As European markets remain relatively stable, with the pan-European STOXX Europe 600 Index ending flat amid ongoing trade discussions, investors are keenly observing economic indicators such as inflation and industrial output. In this environment, dividend stocks can be appealing for those seeking steady income streams, especially when they demonstrate resilience and consistent performance in fluctuating market conditions.

Top 10 Dividend Stocks In Europe

| Name | Dividend Yield | Dividend Rating |

| Zurich Insurance Group (SWX:ZURN) | 4.45% | ★★★★★★ |

| Rubis (ENXTPA:RUI) | 7.19% | ★★★★★★ |

| OVB Holding (XTRA:O4B) | 4.76% | ★★★★★★ |

| Julius Bär Gruppe (SWX:BAER) | 4.67% | ★★★★★★ |

| Holcim (SWX:HOLN) | 4.85% | ★★★★★★ |

| HEXPOL (OM:HPOL B) | 4.87% | ★★★★★★ |

| ERG (BIT:ERG) | 5.34% | ★★★★★★ |

| DKSH Holding (SWX:DKSH) | 4.01% | ★★★★★★ |

| Banque Cantonale Vaudoise (SWX:BCVN) | 4.58% | ★★★★★★ |

| Allianz (XTRA:ALV) | 4.46% | ★★★★★★ |

Click here to see the full list of 229 stocks from our Top European Dividend Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

