Investors Still Aren't Entirely Convinced By OrderYOYO A/S' (CPH:YOYO) Revenues Despite 38% Price Jump

OrderYOYO A/S (CPH:YOYO) shareholders would be excited to see that the share price has had a great month, posting a 38% gain and recovering from prior weakness. Looking back a bit further, it's encouraging to see the stock is up 86% in the last year.

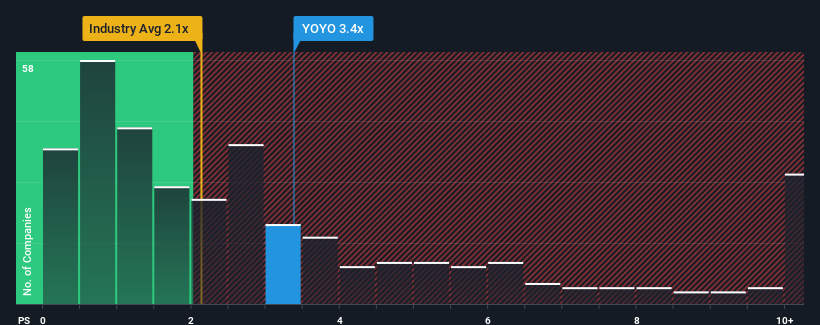

In spite of the firm bounce in price, it would still be understandable if you think OrderYOYO is a stock with good investment prospects with a price-to-sales ratios (or "P/S") of 3.4x, considering almost half the companies in Denmark's Software industry have P/S ratios above 4.5x. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the reduced P/S.

View our latest analysis for OrderYOYO

What Does OrderYOYO's Recent Performance Look Like?

With revenue growth that's superior to most other companies of late, OrderYOYO has been doing relatively well. Perhaps the market is expecting future revenue performance to dive, which has kept the P/S suppressed. If not, then existing shareholders have reason to be quite optimistic about the future direction of the share price.

Want the full picture on analyst estimates for the company? Then our free report on OrderYOYO will help you uncover what's on the horizon.How Is OrderYOYO's Revenue Growth Trending?

The only time you'd be truly comfortable seeing a P/S as low as OrderYOYO's is when the company's growth is on track to lag the industry.

If we review the last year of revenue growth, the company posted a terrific increase of 70%. The latest three year period has also seen an excellent 232% overall rise in revenue, aided by its short-term performance. Therefore, it's fair to say the revenue growth recently has been superb for the company.

Shifting to the future, estimates from the sole analyst covering the company suggest revenue should grow by 16% each year over the next three years. That's shaping up to be materially higher than the 11% per year growth forecast for the broader industry.

In light of this, it's peculiar that OrderYOYO's P/S sits below the majority of other companies. It looks like most investors are not convinced at all that the company can achieve future growth expectations.

What Does OrderYOYO's P/S Mean For Investors?

Despite OrderYOYO's share price climbing recently, its P/S still lags most other companies. Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

A look at OrderYOYO's revenues reveals that, despite glowing future growth forecasts, its P/S is much lower than we'd expect. The reason for this depressed P/S could potentially be found in the risks the market is pricing in. While the possibility of the share price plunging seems unlikely due to the high growth forecasted for the company, the market does appear to have some hesitation.

Plus, you should also learn about these 2 warning signs we've spotted with OrderYOYO (including 1 which is a bit concerning).

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About CPSE:YOYO

OrderYOYO

Provides online ordering, payment, and marketing software solutions in Denmark, the United Kingdom, Germany, Austria, and Ireland.

High growth potential and good value.

Market Insights

Community Narratives