- Spain

- /

- Healthcare Services

- /

- BME:MED

Should Weakness in Medcomtech, S.A.'s (BME:MED) Stock Be Seen As A Sign That Market Will Correct The Share Price Given Decent Financials?

With its stock down 8.3% over the past three months, it is easy to disregard Medcomtech (BME:MED). But if you pay close attention, you might find that its key financial indicators look quite decent, which could mean that the stock could potentially rise in the long-term given how markets usually reward more resilient long-term fundamentals. Specifically, we decided to study Medcomtech's ROE in this article.

ROE or return on equity is a useful tool to assess how effectively a company can generate returns on the investment it received from its shareholders. In other words, it is a profitability ratio which measures the rate of return on the capital provided by the company's shareholders.

View our latest analysis for Medcomtech

How Do You Calculate Return On Equity?

The formula for ROE is:

Return on Equity = Net Profit (from continuing operations) ÷ Shareholders' Equity

So, based on the above formula, the ROE for Medcomtech is:

41% = €4.1m ÷ €9.9m (Based on the trailing twelve months to December 2019).

The 'return' is the profit over the last twelve months. Another way to think of that is that for every €1 worth of equity, the company was able to earn €0.41 in profit.

Why Is ROE Important For Earnings Growth?

So far, we've learned that ROE is a measure of a company's profitability. We now need to evaluate how much profit the company reinvests or "retains" for future growth which then gives us an idea about the growth potential of the company. Assuming everything else remains unchanged, the higher the ROE and profit retention, the higher the growth rate of a company compared to companies that don't necessarily bear these characteristics.

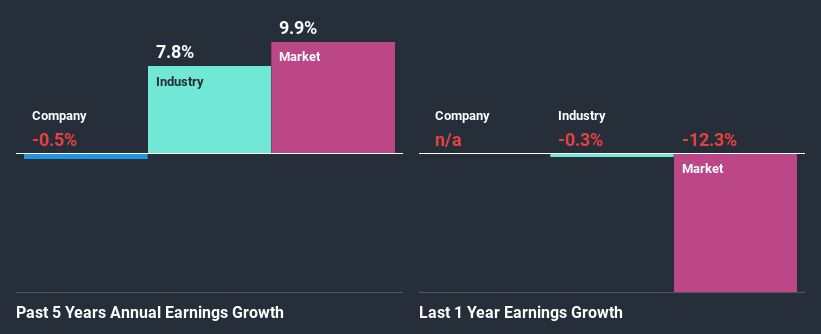

A Side By Side comparison of Medcomtech's Earnings Growth And 41% ROE

Firstly, we acknowledge that Medcomtech has a significantly high ROE. Secondly, even when compared to the industry average of 9.4% the company's ROE is quite impressive. Given the circumstances, we can't help but wonder why Medcomtech saw little to no growth in the past five years. We reckon that there could be some other factors at play here that's limiting the company's growth. For example, it could be that the company has a high payout ratio or the business has allocated capital poorly, for instance.

We then compared Medcomtech's net income growth with the industry and found that the average industry growth rate was 8.1% in the same period.

The basis for attaching value to a company is, to a great extent, tied to its earnings growth. What investors need to determine next is if the expected earnings growth, or the lack of it, is already built into the share price. This then helps them determine if the stock is placed for a bright or bleak future. Is Medcomtech fairly valued compared to other companies? These 3 valuation measures might help you decide.

Is Medcomtech Making Efficient Use Of Its Profits?

Medcomtech doesn't pay any dividend, meaning that the company is keeping all of its profits, which makes us wonder why it is retaining its earnings if it can't use them to grow its business. It looks like there might be some other reasons to explain the lack in that respect. For example, the business could be in decline.

Conclusion

On the whole, we do feel that Medcomtech has some positive attributes. Although, we are disappointed to see a lack of growth in earnings even in spite of a high ROE and and a high reinvestment rate. We believe that there might be some outside factors that could be having a negative impact on the business. So far, we've only made a quick discussion around the company's earnings growth. You can do your own research on Medcomtech and see how it has performed in the past by looking at this FREE detailed graph of past earnings, revenue and cash flows.

If you decide to trade Medcomtech, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About BME:MED

Medcomtech

Medcomtech, S.A. distributes products in the areas of orthopedic surgery, traumatology, neurosurgery, pain, and anesthesia worldwide.

Slightly overvalued with imperfect balance sheet.

Market Insights

Community Narratives