Did You Manage To Avoid CaixaBank's (BME:CABK) 50% Share Price Drop?

CaixaBank, S.A. (BME:CABK) shareholders should be happy to see the share price up 14% in the last month. But that doesn't change the fact that the returns over the last five years have been less than pleasing. After all, the share price is down 50% in that time, significantly under-performing the market.

See our latest analysis for CaixaBank

There is no denying that markets are sometimes efficient, but prices do not always reflect underlying business performance. By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

While the share price declined over five years, CaixaBank actually managed to increase EPS by an average of 31% per year. Given the share price reaction, one might suspect that EPS is not a good guide to the business performance during the period (perhaps due to a one-off loss or gain). Or possibly, the market was previously very optimistic, so the stock has disappointed, despite improving EPS.

Due to the lack of correlation between the EPS growth and the falling share price, it's worth taking a look at other metrics to try to understand the share price movement.

We note that the dividend has fallen in the last five years, so that may have contributed to the share price decline.

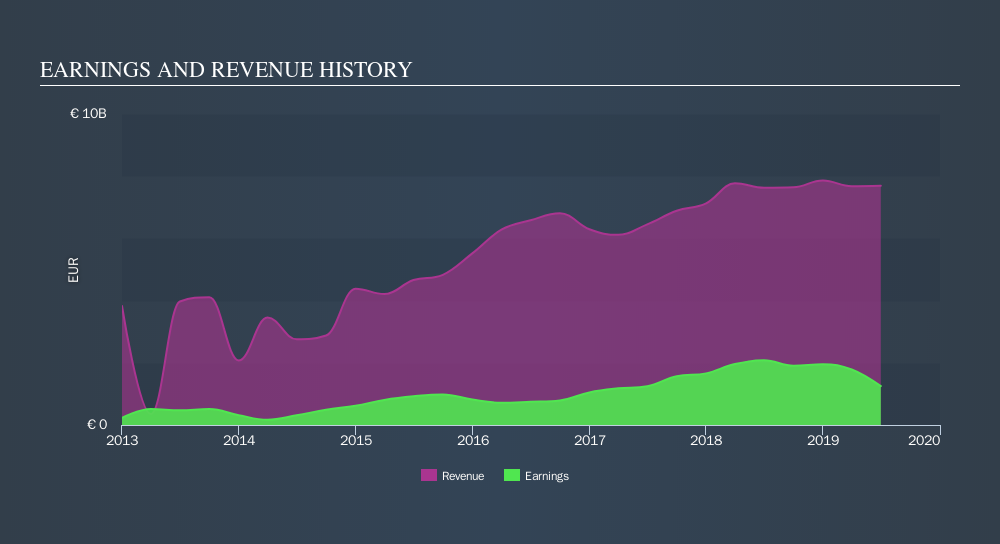

You can see below how earnings and revenue have changed over time.

It's good to see that there was some significant insider buying in the last three months. That's a positive. That said, we think earnings and revenue growth trends are even more important factors to consider. If you are thinking of buying or selling CaixaBank stock, you should check out this free report showing analyst profit forecasts.

What About Dividends?

When looking at investment returns, it is important to consider the difference between total shareholder return (TSR) and share price return. The TSR incorporates the value of any spin-offs or discounted capital raisings, along with any dividends, based on the assumption that the dividends are reinvested. Arguably, the TSR gives a more comprehensive picture of the return generated by a stock. We note that for CaixaBank the TSR over the last 5 years was -40%, which is better than the share price return mentioned above. This is largely a result of its dividend payments!

A Different Perspective

We regret to report that CaixaBank shareholders are down 39% for the year (even including dividends) . Unfortunately, that's worse than the broader market decline of 0.5%. Having said that, it's inevitable that some stocks will be oversold in a falling market. The key is to keep your eyes on the fundamental developments. Unfortunately, last year's performance may indicate unresolved challenges, given that it was worse than the annualised loss of 9.6% over the last half decade. We realise that Buffett has said investors should 'buy when there is blood on the streets', but we caution that investors should first be sure they are buying a high quality businesses. If you want to research this stock further, the data on insider buying is an obvious place to start. You can click here to see who has been buying shares - and the price they paid.

CaixaBank is not the only stock insiders are buying. So take a peek at this free list of growing companies with insider buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on ES exchanges.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About BME:CABK

CaixaBank

Provides various banking products and financial services in Spain and internationally.

Established dividend payer with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives