- Denmark

- /

- Marine and Shipping

- /

- CPSE:DFDS

DFDS A/S (CPH:DFDS) Not Doing Enough For Some Investors As Its Shares Slump 27%

DFDS A/S (CPH:DFDS) shareholders that were waiting for something to happen have been dealt a blow with a 27% share price drop in the last month. For any long-term shareholders, the last month ends a year to forget by locking in a 55% share price decline.

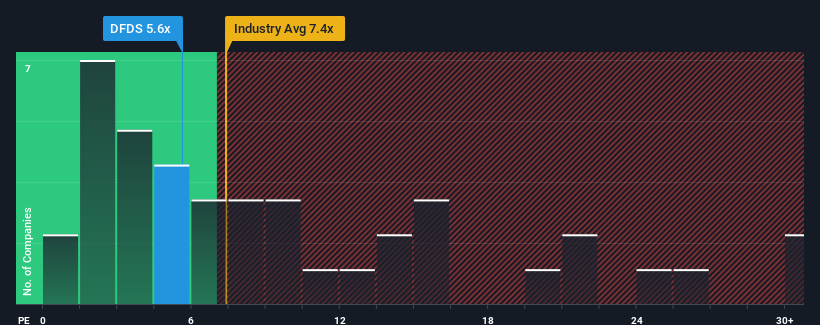

Since its price has dipped substantially, given about half the companies in Denmark have price-to-earnings ratios (or "P/E's") above 15x, you may consider DFDS as a highly attractive investment with its 5.6x P/E ratio. However, the P/E might be quite low for a reason and it requires further investigation to determine if it's justified.

While the market has experienced earnings growth lately, DFDS' earnings have gone into reverse gear, which is not great. It seems that many are expecting the dour earnings performance to persist, which has repressed the P/E. If this is the case, then existing shareholders will probably struggle to get excited about the future direction of the share price.

See our latest analysis for DFDS

How Is DFDS' Growth Trending?

There's an inherent assumption that a company should far underperform the market for P/E ratios like DFDS' to be considered reasonable.

Retrospectively, the last year delivered a frustrating 42% decrease to the company's bottom line. This has soured the latest three-year period, which nevertheless managed to deliver a decent 28% overall rise in EPS. So we can start by confirming that the company has generally done a good job of growing earnings over that time, even though it had some hiccups along the way.

Looking ahead now, EPS is anticipated to slump, contracting by 26% during the coming year according to the four analysts following the company. That's not great when the rest of the market is expected to grow by 20%.

In light of this, it's understandable that DFDS' P/E would sit below the majority of other companies. Nonetheless, there's no guarantee the P/E has reached a floor yet with earnings going in reverse. There's potential for the P/E to fall to even lower levels if the company doesn't improve its profitability.

What We Can Learn From DFDS' P/E?

Shares in DFDS have plummeted and its P/E is now low enough to touch the ground. Using the price-to-earnings ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

As we suspected, our examination of DFDS' analyst forecasts revealed that its outlook for shrinking earnings is contributing to its low P/E. Right now shareholders are accepting the low P/E as they concede future earnings probably won't provide any pleasant surprises. Unless these conditions improve, they will continue to form a barrier for the share price around these levels.

It is also worth noting that we have found 4 warning signs for DFDS (1 is a bit concerning!) that you need to take into consideration.

Of course, you might find a fantastic investment by looking at a few good candidates. So take a peek at this free list of companies with a strong growth track record, trading on a low P/E.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About CPSE:DFDS

DFDS

Provides logistics solutions and services in Denmark and internationally.

Undervalued with moderate growth potential.

Similar Companies

Market Insights

Community Narratives