- Denmark

- /

- Renewable Energy

- /

- CPSE:ORSTED

Is This the Right Moment to Reconsider Ørsted After Its 51.5% Share Price Drop?

Reviewed by Bailey Pemberton

- Curious if Ørsted stock is a bargain or a value trap? You are not alone, as the company's shifting fortunes have caught the attention of many investors recently.

- After a difficult year, Ørsted's share price has dropped by 51.5% over the last 12 months and a striking 66.4% year-to-date. This signals significant changes in market sentiment.

- This dramatic fall follows high-profile news in the renewable energy sector, including project delays, rising costs, and uncertainty around government support. These developments have amplified concerns about Ørsted's future growth, but they also might be creating opportunities for value-focused investors.

- On our 6-point value check, Ørsted scores a 3, meaning it is undervalued in half the areas we assess. Here is a breakdown of the traditional ways analysts value Ørsted, and why there may be an even smarter approach waiting for you at the end of this article.

Find out why Ørsted's -51.5% return over the last year is lagging behind its peers.

Approach 1: Ørsted Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates a company’s intrinsic value by projecting its future cash flows and then discounting them back to today’s value. For Ørsted, this approach provides a clearer picture of potential worth based on actual and anticipated cash generation over time, all reported in Danish kroner (DKK).

Currently, Ørsted’s last twelve months of free cash flow was negative, at approximately DKK -22.2 billion. Analyst projections indicate a challenging couple of years ahead, with free cash flow expected to remain negative in 2026 (DKK -32.1 billion) and 2027 (DKK -19.6 billion). By 2028, forecasts turn positive, projecting DKK 41.7 billion, and estimates for 2029 suggest free cash flow of DKK 28.7 billion. Further out, Simply Wall St extrapolations anticipate more moderate but positive growth over the following years.

