As global markets navigate through fluctuating trade tensions and technological disruptions, small-cap stocks have shown remarkable resilience, with indices like the Russell 2000 indicating a notable uptick in investor interest. This shifting landscape presents an opportune moment to explore potential undiscovered gems on the exchange. In such a dynamic environment, identifying good stocks often involves looking for companies with robust fundamentals that may be undervalued or overlooked by the broader market, especially those that could benefit from current economic conditions or sectoral shifts.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Sure Global Tech | NA | 15.65% | 24.53% | ★★★★★★ |

| Impellam Group | 31.12% | -5.43% | -6.86% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Al Sagr Cooperative Insurance | NA | 10.32% | 28.04% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| Amana Cooperative Insurance | NA | 2.55% | 12.80% | ★★★★★★ |

| Saudi Azm for Communication and Information Technology | 8.57% | 6.93% | 21.97% | ★★★★★☆ |

| Societe de Limonaderies et de Boissons Rafraichissantes d'Afrique | 39.37% | 8.04% | -3.72% | ★★★★★☆ |

| Wilson | 64.79% | 30.09% | 68.29% | ★★★★☆☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

We'll examine a selection from our screener results.

e-finance for Digital and Financial InvestmentsE (CASE:EFIH)

Simply Wall St Value Rating: ★★★★★☆

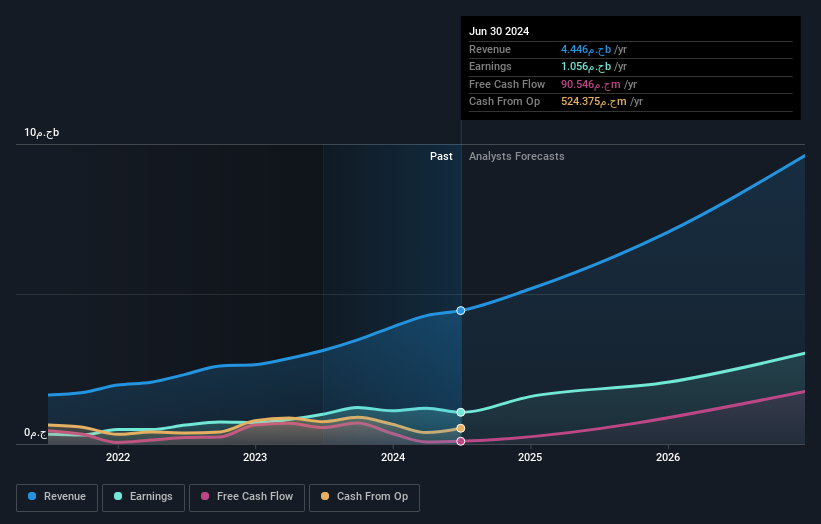

Overview: e-finance for Digital and Financial Investments S.A.E. is an Egyptian company specializing in digital infrastructure and payment solutions, with a market capitalization of EGP 57.45 billion.

Operations: Digital and Financial InvestmentsE generates revenue through diverse segments including cloud services, card operations, technical support, and network maintenance. The company has seen a notable increase in gross profit margins from 42.25% in 2018 to approximately 54.97% by mid-2024, reflecting efficient cost management and potentially higher-margin service offerings. Key revenue drivers include Services and Operation of Cards and Cloud Service, contributing significantly to the total income stream as evidenced by recent figures showing combined revenues exceeding E£3 billion.

E-finance for Digital and Financial Investments S.A.E. showcases robust growth, with a 41.3% earnings increase over the past year, outpacing its industry. Notably, the company's debt to equity ratio rose slightly to 3.1%, yet it maintains a healthy financial stance with more cash than total debt and strong non-cash earnings indicating high-quality past earnings. Recent events include a stock split announced for July 14, 2024, following impressive first-quarter results: sales surged to EGP 1.15 billion from EGP 768 million year-over-year, while net income climbed to EGP 463 million from EGP 282 million.

Servet Gayrimenkul Yatirim Ortakligi (IBSE:SRVGY)

