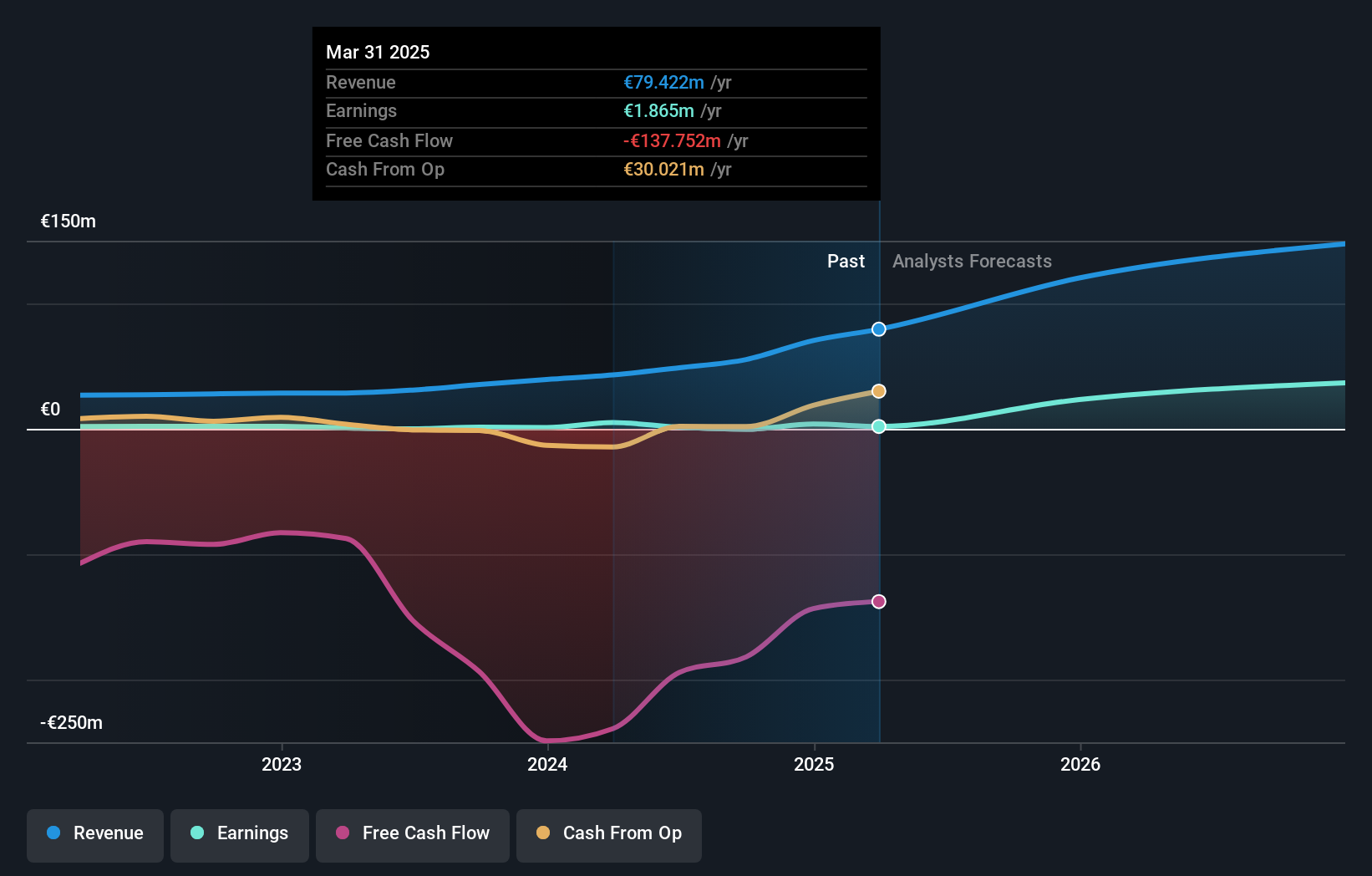

Operations: The company's revenue segment is primarily derived from its Offshore Wind Segment, totaling €79.42 million.