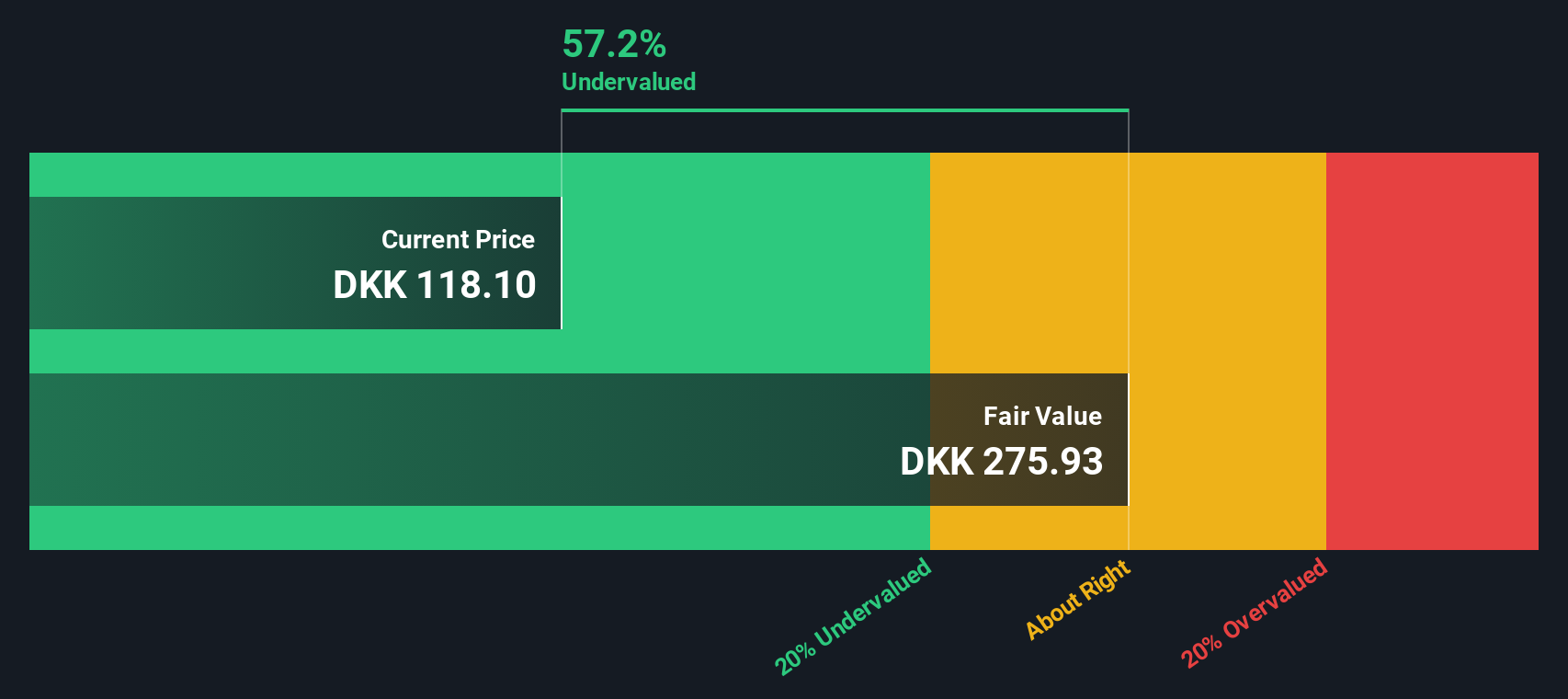

Using the 2 Stage Free Cash Flow to Equity model with these assumptions, the DCF valuation estimates Ørsted’s intrinsic value at DKK 180.1 per share. This implies the stock is about 37.2% undervalued relative to its current market price.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Ørsted is undervalued by 37.2%. Track this in your watchlist or portfolio, or discover 840 more undervalued stocks based on cash flows.

Approach 2: Ørsted Price vs Earnings

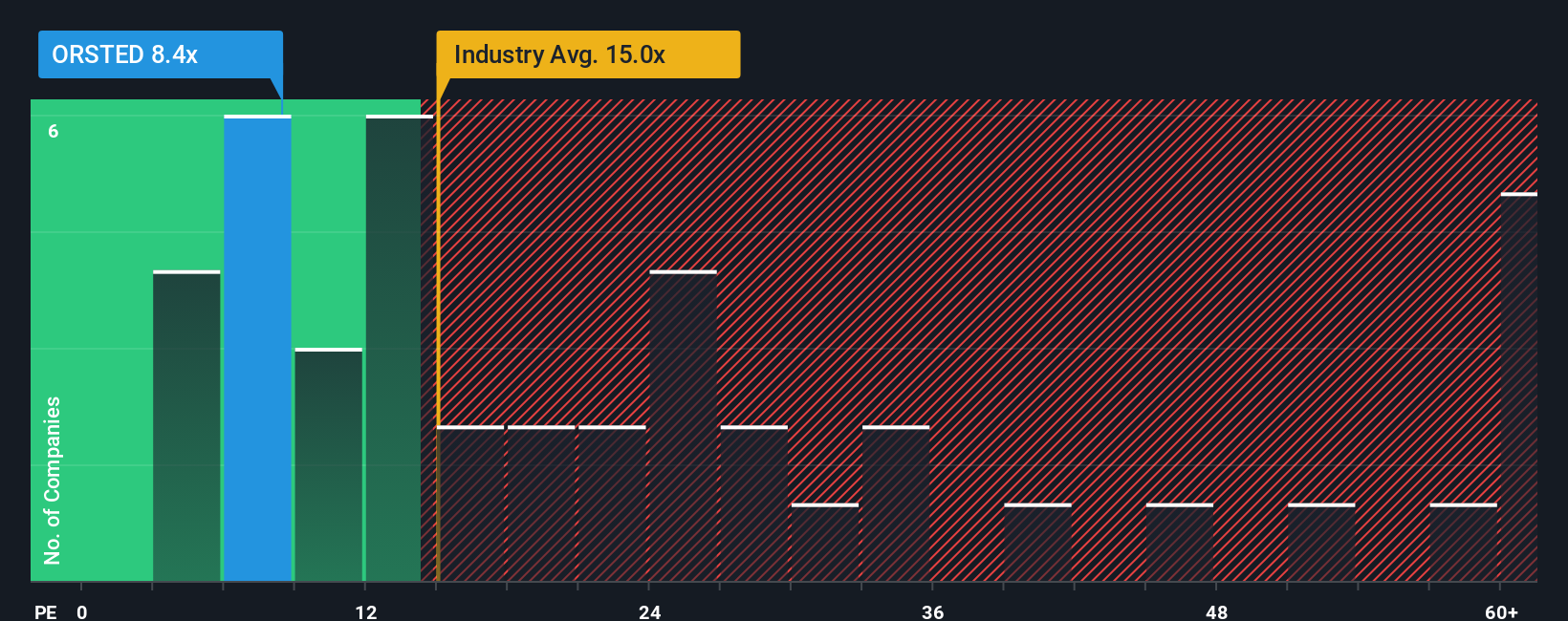

The price-to-earnings (PE) ratio is a widely used metric for valuing profitable companies because it offers a straightforward way to compare a company's market price to its actual earnings. For investors, this ratio indicates how much the market is willing to pay for each unit of earnings, helping to set a baseline for valuation expectations.

Generally, higher growth expectations or lower perceived risk will warrant a higher PE ratio. Companies facing limited growth or greater risks will typically trade at a lower multiple. This means that understanding a “normal” or “fair” PE requires context, particularly industry trends and peer performance.

