SimCorp A/S (CPH:SIM), is not the largest company out there, but it received a lot of attention from a substantial price movement on the CPSE over the last few months, increasing to kr.831 at one point, and dropping to the lows of kr.750. Some share price movements can give investors a better opportunity to enter into the stock, and potentially buy at a lower price. A question to answer is whether SimCorp's current trading price of kr.776 reflective of the actual value of the mid-cap? Or is it currently undervalued, providing us with the opportunity to buy? Let’s take a look at SimCorp’s outlook and value based on the most recent financial data to see if there are any catalysts for a price change.

See our latest analysis for SimCorp

What is SimCorp worth?

According to my price multiple model, which makes a comparison between the company's price-to-earnings ratio and the industry average, the stock price seems to be justfied. I’ve used the price-to-earnings ratio in this instance because there’s not enough visibility to forecast its cash flows. The stock’s ratio of 43.56x is currently trading slightly above its industry peers’ ratio of 42.42x, which means if you buy SimCorp today, you’d be paying a relatively sensible price for it. And if you believe SimCorp should be trading in this range, then there isn’t really any room for the share price grow beyond the levels of other industry peers over the long-term. In addition to this, it seems like SimCorp’s share price is quite stable, which could mean there may be less chances to buy low in the future now that it’s trading around the price multiples of other industry peers. This is because the stock is less volatile than the wider market given its low beta.

What kind of growth will SimCorp generate?

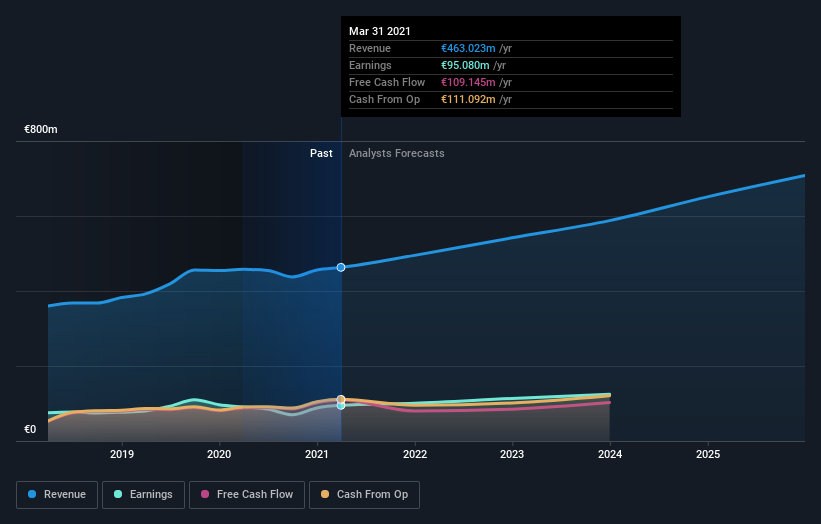

Investors looking for growth in their portfolio may want to consider the prospects of a company before buying its shares. Although value investors would argue that it’s the intrinsic value relative to the price that matter the most, a more compelling investment thesis would be high growth potential at a cheap price. SimCorp's earnings over the next few years are expected to increase by 22%, indicating a highly optimistic future ahead. This should lead to more robust cash flows, feeding into a higher share value.

What this means for you:

Are you a shareholder? It seems like the market has already priced in SIM’s positive outlook, with shares trading around industry price multiples. However, there are also other important factors which we haven’t considered today, such as the financial strength of the company. Have these factors changed since the last time you looked at SIM? Will you have enough conviction to buy should the price fluctuate below the industry PE ratio?

Are you a potential investor? If you’ve been keeping an eye on SIM, now may not be the most advantageous time to buy, given it is trading around industry price multiples. However, the positive outlook is encouraging for SIM, which means it’s worth diving deeper into other factors such as the strength of its balance sheet, in order to take advantage of the next price drop.

Diving deeper into the forecasts for SimCorp mentioned earlier will help you understand how analysts view the stock going forward. Luckily, you can check out what analysts are forecasting by clicking here.

If you are no longer interested in SimCorp, you can use our free platform to see our list of over 50 other stocks with a high growth potential.

If you’re looking to trade a wide range of investments, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About CPSE:SIM

SimCorp

SimCorp A/S, together with its subsidiaries, provides investment management solutions for asset management, fund management, insurance, life/pension, central banks, asset servicing, treasury, sovereign wealth, and wealth management companies.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Weekly Picks

The "Physical AI" Monopoly – A New Industrial Revolution

Czechoslovak Group - is it really so hot?

The Compound Effect: From Acquisition to Integration

Recently Updated Narratives

Spectral AI: First of Its Kind Automated Wound Healing Prediction

Why EnSilica is Worth Possibly 13x its Current Price

SoFi Technologies will ride a 33% revenue growth wave in the next 5 years

Popular Narratives

Is Ubisoft the Market’s Biggest Pricing Error? Why Forensic Value Points to €33 Per Share

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Analyst Commentary Highlights Microsoft AI Momentum and Upward Valuation Amid Growth and Competitive Risks

Trending Discussion

When was the last time that Tesla delivered on its promises? Lets go through the list! The last successful would be the Tesla Model 3 which was 2019 with first deliveries 2017. Roadster not shipped. Tesla Cybertruck global roll out failed. They might have a bunch of prototypes (that are being controlled remotely) And you think they'll be able to ship something as complicated as a robot? It's a pure speculation buy.

This article completely disregards (ignores, forgets) how far China is in this field. If Tesla continues on this path, they will be fighting for their lives trying to sell $40000 dollar robots that can do less than a $10000 dollar one from China will do. Fair value of Tesla? It has always been a hype stock with a valuation completely unbased in reality. Your guess is as good as mine, but especially after the carbon credit scheme got canned, it is downwards of $150.