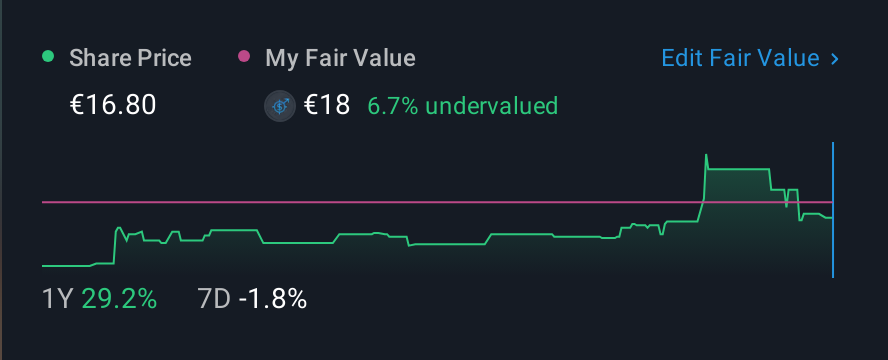

Further Upside For Desarrollos Especiales de Sistemas de Anclaje, S.A. (BME:DESA) Shares Could Introduce Price Risks After 35% Bounce

Desarrollos Especiales de Sistemas de Anclaje, S.A. (BME:DESA) shareholders have had their patience rewarded with a 35% share price jump in the last month. The last 30 days bring the annual gain to a very sharp 65%.

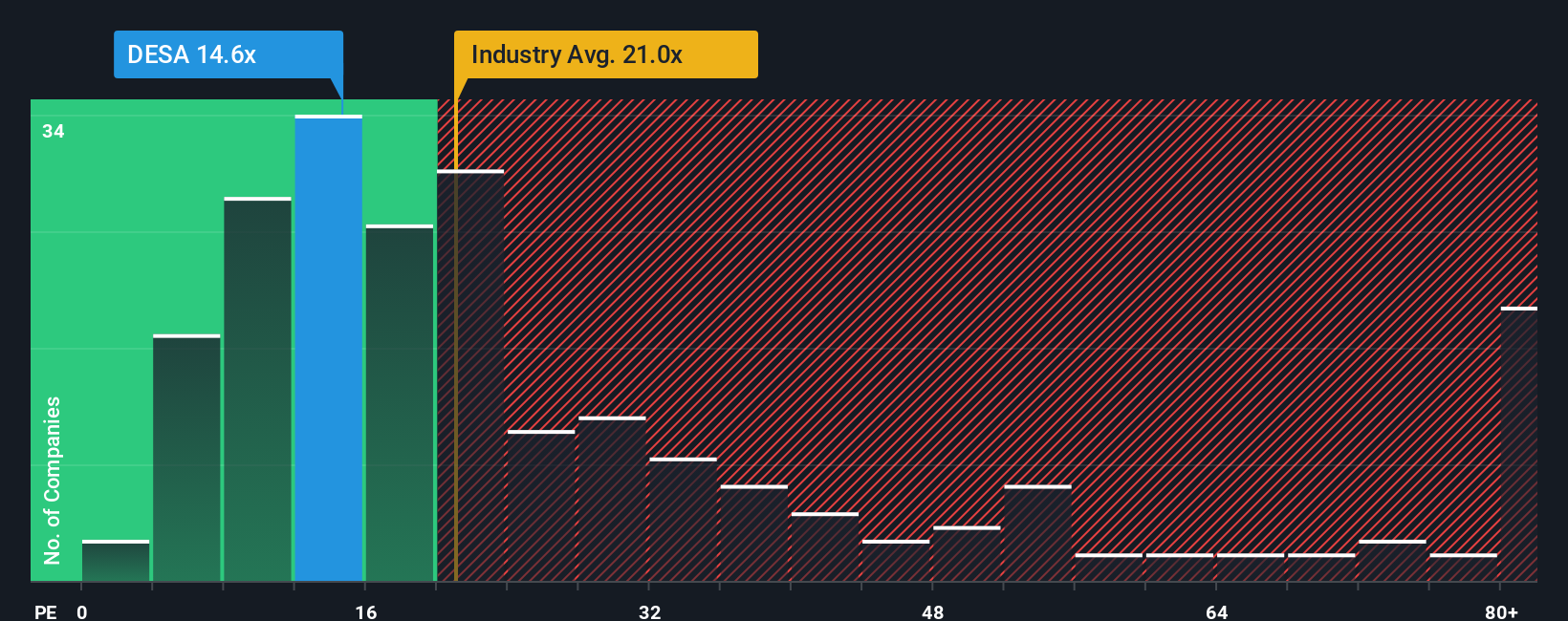

Even after such a large jump in price, Desarrollos Especiales de Sistemas de Anclaje's price-to-earnings (or "P/E") ratio of 14.6x might still make it look like a buy right now compared to the market in Spain, where around half of the companies have P/E ratios above 20x and even P/E's above 30x are quite common. However, the P/E might be low for a reason and it requires further investigation to determine if it's justified.

Recent earnings growth for Desarrollos Especiales de Sistemas de Anclaje has been in line with the market. It might be that many expect the mediocre earnings performance to degrade, which has repressed the P/E. If you like the company, you'd be hoping this isn't the case so that you could pick up some stock while it's out of favour.

View our latest analysis for Desarrollos Especiales de Sistemas de Anclaje

Is There Any Growth For Desarrollos Especiales de Sistemas de Anclaje?

The only time you'd be truly comfortable seeing a P/E as low as Desarrollos Especiales de Sistemas de Anclaje's is when the company's growth is on track to lag the market.

If we review the last year of earnings growth, the company posted a worthy increase of 12%. Ultimately though, it couldn't turn around the poor performance of the prior period, with EPS shrinking 26% in total over the last three years. Accordingly, shareholders would have felt downbeat about the medium-term rates of earnings growth.

Looking ahead now, EPS is anticipated to climb by 11% per annum during the coming three years according to the dual analysts following the company. Meanwhile, the rest of the market is forecast to expand by 9.3% per year, which is not materially different.

With this information, we find it odd that Desarrollos Especiales de Sistemas de Anclaje is trading at a P/E lower than the market. Apparently some shareholders are doubtful of the forecasts and have been accepting lower selling prices.

The Key Takeaway

Despite Desarrollos Especiales de Sistemas de Anclaje's shares building up a head of steam, its P/E still lags most other companies. While the price-to-earnings ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of earnings expectations.

We've established that Desarrollos Especiales de Sistemas de Anclaje currently trades on a lower than expected P/E since its forecast growth is in line with the wider market. There could be some unobserved threats to earnings preventing the P/E ratio from matching the outlook. It appears some are indeed anticipating earnings instability, because these conditions should normally provide more support to the share price.

Before you take the next step, you should know about the 3 warning signs for Desarrollos Especiales de Sistemas de Anclaje that we have uncovered.

Of course, you might also be able to find a better stock than Desarrollos Especiales de Sistemas de Anclaje. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About BME:DESA

Desarrollos Especiales de Sistemas de Anclaje

Desarrollos Especiales de Sistemas de Anclaje, S.A.

Flawless balance sheet and good value.

Market Insights

Community Narratives

Recently Updated Narratives

TAV Havalimanlari Holding will fly high with 25.68% revenue growth

Fiducian: Compliance Clouds or Value Opportunity?

Q3 Outlook modestly optimistic

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success