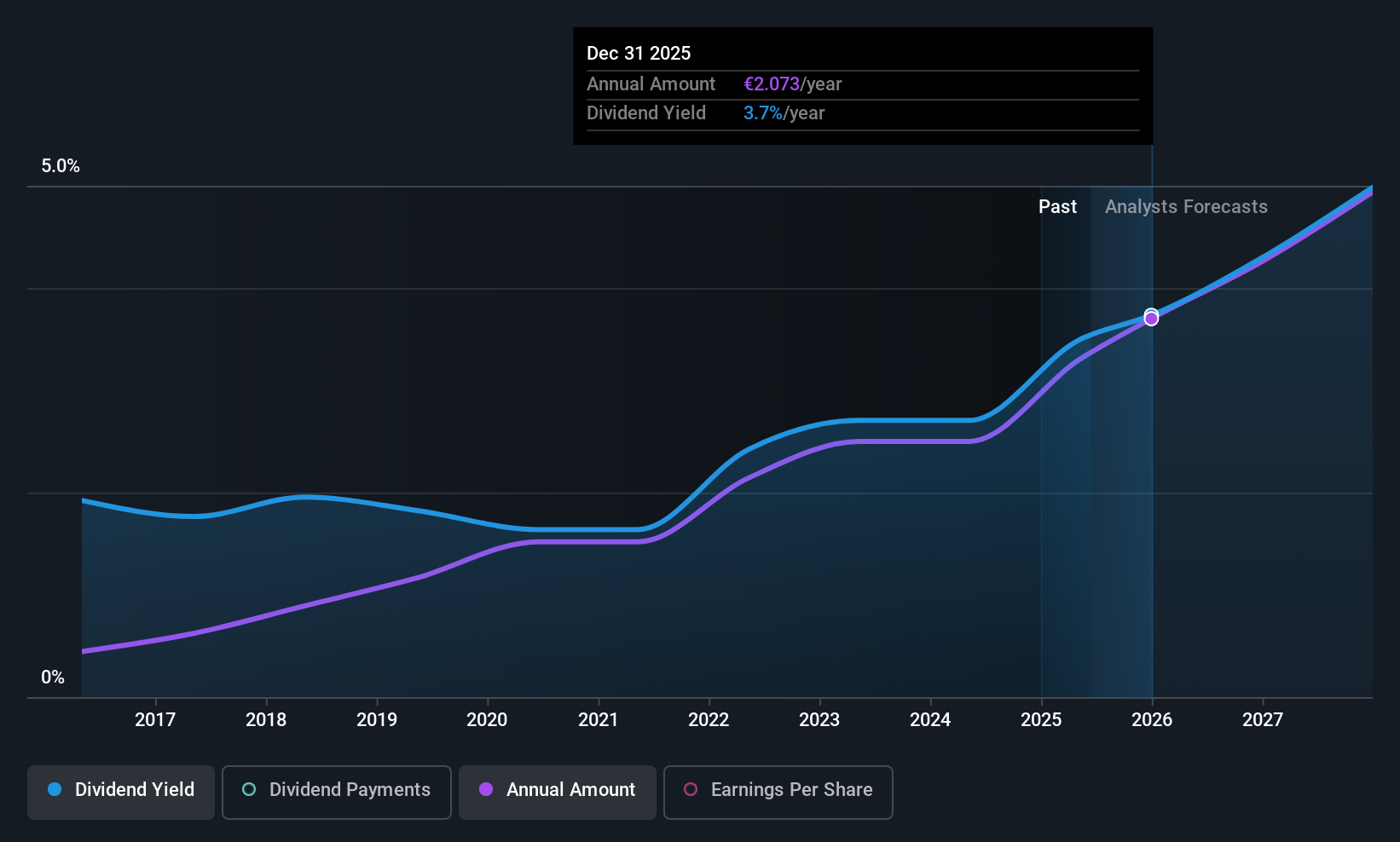

Prim (BME:PRM)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Prim, S.A. operates in Spain, offering health technology, mobility, and healthcare products with a market cap of €207.56 million.

Operations: Prim, S.A.'s revenue is primarily derived from its Medical Technologies segment at €118.75 million and the Mobility and Healthcare segment at €114.56 million.

Dividend Yield: 3.7%

Prim, S.A. offers a mixed dividend profile with its recent cash dividend of €0.18549 set for July 16, 2025. While the company's payout ratio of 42.4% indicates dividends are well covered by earnings, its track record is marred by volatility and unreliability over the past decade. Despite a modest yield of 3.66%, below top Spanish payers, Prim's dividends are supported by both earnings and cash flows with a cash payout ratio at 70.6%.

- Unlock comprehensive insights into our analysis of Prim stock in this dividend report.

- Our comprehensive valuation report raises the possibility that Prim is priced lower than what may be justified by its financials.

