- Denmark

- /

- Infrastructure

- /

- CPSE:KBHL

These 4 Measures Indicate That Københavns Lufthavne (CPH:KBHL) Is Using Debt Reasonably Well

Howard Marks put it nicely when he said that, rather than worrying about share price volatility, 'The possibility of permanent loss is the risk I worry about... and every practical investor I know worries about.' When we think about how risky a company is, we always like to look at its use of debt, since debt overload can lead to ruin. We can see that Københavns Lufthavne A/S (CPH:KBHL) does use debt in its business. But the more important question is: how much risk is that debt creating?

Why Does Debt Bring Risk?

Debt is a tool to help businesses grow, but if a business is incapable of paying off its lenders, then it exists at their mercy. Ultimately, if the company can't fulfill its legal obligations to repay debt, shareholders could walk away with nothing. While that is not too common, we often do see indebted companies permanently diluting shareholders because lenders force them to raise capital at a distressed price. Of course, plenty of companies use debt to fund growth, without any negative consequences. The first step when considering a company's debt levels is to consider its cash and debt together.

See our latest analysis for Københavns Lufthavne

What Is Københavns Lufthavne's Debt?

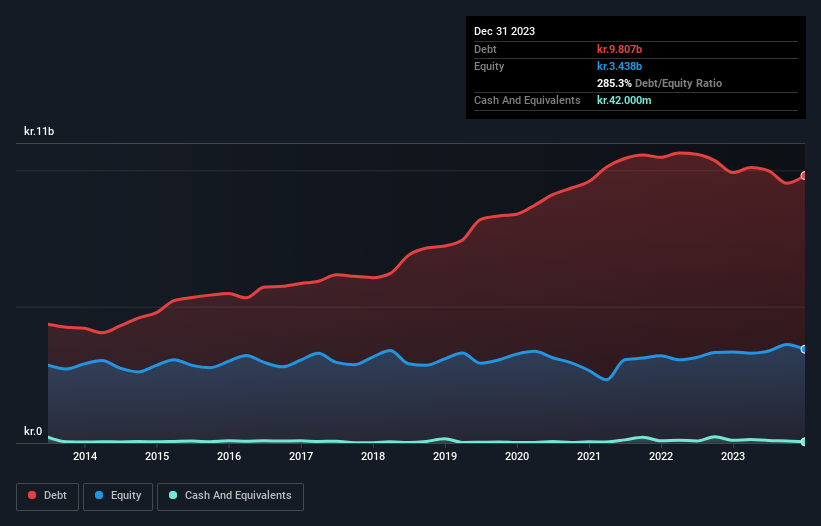

As you can see below, Københavns Lufthavne had kr.9.81b of debt, at December 2023, which is about the same as the year before. You can click the chart for greater detail. Net debt is about the same, since the it doesn't have much cash.

A Look At Københavns Lufthavne's Liabilities

According to the last reported balance sheet, Københavns Lufthavne had liabilities of kr.1.67b due within 12 months, and liabilities of kr.10.4b due beyond 12 months. Offsetting this, it had kr.42.0m in cash and kr.496.0m in receivables that were due within 12 months. So it has liabilities totalling kr.11.5b more than its cash and near-term receivables, combined.

While this might seem like a lot, it is not so bad since Københavns Lufthavne has a market capitalization of kr.41.8b, and so it could probably strengthen its balance sheet by raising capital if it needed to. However, it is still worthwhile taking a close look at its ability to pay off debt.

In order to size up a company's debt relative to its earnings, we calculate its net debt divided by its earnings before interest, tax, depreciation, and amortization (EBITDA) and its earnings before interest and tax (EBIT) divided by its interest expense (its interest cover). The advantage of this approach is that we take into account both the absolute quantum of debt (with net debt to EBITDA) and the actual interest expenses associated with that debt (with its interest cover ratio).

Københavns Lufthavne has a rather high debt to EBITDA ratio of 6.0 which suggests a meaningful debt load. However, its interest coverage of 2.6 is reasonably strong, which is a good sign. Looking on the bright side, Københavns Lufthavne boosted its EBIT by a silky 64% in the last year. Like a mother's loving embrace of a newborn that sort of growth builds resilience, putting the company in a stronger position to manage its debt. The balance sheet is clearly the area to focus on when you are analysing debt. But you can't view debt in total isolation; since Københavns Lufthavne will need earnings to service that debt. So if you're keen to discover more about its earnings, it might be worth checking out this graph of its long term earnings trend.

But our final consideration is also important, because a company cannot pay debt with paper profits; it needs cold hard cash. So we clearly need to look at whether that EBIT is leading to corresponding free cash flow. During the last two years, Københavns Lufthavne produced sturdy free cash flow equating to 67% of its EBIT, about what we'd expect. This free cash flow puts the company in a good position to pay down debt, when appropriate.

Our View

Københavns Lufthavne's EBIT growth rate suggests it can handle its debt as easily as Cristiano Ronaldo could score a goal against an under 14's goalkeeper. But the stark truth is that we are concerned by its net debt to EBITDA. We would also note that Infrastructure industry companies like Københavns Lufthavne commonly do use debt without problems. Looking at all the aforementioned factors together, it strikes us that Københavns Lufthavne can handle its debt fairly comfortably. Of course, while this leverage can enhance returns on equity, it does bring more risk, so it's worth keeping an eye on this one. The balance sheet is clearly the area to focus on when you are analysing debt. But ultimately, every company can contain risks that exist outside of the balance sheet. These risks can be hard to spot. Every company has them, and we've spotted 2 warning signs for Københavns Lufthavne you should know about.

If you're interested in investing in businesses that can grow profits without the burden of debt, then check out this free list of growing businesses that have net cash on the balance sheet.

Valuation is complex, but we're here to simplify it.

Discover if Københavns Lufthavne might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About CPSE:KBHL

Københavns Lufthavne

Owns, develops, and operates Copenhagen Airport and Roskilde Airport in Denmark.

Proven track record with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives