These 4 Measures Indicate That AS Ekspress Grupp (TAL:EEG1T) Is Using Debt Reasonably Well

Legendary fund manager Li Lu (who Charlie Munger backed) once said, 'The biggest investment risk is not the volatility of prices, but whether you will suffer a permanent loss of capital.' So it might be obvious that you need to consider debt, when you think about how risky any given stock is, because too much debt can sink a company. Importantly, AS Ekspress Grupp (TAL:EEG1T) does carry debt. But should shareholders be worried about its use of debt?

Why Does Debt Bring Risk?

Debt and other liabilities become risky for a business when it cannot easily fulfill those obligations, either with free cash flow or by raising capital at an attractive price. In the worst case scenario, a company can go bankrupt if it cannot pay its creditors. While that is not too common, we often do see indebted companies permanently diluting shareholders because lenders force them to raise capital at a distressed price. Having said that, the most common situation is where a company manages its debt reasonably well - and to its own advantage. When we examine debt levels, we first consider both cash and debt levels, together.

View our latest analysis for AS Ekspress Grupp

How Much Debt Does AS Ekspress Grupp Carry?

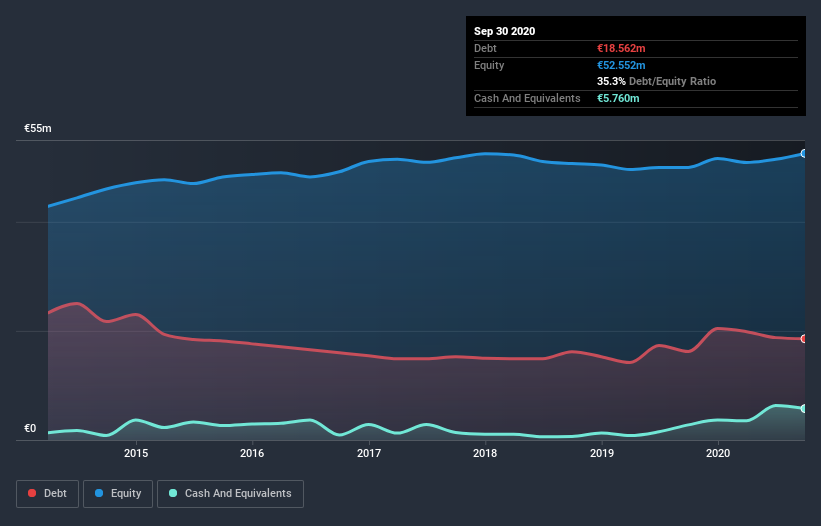

The image below, which you can click on for greater detail, shows that at September 2020 AS Ekspress Grupp had debt of €18.6m, up from €16.2m in one year. On the flip side, it has €5.76m in cash leading to net debt of about €12.8m.

How Strong Is AS Ekspress Grupp's Balance Sheet?

According to the last reported balance sheet, AS Ekspress Grupp had liabilities of €21.1m due within 12 months, and liabilities of €21.9m due beyond 12 months. On the other hand, it had cash of €5.76m and €10.9m worth of receivables due within a year. So it has liabilities totalling €26.3m more than its cash and near-term receivables, combined.

When you consider that this deficiency exceeds the company's €24.5m market capitalization, you might well be inclined to review the balance sheet intently. In the scenario where the company had to clean up its balance sheet quickly, it seems likely shareholders would suffer extensive dilution.

We measure a company's debt load relative to its earnings power by looking at its net debt divided by its earnings before interest, tax, depreciation, and amortization (EBITDA) and by calculating how easily its earnings before interest and tax (EBIT) cover its interest expense (interest cover). The advantage of this approach is that we take into account both the absolute quantum of debt (with net debt to EBITDA) and the actual interest expenses associated with that debt (with its interest cover ratio).

AS Ekspress Grupp has net debt worth 2.0 times EBITDA, which isn't too much, but its interest cover looks a bit on the low side, with EBIT at only 4.3 times the interest expense. While these numbers do not alarm us, it's worth noting that the cost of the company's debt is having a real impact. Notably, AS Ekspress Grupp's EBIT launched higher than Elon Musk, gaining a whopping 226% on last year. There's no doubt that we learn most about debt from the balance sheet. But it is future earnings, more than anything, that will determine AS Ekspress Grupp's ability to maintain a healthy balance sheet going forward. So if you want to see what the professionals think, you might find this free report on analyst profit forecasts to be interesting.

Finally, while the tax-man may adore accounting profits, lenders only accept cold hard cash. So it's worth checking how much of that EBIT is backed by free cash flow. Happily for any shareholders, AS Ekspress Grupp actually produced more free cash flow than EBIT over the last three years. That sort of strong cash conversion gets us as excited as the crowd when the beat drops at a Daft Punk concert.

Our View

AS Ekspress Grupp's conversion of EBIT to free cash flow was a real positive on this analysis, as was its EBIT growth rate. On the other hand, its level of total liabilities makes us a little less comfortable about its debt. Considering this range of data points, we think AS Ekspress Grupp is in a good position to manage its debt levels. But a word of caution: we think debt levels are high enough to justify ongoing monitoring. There's no doubt that we learn most about debt from the balance sheet. But ultimately, every company can contain risks that exist outside of the balance sheet. To that end, you should learn about the 3 warning signs we've spotted with AS Ekspress Grupp (including 1 which is concerning) .

If, after all that, you're more interested in a fast growing company with a rock-solid balance sheet, then check out our list of net cash growth stocks without delay.

If you’re looking to trade AS Ekspress Grupp, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About TLSE:EEG1T

AS Ekspress Grupp

Provides digital content and advertising solutions in the Estonia, Lithuania, Latvia, Rest of Europe, and internationally.

Solid track record, good value and pays a dividend.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

PRME remains a long shot but publication in the New England Journal of Medicine helps.

This one is all about the tax benefits

Estimated Share Price is $79.54 using the Buffett Value Calculation

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026