Insider Ownership: 29.7%

Edda Wind's growth prospects are underpinned by a forecasted earnings increase of 94.6% annually, outpacing the Norwegian market. Despite a decline in profit margins from 11.5% to 2.3%, revenue is expected to grow significantly at 33.1% per year, surpassing the market average. Recent M&A activity resulted in Geveran Trading Co., Ltd., Wilhelmsen New Energy AS, and EPS Ventures Ltd acquiring full ownership, potentially leading to strategic shifts as they plan to de-list the company from Oslo Stock Exchange.

- Click here and access our complete growth analysis report to understand the dynamics of Edda Wind.

- The valuation report we've compiled suggests that Edda Wind's current price could be inflated.

Smart Eye (OM:SEYE)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Smart Eye AB (publ) specializes in developing AI technology solutions that analyze and predict human behavior, serving markets in the Nordics, Europe, North America, Asia, and globally, with a market cap of SEK2.48 billion.

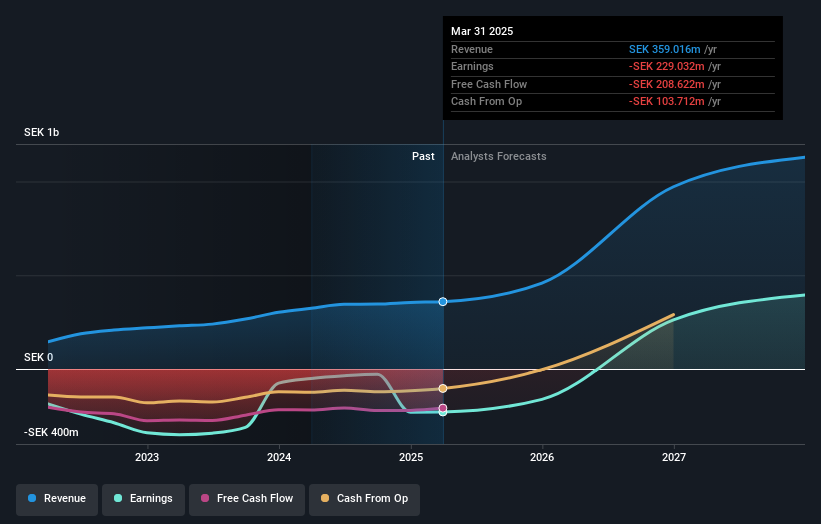

Operations: Smart Eye AB (publ) generates revenue through its segments in Behavioral Research, contributing SEK255.40 million, and Automotive Solutions, contributing SEK103.65 million.

Insider Ownership: 15.2%

Smart Eye is poised for substantial growth, with revenue expected to expand by 42.6% annually, surpassing the Swedish market's average. Recent product innovations like AI ONE and an upgraded AIS system highlight its commitment to advanced driver monitoring solutions. Despite reporting a net loss of SEK 55.1 million in Q1 2025, Smart Eye's forecasted profitability within three years indicates strong potential. Insider ownership remains significant, reflecting confidence in its strategic direction and technological advancements.

- Click to explore a detailed breakdown of our findings in Smart Eye's earnings growth report.

- According our valuation report, there's an indication that Smart Eye's share price might be on the expensive side.

Key Takeaways

- Access the full spectrum of 214 Fast Growing European Companies With High Insider Ownership by clicking on this link.

- Curious About Other Options? These 19 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Valuation is complex, but we're here to simplify it.

Discover if Edda Wind might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OB:EWIND

Edda Wind

Develops, builds, owns, operates, and charters out purpose-built service operation vessels (SOVs) and commissioning service operation vessels (CSOVs) for offshore wind farms and maritime operations worldwide.

High growth potential slight.

Similar Companies

Market Insights

Community Narratives