Ørsted’s current PE ratio is 25x, compared to an industry average of approximately 18x and a peer average of around 38x. While this suggests Ørsted is priced above the sector norm but below peers, using only these benchmarks can overlook critical factors unique to the company.

Simply Wall St’s proprietary “Fair Ratio” offers a more tailored comparison. This metric incorporates Ørsted's earnings growth, sector, profit margins, market capitalization, and risk profile, providing a holistic view that peers and industry averages cannot. It is designed to capture nuances that raw multiples miss, giving investors a smarter sense of underlying value.

When cross-referencing Ørsted’s actual PE ratio with its Fair Ratio, the difference is less than 0.10x. This indicates that the stock’s valuation is very close to what fundamentals and outlook justify.

Result: ABOUT RIGHT

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1410 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Ørsted Narrative

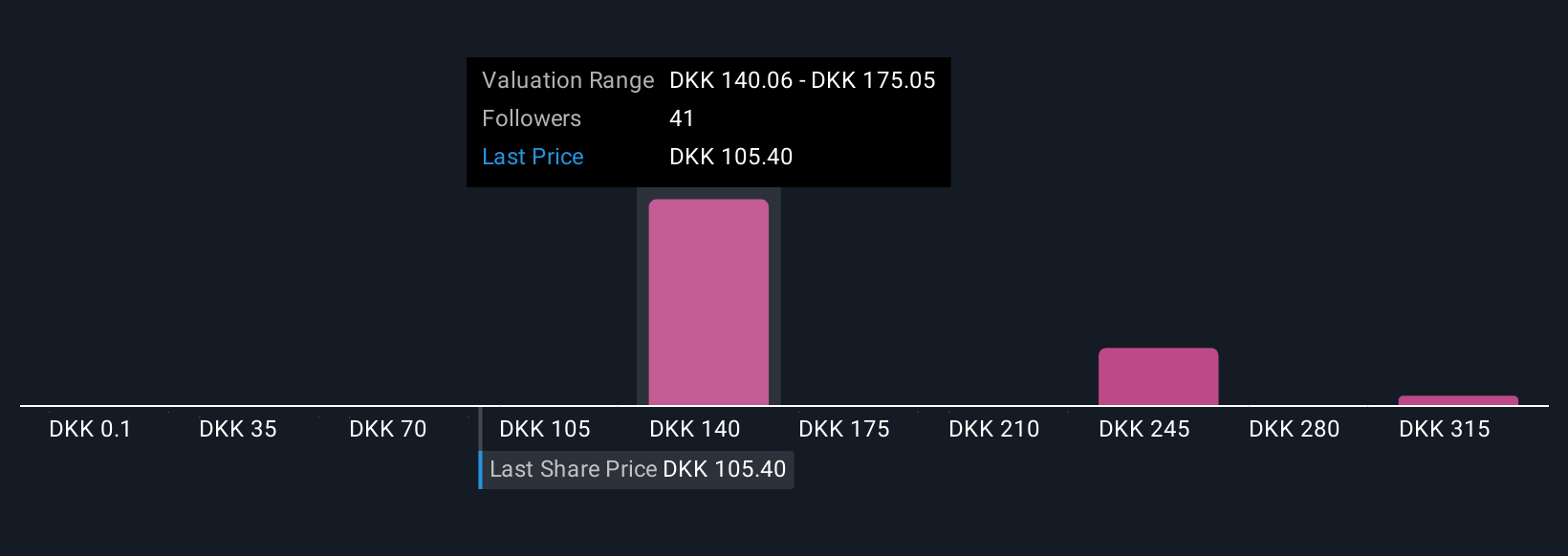

Earlier we mentioned there is an even better way to understand valuation, so let's introduce you to Narratives. Put simply, a Narrative is your personal investing story for a company like Ørsted, built on your assumptions about what its fair value should be, as well as your estimates for future revenue, earnings, and profit margins. Narratives connect the company's story to a financial forecast, and then to a fair value estimate, making your investing decisions more meaningful and tailored to your perspective.

On Simply Wall St's Community page, Narratives are an accessible tool used by millions, enabling investors to compare their own Fair Value against the current share price, and helping them see whether the story they believe in signals a buy, hold, or sell opportunity. These Narratives are kept up to date, automatically reflecting the latest company news, results, or market changes, so your decisions stay relevant and timely.

For example, with Ørsted, some investors set a high fair value based on ambitious growth assumptions, while others forecast lower values due to concerns about future cash flow. Narratives let you easily see and compare both perspectives as events unfold.

Do you think there's more to the story for Ørsted? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Ørsted might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About CPSE:ORSTED

Ørsted

Owns, develops, constructs, and operates offshore and onshore wind farms, solar farms, energy storage and renewable hydrogen facilities, and bioenergy plants.

Slight risk and fair value.

Similar Companies

Market Insights

Community Narratives