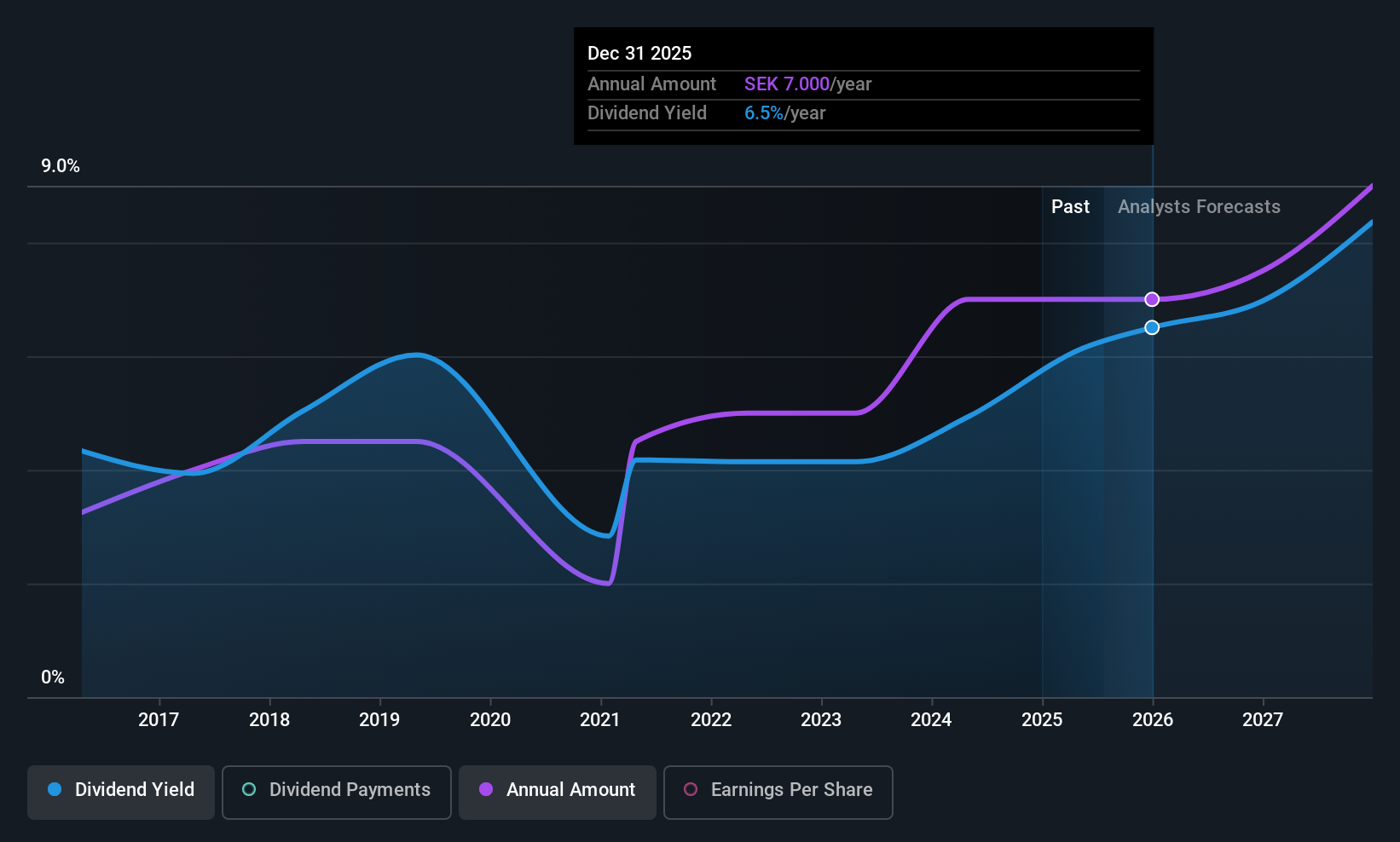

Ework Group (OM:EWRK)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Ework Group AB (publ) provides comprehensive talent solutions across IT/OT, research and development, engineering, and business development in several European countries, with a market capitalization of approximately SEK1.88 billion.

Operations: Ework Group AB (publ) generates revenue through its talent solutions services in IT/OT, research and development, engineering, and business development across Sweden, Norway, Finland, Denmark, Poland, and Slovakia.

Dividend Yield: 6.4%

Ework Group's dividend profile is characterized by a high yield of 6.43%, ranking it among the top Swedish payers, yet its sustainability is questionable due to a payout ratio of 102.9% not covered by earnings. Despite reasonable cash flow coverage with a cash payout ratio of 52.1%, dividends have been volatile and unreliable over the past decade. Recent earnings showed declining revenue and net income, adding pressure on future dividend stability amidst leadership changes.

- Dive into the specifics of Ework Group here with our thorough dividend report.

- In light of our recent valuation report, it seems possible that Ework Group is trading behind its estimated value.

Mensch und Maschine Software (XTRA:MUM)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Mensch und Maschine Software SE offers CAD/CAM/CAE, product data management, and building information modeling/management solutions in Germany, Austria, Switzerland, and internationally with a market cap of €920.73 million.

Operations: Mensch und Maschine Software SE generates revenue through its M+M Software segment, which contributes €111.29 million, and the M+M Digitization segment, which adds €179.71 million.

Dividend Yield: 3.3%

Mensch und Maschine Software offers a dividend yield of 3.35%, below the German market's top tier, with concerns over sustainability due to a high payout ratio of 104.8% not covered by earnings, though cash flows cover dividends at a reasonable 73.8%. Despite recent decreases in annual dividends to €0.31 per share, payments have been stable and growing over the past decade. Recent earnings showed decreased sales and net income compared to last year, potentially impacting future dividends.

- Get an in-depth perspective on Mensch und Maschine Software's performance by reading our dividend report here.

- Upon reviewing our latest valuation report, Mensch und Maschine Software's share price might be too pessimistic.

Where To Now?

- Access the full spectrum of 229 Top European Dividend Stocks by clicking on this link.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About XTRA:MUM

Mensch und Maschine Software

Provides computer aided design, manufacturing, and engineering, product data management, and building information modeling/management solutions in Germany, Austria, Switzerland, the United Kingdom, Italy, France, Hungary, and internationally.

Undervalued with proven track record.

Market Insights

Community Narratives