AS Infortar (TAL:INF1T) has announced that it will pay a dividend of €1.50 per share on the 15th of December. The dividend yield will be 6.2% based on this payment which is still above the industry average.

AS Infortar's Future Dividend Projections Appear Well Covered By Earnings

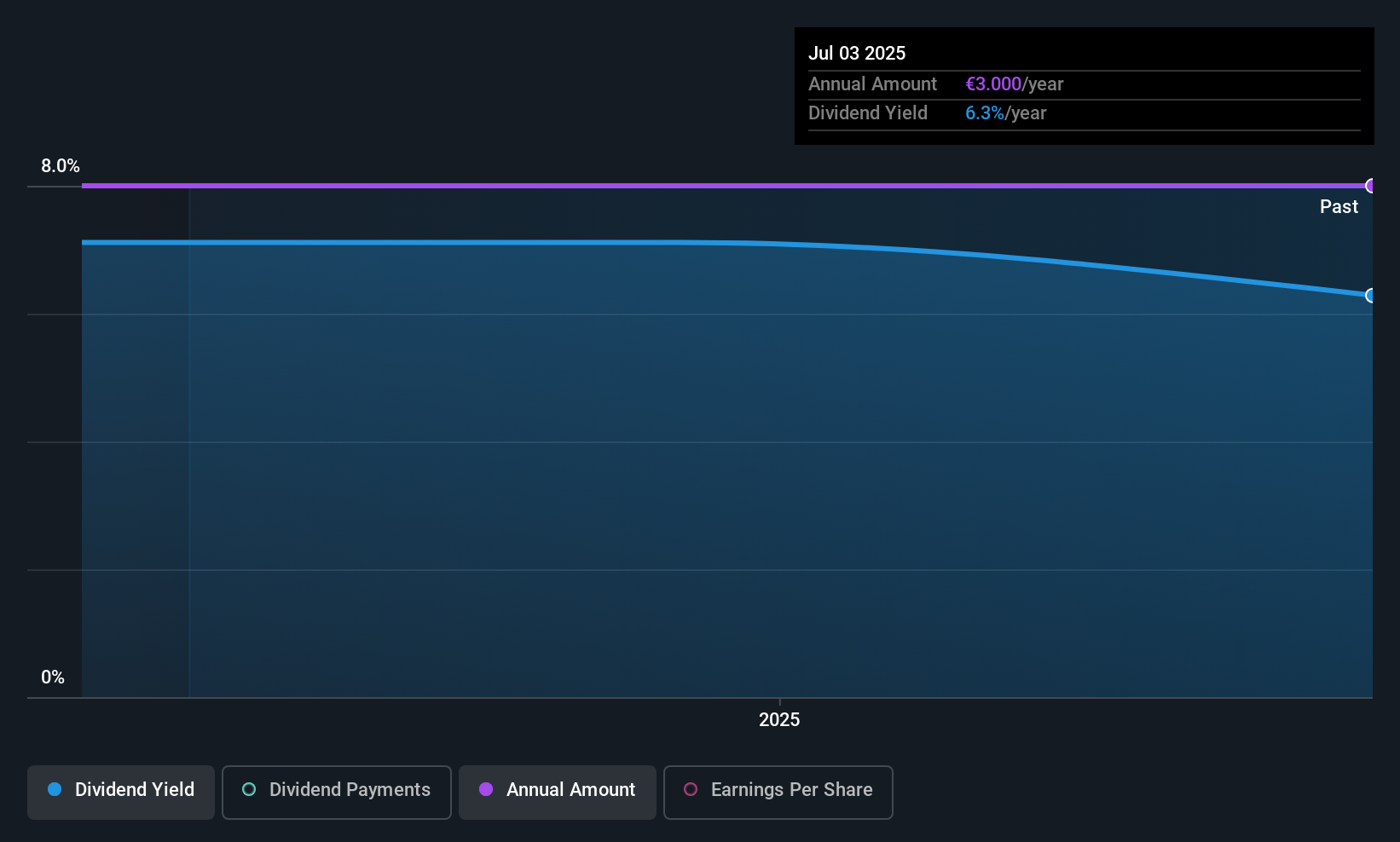

If the payments aren't sustainable, a high yield for a few years won't matter that much. The last payment was quite easily covered by earnings, but it made up 530% of cash flows. This signals that the company is more focused on returning cash flow to shareholders, but it could mean that the dividend is exposed to cuts in the future.

Looking forward, could fall by 44.2% if the company can't turn things around from the last few years. If recent patterns in the dividend continue, we could see the payout ratio reaching 88% in the next 12 months which is on the higher end of the range we would say is sustainable.

View our latest analysis for AS Infortar

AS Infortar Is Still Building Its Track Record

It is tough to make a judgement on how stable a dividend is when the company hasn't been paying one for very long. This doesn't mean that the company can't pay a good dividend, but just that we want to wait until it can prove itself.

Dividend Growth Potential Is Shaky

Investors could be attracted to the stock based on the quality of its payment history. However, things aren't all that rosy. Over the past five years, it looks as though AS Infortar's EPS has declined at around 44% a year. A sharp decline in earnings per share is not great from from a dividend perspective. Even conservative payout ratios can come under pressure if earnings fall far enough.

The Dividend Could Prove To Be Unreliable

Overall, we don't think this company makes a great dividend stock, even though the dividend wasn't cut this year. While the low payout ratio is a redeeming feature, this is offset by the minimal cash to cover the payments. We don't think AS Infortar is a great stock to add to your portfolio if income is your focus.

Investors generally tend to favour companies with a consistent, stable dividend policy as opposed to those operating an irregular one. At the same time, there are other factors our readers should be conscious of before pouring capital into a stock. Case in point: We've spotted 4 warning signs for AS Infortar (of which 1 is concerning!) you should know about. Is AS Infortar not quite the opportunity you were looking for? Why not check out our selection of top dividend stocks.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TLSE:INF1T

AS Infortar

Together with its subsidiaries operates in the maritime transportation, energy, and real estate sectors in Estonia, Finland, Lithuania, Latvia, rest of European Union, and internationally.

Slight risk and slightly overvalued.

Market Insights

Community Narratives

Recently Updated Narratives

Astor Enerji will surge with a fair value of $140.43 in the next 3 years

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

CEO: We are winners in the long term in the AI world

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.