- Spain

- /

- Personal Products

- /

- BME:PUIG

Why Puig Brands (BME:PUIG) Is Down 9.0% After Reporting Strong Half-Year Earnings and Profitability Gains

Reviewed by Simply Wall St

- On September 9, 2025, Puig Brands, S.A. reported its half-year earnings, announcing sales of €2.30 billion and net income of €275.01 million for the period ended June 30, both up from the previous year.

- The substantial rise in net income underscores an improvement in the company’s profitability and operational effectiveness over the past year.

- We’ll explore how Puig Brands’ significant growth in earnings and profitability shapes its current investment narrative.

The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

What Is Puig Brands' Investment Narrative?

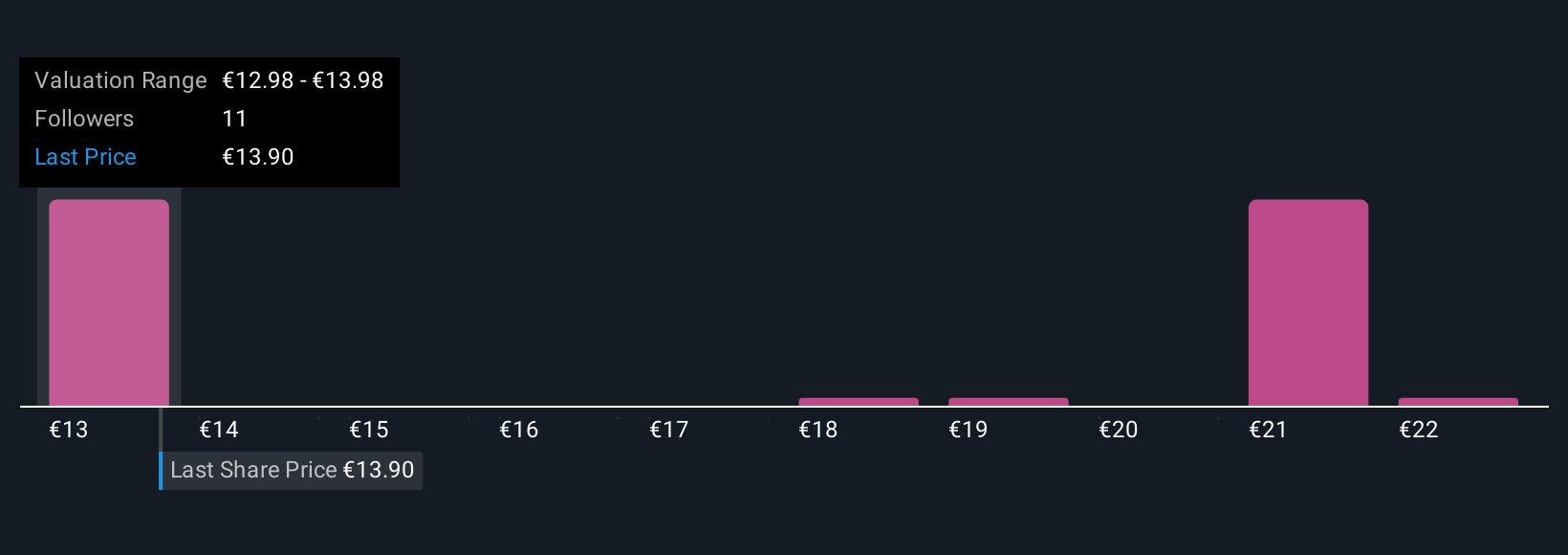

To believe in Puig Brands as a shareholder right now, you’d need to be confident in its ability to translate recent operational improvements into lasting performance and shareholder value. The company’s latest half-year report delivered a sharp increase in both sales and net income, hinting at stronger margins and operational discipline following its IPO and index inclusions last year. These fresh numbers may temper some earlier concerns around profitability, especially since net income nearly doubled compared to last year’s first half. The upgraded earnings could serve as a short-term catalyst, potentially affecting future guidance and analyst fair value estimates. Nonetheless, risks remain: the share price has seen a sustained decline this year, and an inexperienced board may pose challenges as the business faces sector competition and the expiry of key lock-up periods. Whether the recent earnings gains are enough to shift sentiment could hinge on management’s ability to sustain this momentum while stabilizing investor confidence. On the flip side, governance concerns still linger and warrant close attention.

Puig Brands' share price has been on the slide but might be dropping deeper into value territory. Find out whether it's a bargain at this price.Exploring Other Perspectives

Explore 6 other fair value estimates on Puig Brands - why the stock might be worth 11% less than the current price!

Build Your Own Puig Brands Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Puig Brands research is our analysis highlighting 4 key rewards that could impact your investment decision.

- Our free Puig Brands research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Puig Brands' overall financial health at a glance.

Ready For A Different Approach?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- Outshine the giants: these 25 early-stage AI stocks could fund your retirement.

- Find companies with promising cash flow potential yet trading below their fair value.

- We've found 18 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About BME:PUIG

Puig Brands

Operates in the beauty and fashion industry in Europe, the Middle East, Africa, the Americas, and the Asia-Pacific.

Solid track record with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives