- Spain

- /

- Electrical

- /

- BME:SOL

Investors Continue Waiting On Sidelines For Soltec Power Holdings, S.A. (BME:SOL)

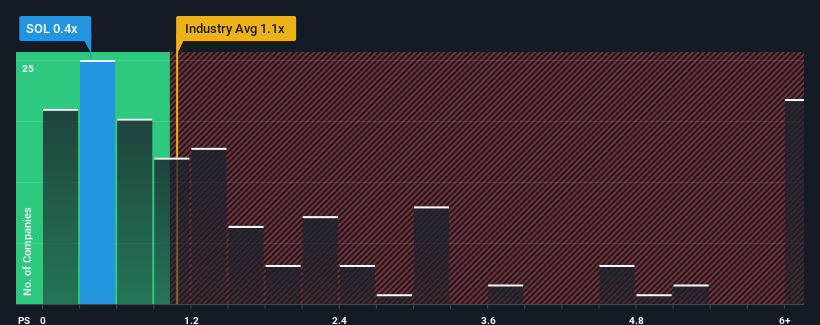

When you see that almost half of the companies in the Electrical industry in Spain have price-to-sales ratios (or "P/S") above 1.1x, Soltec Power Holdings, S.A. (BME:SOL) looks to be giving off some buy signals with its 0.4x P/S ratio. However, the P/S might be low for a reason and it requires further investigation to determine if it's justified.

See our latest analysis for Soltec Power Holdings

How Soltec Power Holdings Has Been Performing

Soltec Power Holdings hasn't been tracking well recently as its declining revenue compares poorly to other companies, which have seen some growth in their revenues on average. It seems that many are expecting the poor revenue performance to persist, which has repressed the P/S ratio. If this is the case, then existing shareholders will probably struggle to get excited about the future direction of the share price.

Keen to find out how analysts think Soltec Power Holdings' future stacks up against the industry? In that case, our free report is a great place to start.Is There Any Revenue Growth Forecasted For Soltec Power Holdings?

In order to justify its P/S ratio, Soltec Power Holdings would need to produce sluggish growth that's trailing the industry.

Retrospectively, the last year delivered a frustrating 35% decrease to the company's top line. Even so, admirably revenue has lifted 70% in aggregate from three years ago, notwithstanding the last 12 months. Although it's been a bumpy ride, it's still fair to say the revenue growth recently has been more than adequate for the company.

Shifting to the future, estimates from the five analysts covering the company suggest revenue should grow by 25% per annum over the next three years. With the industry only predicted to deliver 9.3% per annum, the company is positioned for a stronger revenue result.

With this in consideration, we find it intriguing that Soltec Power Holdings' P/S sits behind most of its industry peers. It looks like most investors are not convinced at all that the company can achieve future growth expectations.

The Bottom Line On Soltec Power Holdings' P/S

It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

Soltec Power Holdings' analyst forecasts revealed that its superior revenue outlook isn't contributing to its P/S anywhere near as much as we would have predicted. There could be some major risk factors that are placing downward pressure on the P/S ratio. It appears the market could be anticipating revenue instability, because these conditions should normally provide a boost to the share price.

Before you take the next step, you should know about the 1 warning sign for Soltec Power Holdings that we have uncovered.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About BME:SOL

Soltec Power Holdings

Engages in the development of solutions for photovoltaic energy projects in Spain, Italy, Brazil, the United States, Mexico, Argentina, Chile, Colombia, Peru, Panama, Australia, China, India, Thailand, France, Denmark, Egypt, Israel, Portugal, the United Arab Emirates, Romania, and Kenya.

Undervalued with high growth potential.

Market Insights

Community Narratives