- Switzerland

- /

- Pharma

- /

- SWX:NOVN

Top European Dividend Stocks To Consider In March 2025

Reviewed by Simply Wall St

As the pan-European STOXX Europe 600 Index continues its longest streak of weekly gains since August 2012, buoyed by encouraging company results and defensive stock performance, investors are increasingly looking towards dividend stocks as a potential source of steady income amidst economic uncertainties. In this context, identifying robust dividend stocks becomes crucial, as they can offer resilience and consistent returns even when market conditions are mixed or unpredictable.

Top 10 Dividend Stocks In Europe

| Name | Dividend Yield | Dividend Rating |

| Bredband2 i Skandinavien (OM:BRE2) | 4.95% | ★★★★★★ |

| Zurich Insurance Group (SWX:ZURN) | 4.21% | ★★★★★★ |

| Julius Bär Gruppe (SWX:BAER) | 4.15% | ★★★★★★ |

| Mapfre (BME:MAP) | 5.96% | ★★★★★★ |

| Rubis (ENXTPA:RUI) | 7.66% | ★★★★★★ |

| Vaudoise Assurances Holding (SWX:VAHN) | 4.21% | ★★★★★★ |

| Cembra Money Bank (SWX:CMBN) | 4.33% | ★★★★★★ |

| VERBUND (WBAG:VER) | 5.82% | ★★★★★★ |

| Banque Cantonale Vaudoise (SWX:BCVN) | 4.51% | ★★★★★★ |

| CaixaBank (BME:CABK) | 8.21% | ★★★★★☆ |

Click here to see the full list of 216 stocks from our Top European Dividend Stocks screener.

Let's take a closer look at a couple of our picks from the screened companies.

Grupo Catalana Occidente (BME:GCO)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Grupo Catalana Occidente, S.A., along with its subsidiaries, operates globally by offering a range of insurance products and services, with a market cap of approximately €4.66 billion.

Operations: Grupo Catalana Occidente, S.A. generates revenue through its diverse portfolio of insurance products and services offered on a global scale.

Dividend Yield: 3.1%

Grupo Catalana Occidente offers a reliable dividend yield of 3.08%, supported by stable and growing payments over the past decade. The company's dividends are well-covered, with low payout ratios of 22.5% from earnings and 27.4% from cash flows, indicating sustainability. Although its yield is below the top tier in Spain, GCO trades at a significant discount to fair value estimates and has shown strong earnings growth, reporting €636.45 million net income for 2024 compared to €580.6 million in 2023.

- Take a closer look at Grupo Catalana Occidente's potential here in our dividend report.

- Our valuation report unveils the possibility Grupo Catalana Occidente's shares may be trading at a discount.

What's Cooking Group/SA (ENXTBR:WHATS)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: What's Cooking Group NV/SA, along with its subsidiaries, is involved in the production and sale of meat products and ready meals, with a market cap of €195.83 million.

Operations: What's Cooking Group NV/SA generates revenue through its production and sale of meat products and ready meals.

Dividend Yield: 4.1%

What's Cooking Group/SA provides a reliable dividend yield of 4.06%, with stable and growing payments over the past decade. The dividends are well-covered by earnings (51.6% payout ratio) and cash flows (23.3% cash payout ratio), ensuring sustainability despite being below the top tier in Belgium. Recent earnings results show strong growth, with net income rising to €20.65 million for 2024 from €7.66 million in 2023, supporting continued dividend stability.

- Click to explore a detailed breakdown of our findings in What's Cooking Group/SA's dividend report.

- Our expertly prepared valuation report What's Cooking Group/SA implies its share price may be lower than expected.

