- Spain

- /

- Auto Components

- /

- BME:LGT

Don't Buy Lingotes Especiales, S.A. (BME:LGT) For Its Next Dividend Without Doing These Checks

Lingotes Especiales, S.A. (BME:LGT) is about to trade ex-dividend in the next three days. You will need to purchase shares before the 17th of March to receive the dividend, which will be paid on the 19th of March.

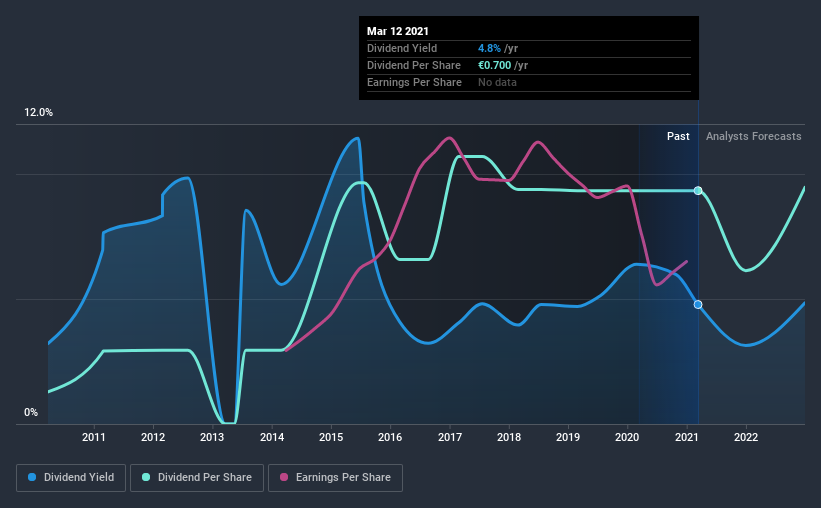

Lingotes Especiales's next dividend payment will be €0.57 per share, on the back of last year when the company paid a total of €0.70 to shareholders. Calculating the last year's worth of payments shows that Lingotes Especiales has a trailing yield of 4.8% on the current share price of €14.65. If you buy this business for its dividend, you should have an idea of whether Lingotes Especiales's dividend is reliable and sustainable. So we need to check whether the dividend payments are covered, and if earnings are growing.

Check out our latest analysis for Lingotes Especiales

Dividends are typically paid from company earnings. If a company pays more in dividends than it earned in profit, then the dividend could be unsustainable. Lingotes Especiales distributed an unsustainably high 118% of its profit as dividends to shareholders last year. Without extenuating circumstances, we'd consider the dividend at risk of a cut.

Click here to see how much of its profit Lingotes Especiales paid out over the last 12 months.

Have Earnings And Dividends Been Growing?

Businesses with shrinking earnings are tricky from a dividend perspective. Investors love dividends, so if earnings fall and the dividend is reduced, expect a stock to be sold off heavily at the same time. So we're not too excited that Lingotes Especiales's earnings are down 2.4% a year over the past five years.

Another key way to measure a company's dividend prospects is by measuring its historical rate of dividend growth. In the last 10 years, Lingotes Especiales has lifted its dividend by approximately 22% a year on average. The only way to pay higher dividends when earnings are shrinking is either to pay out a larger percentage of profits, spend cash from the balance sheet, or borrow the money. Lingotes Especiales is already paying out a high percentage of its income, so without earnings growth, we're doubtful of whether this dividend will grow much in the future.

Final Takeaway

Is Lingotes Especiales an attractive dividend stock, or better left on the shelf? Earnings per share are in decline and Lingotes Especiales is paying out what we feel is an uncomfortably high percentage of its profit as dividends. Generally we think dividend investors should avoid businesses in this situation, as high payout ratios and declining earnings can lead to the dividend being cut. Lingotes Especiales doesn't appear to have a lot going for it, and we're not inclined to take a risk on owning it for the dividend.

With that in mind though, if the poor dividend characteristics of Lingotes Especiales don't faze you, it's worth being mindful of the risks involved with this business. Case in point: We've spotted 3 warning signs for Lingotes Especiales you should be aware of.

We wouldn't recommend just buying the first dividend stock you see, though. Here's a list of interesting dividend stocks with a greater than 2% yield and an upcoming dividend.

If you’re looking to trade Lingotes Especiales, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About BME:LGT

Lingotes Especiales

Together with its subsidiary, Frenos y Conjuntos, engages in the design, development, casting, machining, and assembly of grey and spheroidal iron parts in Spain, rest of Europe, Africa, and internationally.

Reasonable growth potential with slight risk.

Market Insights

Community Narratives