- Estonia

- /

- Infrastructure

- /

- TLSE:TSM1T

How Much Did AS Tallinna Sadam's(TAL:TSM1T) Shareholders Earn From Share Price Movements Over The Last Year?

Passive investing in an index fund is a good way to ensure your own returns roughly match the overall market. While individual stocks can be big winners, plenty more fail to generate satisfactory returns. Investors in AS Tallinna Sadam (TAL:TSM1T) have tasted that bitter downside in the last year, as the share price dropped 14%. That's well below the market return of 5.4%. We wouldn't rush to judgement on AS Tallinna Sadam because we don't have a long term history to look at.

Check out our latest analysis for AS Tallinna Sadam

To paraphrase Benjamin Graham: Over the short term the market is a voting machine, but over the long term it's a weighing machine. One flawed but reasonable way to assess how sentiment around a company has changed is to compare the earnings per share (EPS) with the share price.

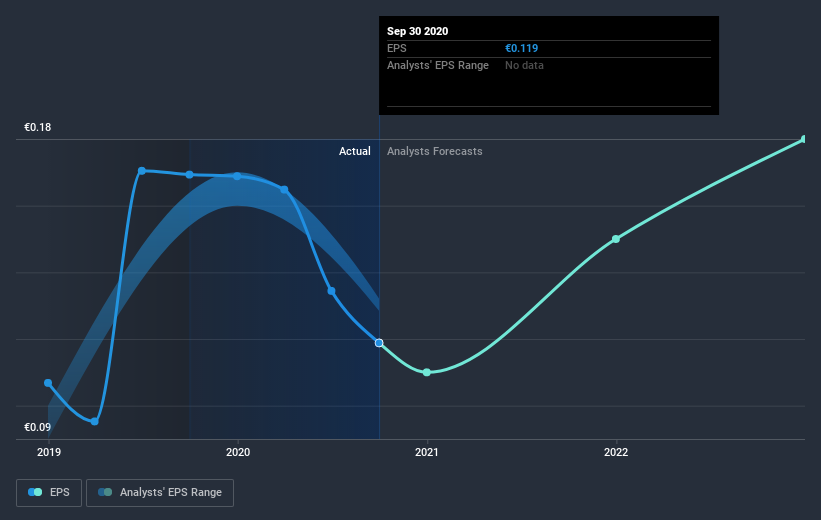

Unfortunately AS Tallinna Sadam reported an EPS drop of 30% for the last year. The share price fall of 14% isn't as bad as the reduction in earnings per share. It may have been that the weak EPS was not as bad as some had feared.

You can see how EPS has changed over time in the image below (click on the chart to see the exact values).

It's probably worth noting that the CEO is paid less than the median at similar sized companies. It's always worth keeping an eye on CEO pay, but a more important question is whether the company will grow earnings throughout the years. Dive deeper into the earnings by checking this interactive graph of AS Tallinna Sadam's earnings, revenue and cash flow.

What About Dividends?

When looking at investment returns, it is important to consider the difference between total shareholder return (TSR) and share price return. The TSR is a return calculation that accounts for the value of cash dividends (assuming that any dividend received was reinvested) and the calculated value of any discounted capital raisings and spin-offs. Arguably, the TSR gives a more comprehensive picture of the return generated by a stock. As it happens, AS Tallinna Sadam's TSR for the last year was -8.7%, which exceeds the share price return mentioned earlier. The dividends paid by the company have thusly boosted the total shareholder return.

A Different Perspective

While AS Tallinna Sadam shareholders are down 8.7% for the year (even including dividends), the market itself is up 5.4%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. It's great to see a nice little 7.6% rebound in the last three months. This could just be a bounce because the selling was too aggressive, but fingers crossed it's the start of a new trend. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. To that end, you should be aware of the 2 warning signs we've spotted with AS Tallinna Sadam .

We will like AS Tallinna Sadam better if we see some big insider buys. While we wait, check out this free list of growing companies with considerable, recent, insider buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on EE exchanges.

If you’re looking to trade AS Tallinna Sadam, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About TLSE:TSM1T

AS Tallinna Sadam

Provides port services in the Republic of Estonia, Canada, and Great Britain.

Good value with proven track record.

Market Insights

Community Narratives