Simply Wall St Value Rating: ★★★★☆☆

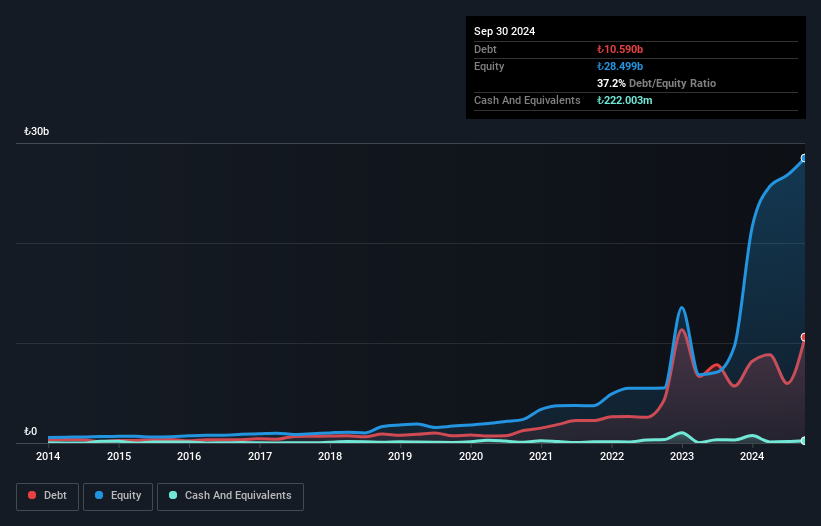

Overview: Servet Gayrimenkul Yatirim Ortakligi A.S. is a real estate investment company in Turkey with a market capitalization of TRY 19.45 billion.

Operations: The company generates revenue primarily through its core operations which involve significant gross profits and non-operating income, leading to substantial net income figures. Over the years, it has consistently reported a positive net income margin, with recent figures reflecting margins exceeding 2%, highlighting efficient management and robust financial strategies.

Servet Gayrimenkul Yatirim Ortakligi, a lesser-known entity in the REIT sector, shows intriguing financial dynamics despite a 5.6% dip in earnings last year. With debt significantly reduced from 53.8% to 3.4%, and interest payments comfortably covered 14 times by EBIT, its fiscal prudence is evident. The firm's price-to-earnings ratio stands at an appealing four times the market average of 16.8x, underlining potential value for discerning investors looking beyond mainstream picks.

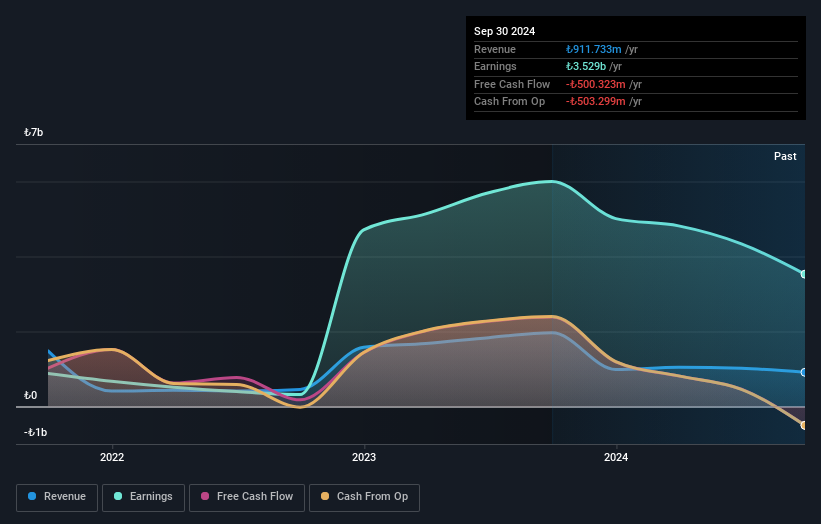

Vestel Beyaz Esya Sanayi ve Ticaret (IBSE:VESBE)

Simply Wall St Value Rating: ★★★★★★

Overview: Vestel Beyaz Esya Sanayi ve Ticaret A.S. is a Turkish company specializing in the manufacture and sale of white goods, primarily serving markets in Turkey and Europe, with a market capitalization of TRY 37.15 billion.

Operations: The company generates its revenue primarily from the production of white goods, with a recent reported revenue of ₺58.13 billion. It operates with a gross profit margin of 18.05%, reflecting the cost efficiency in its manufacturing processes despite substantial operating and non-operating expenses.

Vestel Beyaz Esya Sanayi ve Ticaret, trading at a compelling price-to-earnings ratio of 8.8, well below Turkey's market average of 16.8, emerges as an intriguing investment prospect. The company has demonstrated robust earnings growth, with a remarkable increase of 461.4% over the past year, significantly outpacing the Consumer Durables industry's decline of 14.7%. Additionally, its debt to equity ratio improved from 46% to 34.4%, reflecting prudent financial management and enhancing its appeal among value seekers in lesser-known markets.

- Dive into the specifics of Vestel Beyaz Esya Sanayi ve Ticaret here with our thorough health report.

Next Steps

- Explore the 4803 names from our Undiscovered Gems With Strong Fundamentals screener here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About IBSE:SRVGY

Servet Gayrimenkul Yatirim Ortakligi

Servet Gayrimenkul Yatirim Ortakligi A.S.

Mediocre balance sheet with questionable track record.