- Spain

- /

- Construction

- /

- BME:SCYR

Sacyr (BME:SCYR) Valuation in Focus After Higher Sales but Lower Net Income in 2025 Results

Reviewed by Simply Wall St

Sacyr (BME:SCYR) released its earnings for the first nine months of 2025, with both sales and revenue moving up compared to last year. However, net income slipped, giving investors something to weigh regarding recent trends.

See our latest analysis for Sacyr.

Despite mixed earnings, Sacyr’s total shareholder return over the past year stands out at 31.5%. The share price has trended up 17.4% year-to-date, suggesting that investors see ongoing value, even as recent net profits dipped amid revenue growth.

If you’re interested in broadening your investment perspective after Sacyr’s update, consider the opportunity to discover fast growing stocks with high insider ownership.

With Sacyr’s shares climbing even as net income declines, investors are left questioning the current valuation. They are also considering whether the market is already factoring in future growth or if a genuine buying opportunity exists.

Most Popular Narrative: 11% Undervalued

Sacyr's most widely followed narrative suggests its fair value is 11% above the latest closing price of €3.78, implying notable upside. Here is a core excerpt that reveals what analysts believe will drive the company forward.

The significant growth and robust pipeline in recurring, long-duration concession assets, highlighted by contract wins in high-growth regions (e.g., U.S., Chile, Italy) and a record €10.8bn backlog, position Sacyr to benefit from a global surge in infrastructure investment and urbanization. This supports higher future revenue and more predictable, resilient cash flows.

Want to know the secret ingredient in this bullish forecast? One key projection involves a sharp change in profit margins, with expected numbers usually reserved for industry leaders. If you are curious which assumptions about future expansion and operating discipline push the price target up, the full narrative reveals the details behind the anticipated jump in value and how analysts justify a lofty valuation.

Result: Fair Value of €4.24 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, rising interest expenses from Sacyr’s substantial net debt and unpredictable currency movements remain key risks that could challenge the bullish outlook.

Find out about the key risks to this Sacyr narrative.

Another View: Are Shares a Good Deal Right Now?

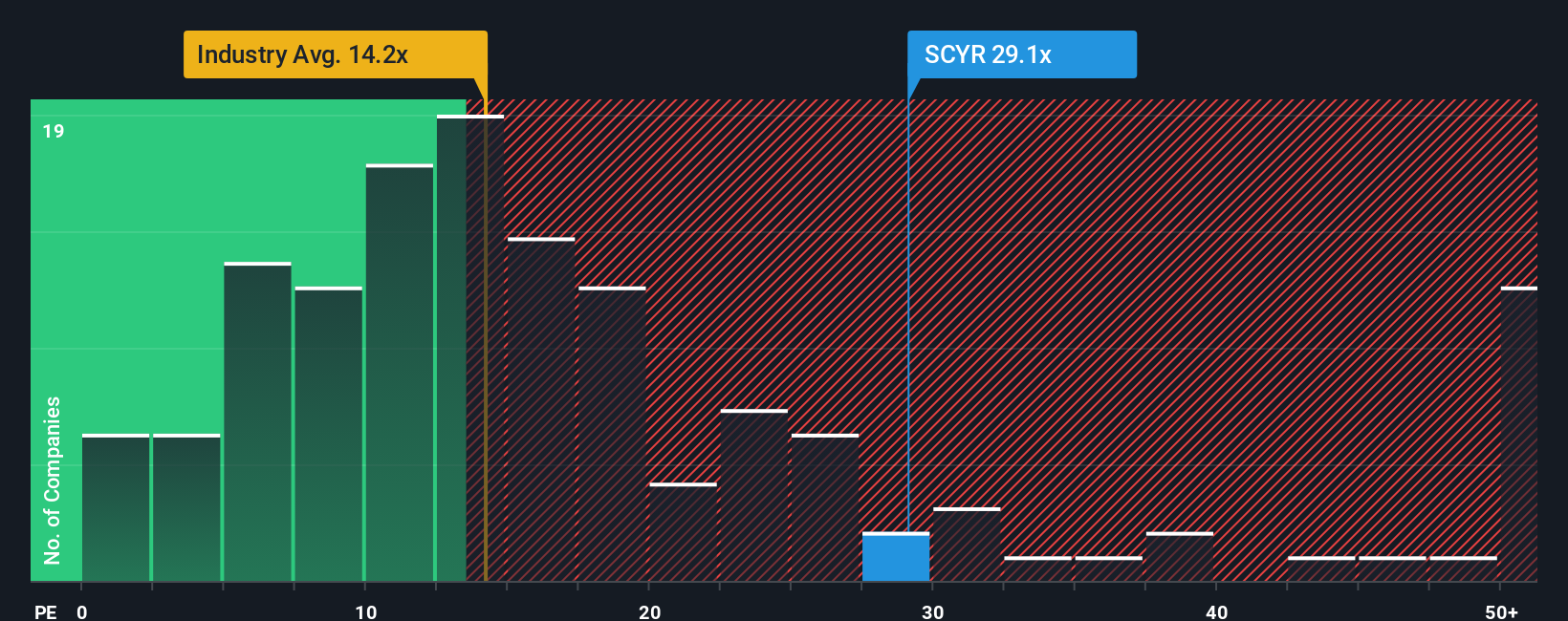

Looking from a different angle, Sacyr’s price-to-earnings ratio stands at 29.4x, which is noticeably higher than the European Construction industry average of 14.2x and the fair ratio of 24.2x based on market expectations. This premium raises questions about the level of optimism built into today’s price. Is value already baked in?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Sacyr Narrative

If you see things differently or have your own investment thesis, you can dig into the numbers and craft a unique story in just a few minutes. Do it your way

A great starting point for your Sacyr research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Smart Investment Ideas?

Don’t let your momentum stop here. Strategic investors are constantly scanning for the next big opportunity, and the right screen can give you an edge.

- Tap into strong income potential by targeting dependable yields with these 15 dividend stocks with yields > 3% that consistently deliver over 3%.

- Identify companies pushing boundaries in artificial intelligence and set your sights on future leaders via these 27 AI penny stocks for forward-thinking innovation.

- Find bargains others might overlook by analyzing these 874 undervalued stocks based on cash flows with cash flows suggesting prices fall below intrinsic value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About BME:SCYR

Sacyr

Engages in the construction and infrastructure concession services businesses worldwide.

Acceptable track record with limited growth.

Similar Companies

Market Insights

Community Narratives