- Spain

- /

- Hospitality

- /

- BME:HBX

HBX Group (BME:HBX) Returns to Profit in H2, Challenging Persistent Loss Narrative

Reviewed by Simply Wall St

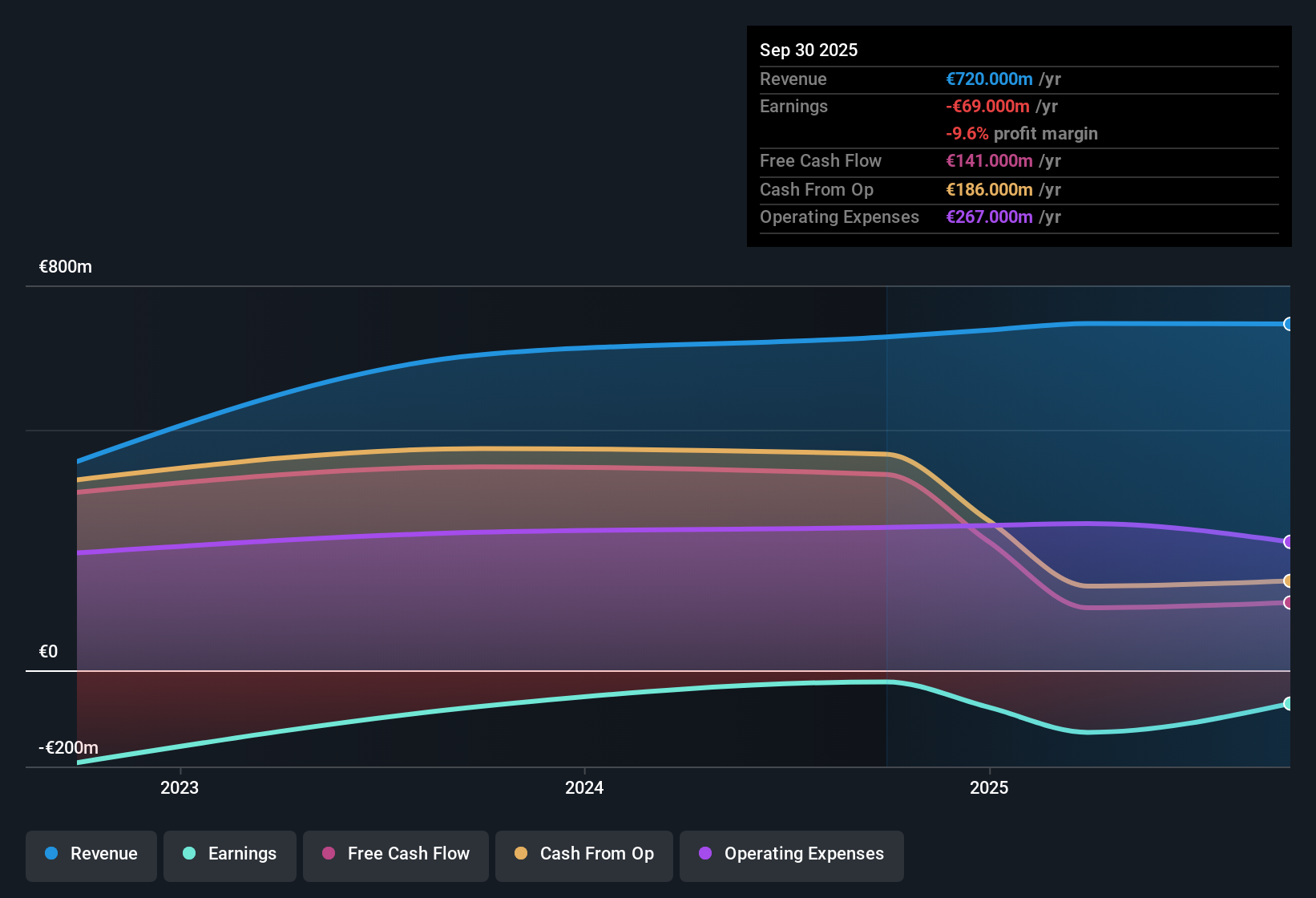

HBX Group International (BME:HBX) has just released its FY 2025 financial results, revealing second-half revenue of €401 million and net income of €158 million, with basic EPS coming in at €0.64. The company has seen revenue move from €291 million in FY 2024 H1 to €319 million in FY 2025 H1, and then up again to €401 million in FY 2025 H2. Margins moved sharply through the year, highlighting volatile profitability as HBX continues to balance growth expectations with its bottom line performance.

See our full analysis for HBX Group International.Next, we’re putting the results side-by-side with the dominant market narratives to see which stories hold up and which expectations may be in for a reality check.

Curious how numbers become stories that shape markets? Explore Community Narratives

Net Income Swings From Loss to €158 Million

- The second half of FY 2025 saw net income rise to €158 million, reversing from a €227 million loss in the first half of the same year.

- It is notable that, even as the latest half shows a sharp profit, annual trailing twelve month figures still reflect a net loss of €69 million. This suggests the turnaround is recent and not yet established as a long-term trend.

- This supports the prevailing view that HBX is at a pivotal moment, as moving from persistent loss into profitability is key for delivering on forecasts of earnings growth averaging 46.78% per year over the coming years.

- However, consensus narratives highlight that sustained profitability remains uncertain, as there is no evidence yet of margin or earnings growth over a five-year period. The market may remain cautious until these gains are proven durable.

- To see how the full narrative weighs these profit swings against HBX's future, catch the complete market view in the consensus breakdown. 📊 Read the full HBX Group International Consensus Narrative.

Share Price Sits 70% Below DCF Fair Value

- Despite a recent close at €6.17, HBX’s stock trades at a steep 70.3% discount to its estimated DCF fair value of €20.75 per share.

- The general market view is that while growth forecasts are compelling, this valuation discount must be weighed carefully against HBX’s persistent unprofitability.

- Bulls may point to revenue growth outpacing the Spanish market at 3.9% last year and a forecasted 5.5% annual growth rate as reason for optimism.

- Bears, however, could counter that a higher price-to-sales ratio than the wider European hospitality sector and recent share price volatility suggest these favorable comparisons may already be captured, or at least come with significant risks attached.

Revenue Edges Up, Profitability Still Lags Peers

- HBX delivered trailing twelve month revenue growth of 3.9%, a tick above the broader Spanish market’s 4.5% annualized rate, but remains unprofitable on an annualized basis.

- Consensus narrative notes that, even with short-term topline gains, HBX has not demonstrated improvement in profit margins or earnings quality relative to direct sector rivals.

- This underlines that, for all the promise in revenue expansion, the real test for bullish arguments will be converting these gains to sustainable profitability in coming periods.

- Absent clear progress on margin improvement, market opinion may stay neutral or discounted until future filings confirm a convincing shift in the bottom line story.

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on HBX Group International's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

See What Else Is Out There

HBX’s recent turnaround in profitability is not yet established, and its earnings remain inconsistent with no clear trend of sustained improvement.

Prefer businesses with a steadier financial track record? You can filter for proven performers by using stable growth stocks screener (2074 results) to discover companies delivering reliable growth and consistent results through market cycles.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if HBX Group International might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About BME:HBX

HBX Group International

Engages in the intermediation of hotel accommodation.

High growth potential and fair value.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

No miracle in sight

Q3 Outlook modestly optimistic

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success