If You Had Bought Coop Pank (TAL:CPA1T) Shares A Year Ago You'd Have Earned 11% Returns

If you want to compound wealth in the stock market, you can do so by buying an index fund. But one can do better than that by picking better than average stocks (as part of a diversified portfolio). For example, the Coop Pank AS (TAL:CPA1T) share price is up 11% in the last year, clearly besting the market return of around 2.4% (not including dividends). If it can keep that out-performance up over the long term, investors will do very well! We'll need to follow Coop Pank for a while to get a better sense of its share price trend, since it hasn't been listed for particularly long.

Check out our latest analysis for Coop Pank

In his essay The Superinvestors of Graham-and-Doddsville Warren Buffett described how share prices do not always rationally reflect the value of a business. By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

Over the last twelve months, Coop Pank actually shrank its EPS by 24%.

Given the share price gain, we doubt the market is measuring progress with EPS. Therefore, it seems likely that investors are putting more weight on metrics other than EPS, at the moment.

However the year on year revenue growth of 20% would help. Many businesses do go through a phase where they have to forgo some profits to drive business development, and sometimes its for the best.

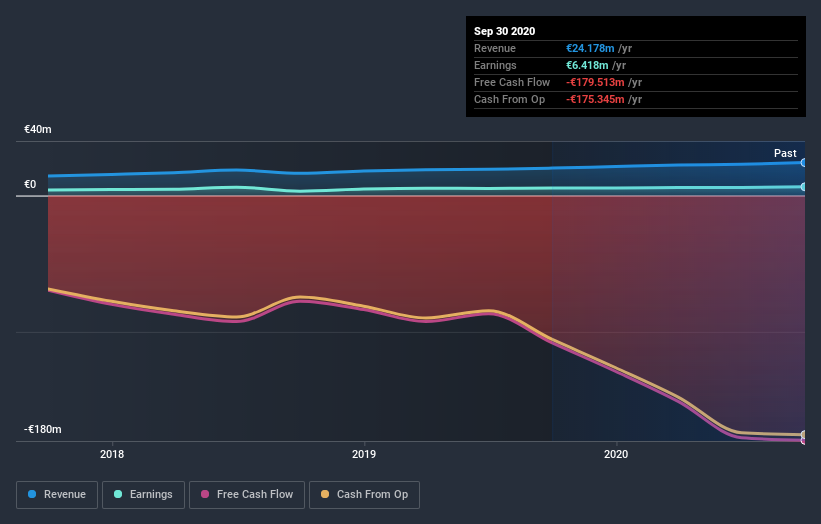

The company's revenue and earnings (over time) are depicted in the image below (click to see the exact numbers).

It's probably worth noting that the CEO is paid less than the median at similar sized companies. But while CEO remuneration is always worth checking, the really important question is whether the company can grow earnings going forward. Dive deeper into the earnings by checking this interactive graph of Coop Pank's earnings, revenue and cash flow.

A Different Perspective

Coop Pank shareholders should be happy with the total gain of 11% over the last twelve months. And the share price momentum remains respectable, with a gain of 16% in the last three months. This suggests the company is continuing to win over new investors. Before deciding if you like the current share price, check how Coop Pank scores on these 3 valuation metrics.

If you are like me, then you will not want to miss this free list of growing companies that insiders are buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on EE exchanges.

If you decide to trade Coop Pank, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About TLSE:CPA1T

Coop Pank

Provides banking and financing solutions to private and corporate clients in Estonia.

Adequate balance sheet and fair value.

Market Insights

Community Narratives