- Spain

- /

- Construction

- /

- BME:SCYR

Sacyr (BME:SCYR): Digging Into Valuation Signals After Recent Investor Attention

Reviewed by Kshitija Bhandaru

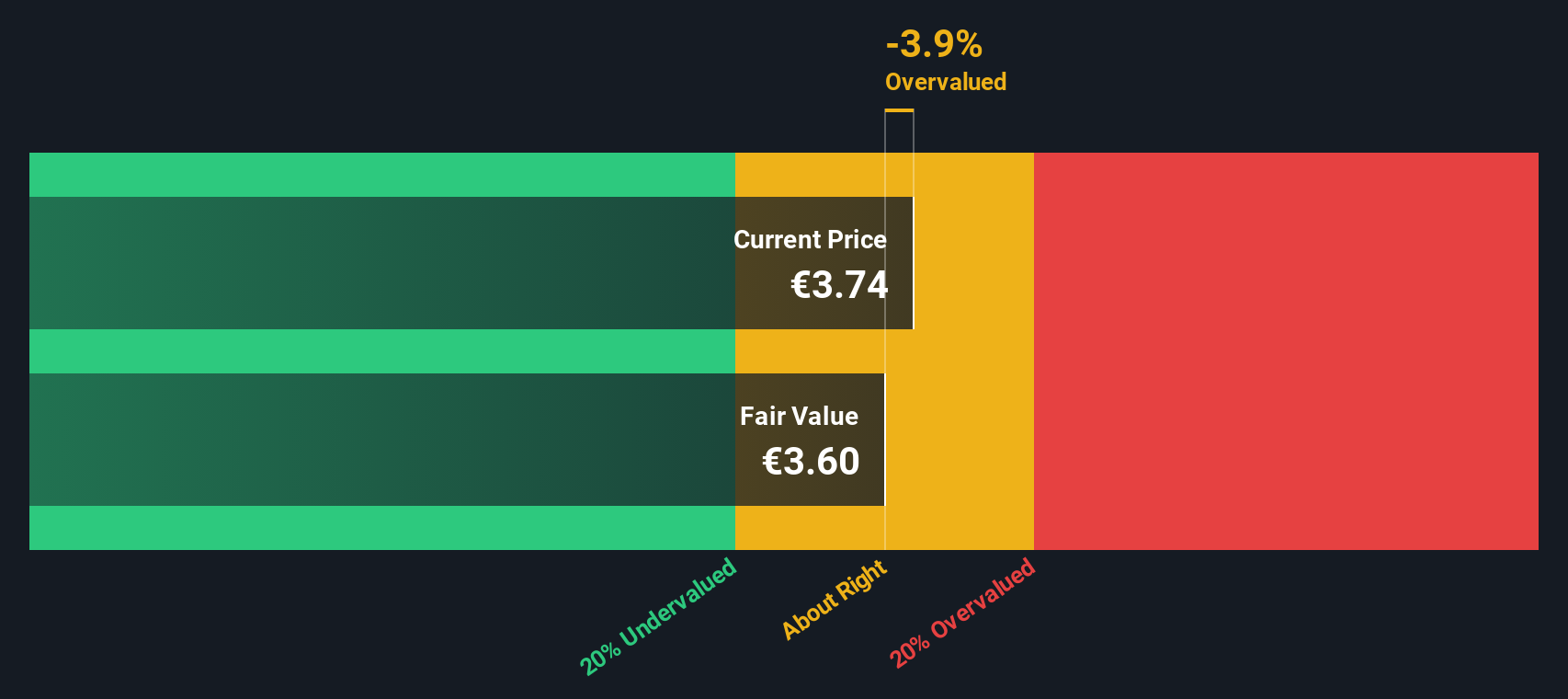

Most Popular Narrative: 4.4% Overvalued

According to Panayiotis, the most popular narrative suggests that Sacyr is trading at a modest premium to its fair value, factoring in projected moderate growth and future profitability. This viewpoint considers Sacyr's strategic push into renewables and digital infrastructure upgrades as potential catalysts for continued expansion, yet maintains a cautious stance on the company's overall valuation.

New Services & Projects: Sacyr’s pipeline includes opportunities in renewables, sustainable infrastructure, and digital upgrades. These initiatives, if successfully executed, could lift revenue beyond mere inflation.

Curious why Sacyr's growth ambitions have not translated into a discount? This narrative combines a surprising blend of steady margin expectations with a forward profit multiple that is rarely seen in the engineering space. What are the assumptions holding up this premium? If you want to uncover exactly how the future financials power this valuation, you will want to read further.

Result: Fair Value of €3.43 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, execution delays or tighter regulations could quickly challenge these growth assumptions. This reminds investors that optimism in infrastructure comes with persistent risks.

Find out about the key risks to this Sacyr narrative.Another View: SWS DCF Model Perspective

While the most popular narrative centers on future growth and profitability, our DCF model points to a very different outcome. This suggests the stock may not be as attractively priced as some believe. Could this deeper dive into cash flows shift the outlook?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Sacyr for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Sacyr Narrative

If you see things differently or want to dig deeper on your own terms, building your own Sacyr narrative is quick and straightforward. Do it your way.

A great starting point for your Sacyr research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Set yourself up for success by acting now and tapping into investment themes that could define tomorrow’s winners. Here are three powerful ways to expand your watchlist and make smarter choices:

- Capture the potential for breakout returns by spotting market underdogs showing strong cash-flow signals through our undervalued stocks based on cash flows.

- Get in early on companies leading medical innovation by using our gateway to next-generation healthcare AI stocks opportunities.

- Boost your passive income stream with a tailored selection of dividend stocks with yields > 3% with yields above 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About BME:SCYR

Sacyr

Engages in the construction and infrastructure concession services businesses worldwide.

Acceptable track record with limited growth.

Similar Companies

Market Insights

Community Narratives