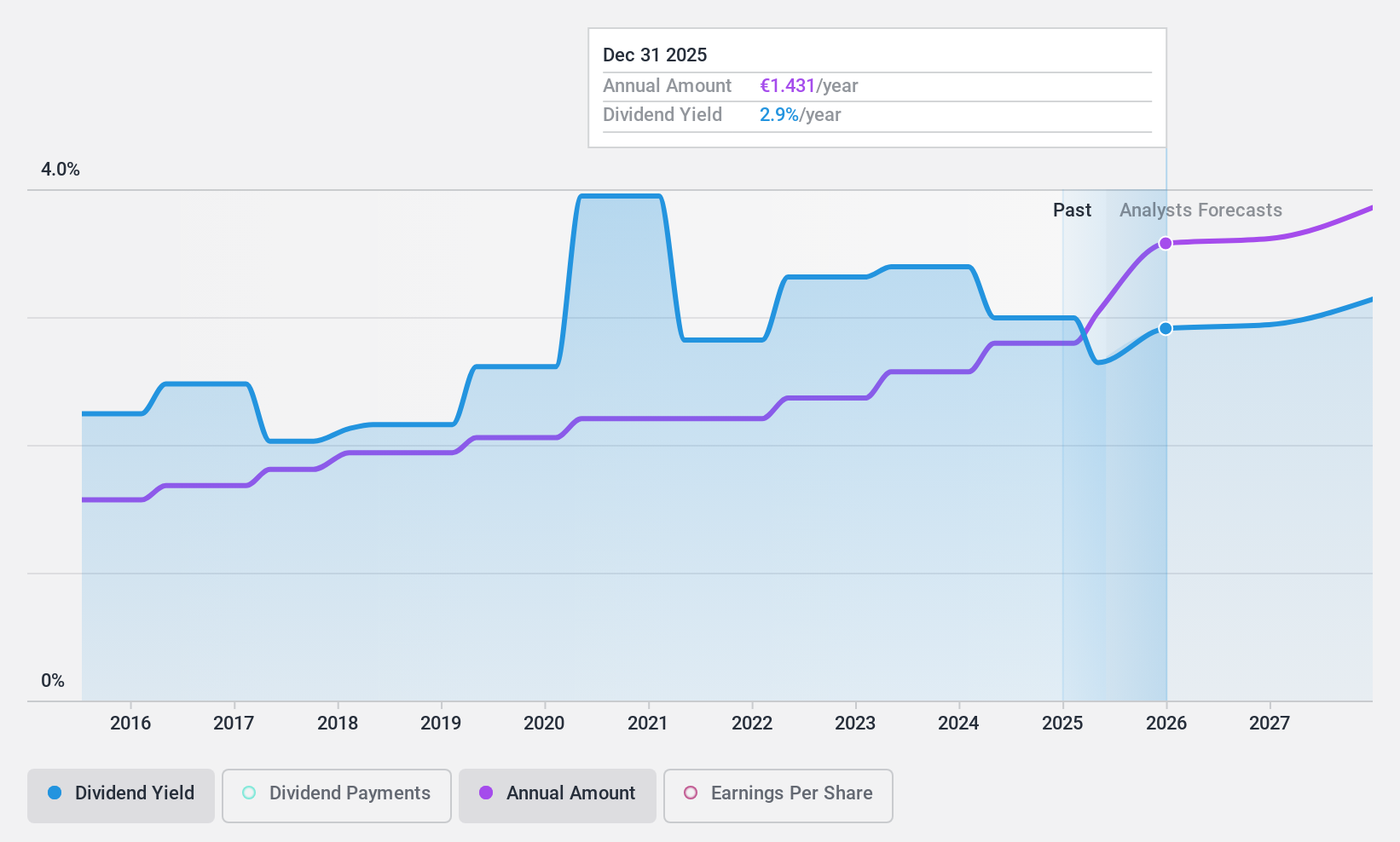

Novartis (SWX:NOVN)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Novartis AG is a Swiss-based company involved in the research, development, manufacture, distribution, marketing, and sale of pharmaceutical medicines worldwide with a market cap of CHF197.51 billion.

Operations: Novartis AG generates revenue primarily through its Innovative Medicines segment, which reported $51.72 billion.

Dividend Yield: 3.4%

Novartis offers a stable dividend yield of 3.41%, supported by a decade of consistent growth and reliability. The dividend is well-covered, with payout ratios of 65.3% from earnings and 54.5% from cash flows, ensuring sustainability despite being below Switzerland's top tier payers. Recent news highlights the company’s strategic advancements in pharmaceuticals, such as Fabhalta's EMA recommendation for C3G treatment, reinforcing Novartis' potential for sustained revenue growth and future dividend stability.

- Unlock comprehensive insights into our analysis of Novartis stock in this dividend report.

- Insights from our recent valuation report point to the potential undervaluation of Novartis shares in the market.

Key Takeaways

- Get an in-depth perspective on all 216 Top European Dividend Stocks by using our screener here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Novartis might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SWX:NOVN

Novartis

Researches, develops, manufactures, distributes, markets, and sells pharmaceutical medicines in Switzerland and internationally.

Outstanding track record, undervalued and pays a dividend.

Similar Companies

Market Insights

Community Narratives