- Spain

- /

- Commercial Services

- /

- BME:FCC

FCC (BME:FCC): Unpacking the Valuation After Recent Gains and Shifting Share Price Trends

Reviewed by Simply Wall St

For investors watching Fomento de Construcciones y Contratas (BME:FCC), the recent stock moves may feel like a puzzle waiting to be solved. There’s no single headline or dramatic announcement grabbing the spotlight right now. However, sometimes the absence of big news can draw its own kind of attention. When a company’s price keeps shifting, it’s natural to wonder whether something subtle is brewing beneath the surface or if market expectations have simply evolved.

Over the last year, Fomento de Construcciones y Contratas shares have delivered a total return just under 30%, outpacing many peers, while momentum since the start of the year has also been solid. The stock’s long-term track record is even more impressive, with roughly 94% and 130% in total returns over the last 3 and 5 years respectively, though recent months did see a dip. Against a backdrop of steady revenue growth and a sharp jump in net income, valuation has become the main topic of interest.

This leaves us with a key question: is Fomento de Construcciones y Contratas at a discount right now, or is the market already factoring in its growth story?

Most Popular Narrative: 17.5% Undervalued

According to the most widely followed narrative, Fomento de Construcciones y Contratas is trading at a significant discount to its estimated fair value. The consensus view is that the current price does not fully reflect the company’s future potential, leaving room for upside if forecasts prove accurate.

The company's expanding backlog (€44 billion+ in guaranteed/project-based contracts) provides strong visibility and stability in future revenues, supported by increased government outsourcing and recurring, multi-decade service contracts. These factors contribute to more predictable cash flows and sustained net earnings growth.

Ever wondered what is driving this massive disconnect between the current price and fair value? Behind the curtain lie bold assumptions about revenue growth, scaling profit margins, and an ambitious outlook on future earnings. Interested in the details that make or break this story? The financial leap of faith at the heart of this valuation just might surprise you.

Result: Fair Value of €13.5 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, possible legal challenges and continued pressure on construction margins could quickly alter the current outlook for Fomento de Construcciones y Contratas.

Find out about the key risks to this Fomento de Construcciones y Contratas narrative.Another View: What Do Market Comparisons Say?

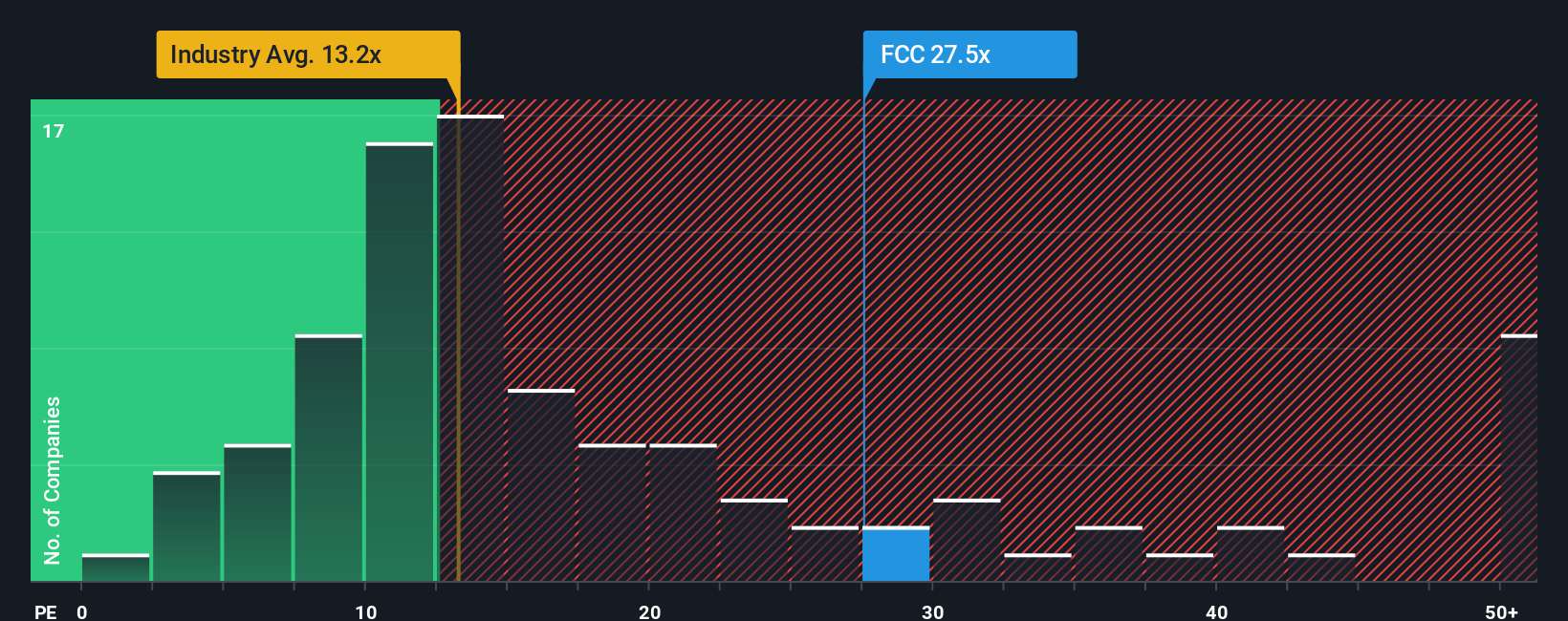

While fair value estimates suggest Fomento de Construcciones y Contratas may be undervalued, looking at how its valuation compares to the industry paints a different picture. By this method, shares actually look expensive. Could the market be factoring in too much hope, or is there further upside that multiples alone cannot capture?

See what the numbers say about this price — find out in our valuation breakdown.

Stay updated when valuation signals shift by adding Fomento de Construcciones y Contratas to your watchlist or portfolio. Alternatively, explore our screener to discover other companies that fit your criteria.

Build Your Own Fomento de Construcciones y Contratas Narrative

If you think the experts might have missed something, or simply want to dig into the numbers yourself, you can easily craft a personal take in just a few minutes. Do it your way

A great starting point for your Fomento de Construcciones y Contratas research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Act now to spot tomorrow’s winners and sharpen your portfolio. Don’t let these unique market opportunities pass you by. Smart investors act before the crowd catches on.

- Uncover hidden value by tracking companies backed by strong cash flows with our undervalued stocks based on cash flows and see where others might be missing opportunities.

- Ride the tech wave and get ahead of the curve by browsing AI penny stocks transforming industries with future-defining artificial intelligence breakthroughs.

- Boost your income potential by targeting dividend stocks with yields > 3% offering reliable returns and steady yields above 3% for added portfolio strength.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Kshitija Bhandaru

Kshitija (or Keisha) Bhandaru is an Equity Analyst at Simply Wall St and has over 6 years of experience in the finance industry and describes herself as a lifelong learner driven by her intellectual curiosity. She previously worked with Market Realist for 5 years as an Equity Analyst.

About BME:FCC

Fomento de Construcciones y Contratas

tal services in Europe and internationally.

Adequate balance sheet and fair value.

Market Insights

Community Narratives