- Denmark

- /

- Renewable Energy

- /

- CPSE:ORSTED

Does Ørsted's Share Price Gain of 26% Match Its Business Performance?

These days it's easy to simply buy an index fund, and your returns should (roughly) match the market. But investors can boost returns by picking market-beating companies to own shares in. To wit, the Ørsted A/S (CPH:ORSTED) share price is 26% higher than it was a year ago, much better than the market return of around 3.3% (not including dividends) in the same period. That's a solid performance by our standards! We'll need to follow Ørsted for a while to get a better sense of its share price trend, since it hasn't been listed for particularly long.

See our latest analysis for Ørsted

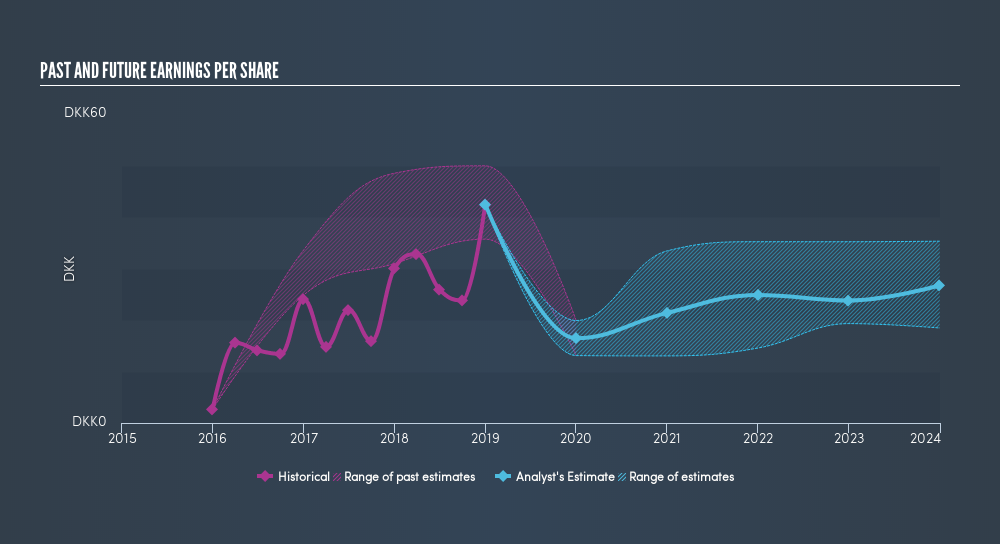

There is no denying that markets are sometimes efficient, but prices do not always reflect underlying business performance. One imperfect but simple way to consider how the market perception of a company has shifted is to compare the change in the earnings per share (EPS) with the share price movement.

During the last year Ørsted grew its earnings per share (EPS) by 41%. This EPS growth is significantly higher than the 26% increase in the share price. So it seems like the market has cooled on Ørsted, despite the growth. Interesting. The caution is also evident in the lowish P/E ratio of 11.34.

The image below shows how EPS has tracked over time (if you click on the image you can see greater detail).

It is of course excellent to see how Ørsted has grown profits over the years, but the future is more important for shareholders. If you are thinking of buying or selling Ørsted stock, you should check out this FREEdetailed report on its balance sheet.

What About Dividends?

As well as measuring the share price return, investors should also consider the total shareholder return (TSR). Whereas the share price return only reflects the change in the share price, the TSR includes the value of dividends (assuming they were reinvested) and the benefit of any discounted capital raising. It's fair to say that the TSR gives a more complete picture for stocks that pay a dividend. In the case of Ørsted, it has a TSR of 29% for the last year. That exceeds its share price return that we previously mentioned. The dividends paid by the company have thusly boosted the total shareholder return.

A Different Perspective

Ørsted shareholders should be happy with the total gain of 29% over the last twelve months, including dividends. And the share price momentum remains respectable, with a gain of 11% in the last three months. Demand for the stock from multiple parties is pushing the price higher; it could be that word is getting out about its virtues as a business. Before forming an opinion on Ørsted you might want to consider these 3 valuation metrics.

Of course Ørsted may not be the best stock to buy. So you may wish to see this freecollection of growth stocks.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on DK exchanges.We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About CPSE:ORSTED

Ørsted

Owns, develops, constructs, and operates offshore and onshore wind farms, solar farms, energy storage and renewable hydrogen facilities, and bioenergy plants.

Moderate growth potential with low risk.

Similar Companies

Market Insights

Community Narratives